.

BlackRock reported that it managed a record $10.5 trillion in assets as client cash poured in and the market grew.

-

BlackRock announced its first-quarter financial results on Friday.

-

Koon assets grew by 15% in 12 months to a record $10.5 trillion.

-

The world's largest asset manager said the market was strong with large net inflows of client cash.

In the first quarter, BlackRock's assets jumped 151 TP3T year-over-year to a record $10.5 trillion as more people trusted the firm to make their cash work and markets performed well.

The Wall Street giant's assets grew by $1.4 trillion in 12 months, according to its first-quarter results released Friday. The growth reflects a large net inflow of client money and a positive market backdrop.

BlackRock's revenues grew 111 TP3T to $4.7 billion, which helped its operating income grow 181 TP3T to $1.7 billion. Management also purchased $375 million worth of stock and raised its quarterly dividend by 21 TP3T to $5.10 per share.

Investors celebrated BlackRock's strong performance by pushing its shares up to around $807 in pre-ban trading, a 3% increase, and as of Thursday's close, BlackRock's shares were essentially flat for the year.

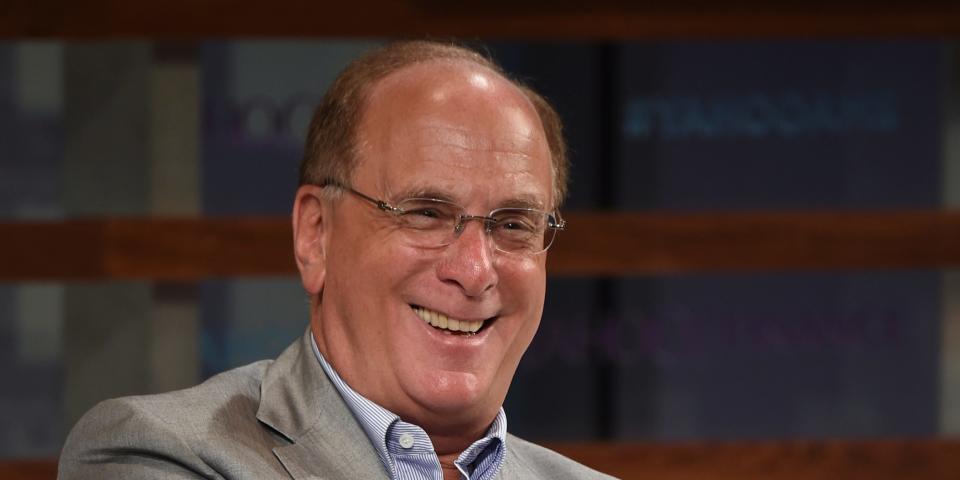

"BlackRock's momentum continues," said Larry Fink, BlackRock's chief executive officer, in the financial report.

"Growth in organic assets and base fees accelerated towards the end of the quarter, with $76 billion of long-term net inflows in the first quarter already accounting for nearly 40% of the full-year 2023 level.

In fact, BlackRock saw net inflows of $76 billion in the first quarter and $183 billion in 2023. The large inflows are not too surprising given that market sentiment has been largely solid so far this year, helping to push equities and other assets to new record highs.

Read the original article on Business Insider