.

Got $500 to invest in stocks? Put it in this ETF.

Got $500 to invest?Pioneer Utilities ETF (NYSEMKT: VPU)This exchange-traded fund (ETF) has had an annualized return of 8.91 TP3T since 2004. Since 2004, this exchange-traded fund (ETF) has had an annualized return of 8.9%. These returns have been very consistent, with positive returns in almost every period, including the past one, three, five, and ten years.

If you want your money to keep growing with minimal volatility, read on.

Don't snub these "boring" profits

Utilities are often thought of as "boring" businesses. In many ways, they are. For example, many utility stocks are regulated utilities. This means that they have been given a monopoly on providing a certain resource, such as water or electricity, to a certain community. In exchange for the monopoly, the company agrees to put a cap on the amount of profit it can generate.

In this way, utilities tend to be slow but stable companies. Let's take a look atHydroHydro One is a regulated utility that provides - you guessed it - hydroelectric power to residents of Ontario, Canada. Its distribution network operates 98% of high-voltage transmission lines across the province. As a quid pro quo for this monopoly status, its rates are capped by the provincial government.

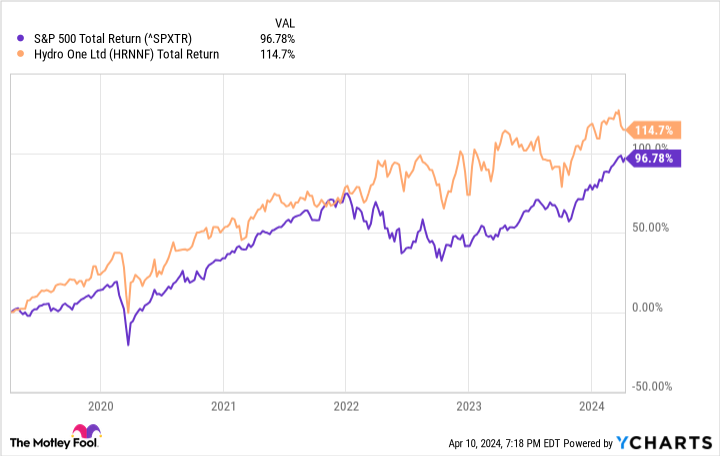

In a strong bull market, regulated utilities like Hydro One typically underperform. That's because they can't suddenly raise rates. Their profits are already determined in many ways by the regulator. For example, over the past 12 months, Hydro One's total return to shareholders has been only 1.08%.Standard & Poor's 500 The value of the index has increased by nearly 30% over this time period.

However, zoom in further and you quickly realize the strength of these companies. For example, over the past five years, Hydro One's shares have actually outperformed the S&P 500, though it has lagged the market by nearly 30% over the past 12 months, because utility stocks like this tend to weather economic turbulence better than other businesses. Demand for energy and water, for example, doesn't fluctuate much during recessions. Just as predetermined profit margins can hurt utilities in bull markets, they can spare these companies pain in bear markets. For example, during the flash crash of 2020 and the mini-bear market of 2022, Tier 1 utilities' stock prices healthily outperformed the market's overall weakness.

Utility companies can insulate your portfolio from bear markets and overall volatility. As we'll see, Vanguard's utility ETFs are a great way for you to get immediate exposure.

Vanguard's Utility ETFs Are a Good Choice

Investing in utility stocks can help you get reliable long-term returns and beat the market, especially during economic downturns. But which utility stocks should you choose?Vanguard's Utilities ETF takes the guesswork out of it at a very reasonable price. The ETF spreads your money across 65 utility stocks in real time. Its expense ratio is just 0.10%, which means you'll pay just $1 per year for every $1,000 invested. By comparison, the average utility ETF has a 0.97% expense ratio, which is almost 10 times higher. In addition, this ETF has a good long-term track record, with an annualized return of nearly 91 TP3T since its inception 20 years ago.

Will an ETF make you a millionaire overnight? Almost certainly not. But will it allow you to grow your capital with less volatility than the market? It's a good bet. For example, Vanguard's Utilities ETF is a very good bet against theDow Jones Industrial AverageSimply put, this means that the ETF is about 30% less volatile than the market as a whole.

If you're not convinced, just know that now may be the best time in years to buy this ETF. As mentioned earlier, utilities tend to underperform Big Rock in strong bull markets, like the one we're in right now. Last year was the worst year for the ETF in decades, and in 2023, it lost about 7.5% of its value. Historically, this is a good time to buy. In 2020, for example, the ETF lost 11 TP3T in value.It's growing.In 2015, the ETF lost 51 TP3T in value, but gained back 171 TP3T the following year.

Buying utility stocks when they are out of favor has been a profitable strategy for decades, and the Vanguard Utility ETFs allow you to invest in this opportunity quickly and efficiently.

Should you invest $1,000 in the Vanguard World Fund - Vanguard Utilities ETF right now?

Before you buy shares of Vanguard World Fund - Vanguard Utilities ETF, consider the following:

Motley Fool Stock AdvisorThe analyst team has just selected what they think is the best name for investors to buy now.10The Vanguard World Fund - Vanguard Utilities ETF is not included in the list of stocks available at ....... The 10 stocks that made the cut are likely to generate huge returns over the next few years.

Consider that on April 15, 2005Nvidia) on the list when ...... If you invested $1,000 at the time of our referralYou will have $555,209.! * *The

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View these 10 stocks."

*Stock Advisor's Report as of April 8, 2024

Ryan Vanzo does not own any of the shares listed above.The Motley Fool does not own any of the shares listed above.The Motley Fool has a disclosure policy.

Have $500 to invest in stocks? Originally published by The Motley Fool.