.

The market dynamics are as follows: April 12

Markets closed in the red today after the three major banks released their quarterly earnings reports before Friday's close.

JPMorgan Chase's first-quarter profit rose 6% to $13.4 billion. Despite the positive results, Jamie Dimon, Chairman and Chief Executive Officer of JPMorgan Chase, emphasized his concerns about the future, stating: "Looking ahead, we remain vigilant about some significant uncertainties ...... There appear to be substantial and persistent inflationary pressures, which are likely to persist. This pressure is likely to continue.

Wells Fargo and Citibank both saw declines, but not as big as Wall Street expected. Bank ETFs fell on poor reports.Financial Select Sector SPDR Fund XLF fell by 1%.

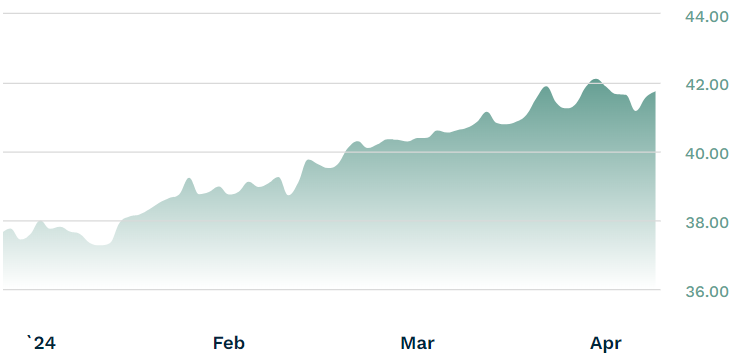

The banking sector has been strong as rising interest rates have boosted margins in the financial sector. So far this year, the XLF has risen nearly 11%, but today's report emphasizes that rising rates could be a downside going forward.

XLF YTD Performance

Source: etf.com data

Blackrock also announced its quarterly results before Friday's closing bell, beating both earnings and revenue estimates. Blackrock's AUM jumped to a record $10.5 trillion and revenues grew 11%, thanks to higher fees and strong market performance.

The Blackrock ETF continues to perform well, while Blackrock's largest ETF, IVV (iShares Core S&P 500 ETF) has risen more than 9.5% so far this year as the market continues its bullish run.

Whilst interest rate rises usually boost the financial sector, the "higher rates, longer hours" environment also poses challenges. Higher interest rates are sending consumers elsewhere to look for higher yielding savings accounts offered by smaller banks, while many seeking loans for financial products such as buttress loans are choosing to wait and see how interest rates fall back down.

The Consumer Price Index (CPI) released on Wednesday highlighted a persistent and stubborn inflationary trend, which has been the focus of market attention this week.

Investors are now predicting that the Fed won't cut rates until its July policy meeting at the earliest, which will continue to weigh on real estate and fixed income ETFs.

Permalink | © Copyright 2024etf.com Press validate it