.

Here are my top three dividend-paying stocks to buy for April.

The stock market is off to a red-hot start in 2024.Standard & Poor's 500Indices andNasdaq ResonanceThe indexes have all reached record levels, thanks in large part to the giant tech companies that are leading the way in the field of artificial intelligence (AI).

Artificial Intelligence is undoubtedly a compelling growth market at the moment. However, there are other opportunities for investors to supplement their portfolios. Dividend stocks are a reliable source of growth.

In particular, Business Development Corporations (BDCs) are a unique source of passive income because they must pay 90% of their taxable income to investors each year. Let's analyze three leading BDCs that can help your portfolio get more bang for your buck.

1. Hercules Capital: Dividend Yield of 10.4%

Hercules Capital (NYSE: HTGC)is a leading BDC focused on technology, life sciences and sustainable energy. It specializes in an investment vehicle called venture debt.

Typically, in the early stages of a start-up, a company needs to raise capital from venture capital or private equity firms. However, as the company matures, the dilution of equity makes raising additional equity less desirable for the founders.

This is where Hercules excels. Debt is non-dilutive, so it does not reduce the equity of the founders and employees. In addition, Hercules usually writes larger checks than the average bank.

The problem, however, is that Hercules' term loan interest rates are much higher given this risk. In addition, the BDC typically includes warrants that can be converted to equity in its deals-an extra sweetener if the borrower is acquired or goes through an initial public offering (IPO).

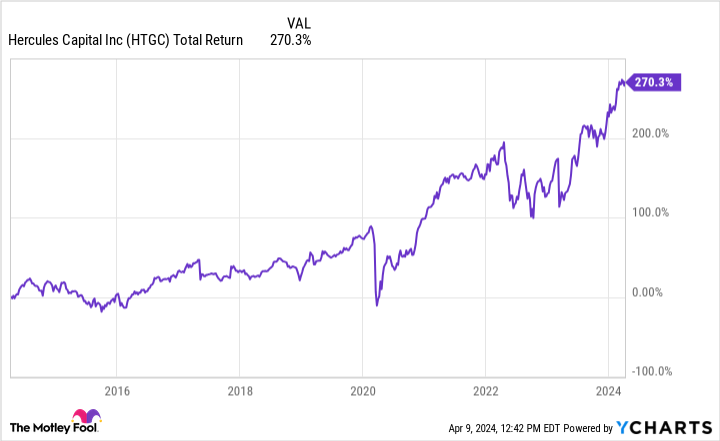

Over the past 10 years, Hercules stock has returned an aggregate return of 270%, which not only demonstrates the company's superior investment outlook, but also underscores the importance of dividend reinvestment.

With a dividend yield of 10.41 TP3T, now is a great time to snap up shares of this leading BDC.

2. 11.71 TP3T Dividend Yield on Horizon Tech Financial, Inc.

Horizon Technology (NASDAQ resonance stock code: HRZN)Hercules is a major competitor of Hercules. The company also specializes in providing high-yield loans to venture-backed startups in the technology, energy, and healthcare sectors. Over the last ten years, the company's ARR was 1,47%, which is not quite as good as Hercules, but not too bad, in my opinion.

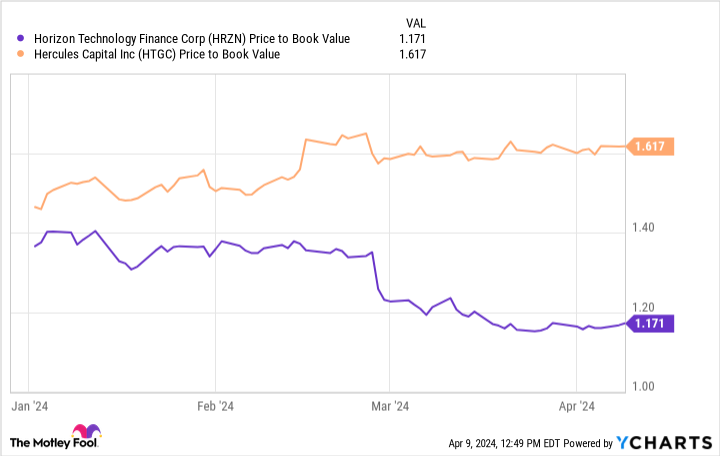

Additionally, Horizon's price-to-book ratio of approximately 1.2 is significantly lower than Hercules' price-to-book ratio. Both companies are leading BDCs among startups, but the difference in valuation multiples in the chart above may indicate that Horizon is currently a better value.

With a yield of 11.7%, Horizon is hard to pass up. For now, this could be a solid opportunity to complement other dividend investments in your portfolio.

3. Battlestar Galactica Capital: Dividend Yield of 9.4%

The last BDC on my list isAres Capital (NASDAQ resonance code: ARCC)Ares is actually very different from Hercules and Horizon.

The company tends to focus on BDC companies in a variety of industry sectors. In essence, Ares has carved out a unique niche in the BDC space. The company works with carriers that may be considered too risky or unattractive to work with a traditional investment bank.

However, Ares' large balance sheet and savvy due diligence approach provide the company with a high degree of financial flexibility. As a result, Ares can offer a range of more complex financial solutions than other BDCs, including leveraged buyouts (LBOs).

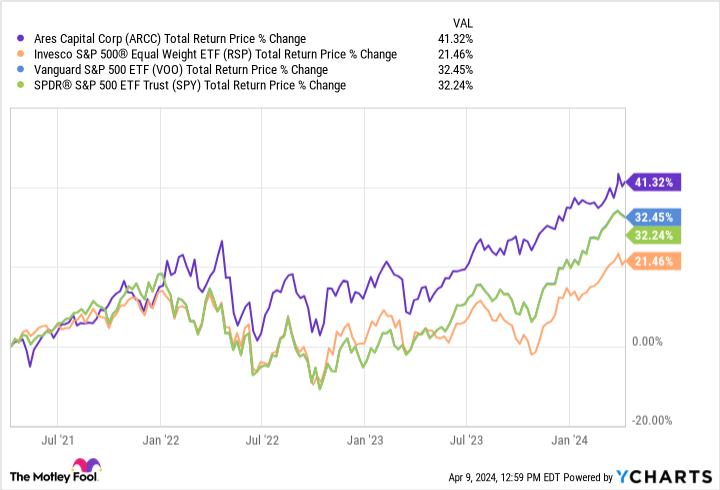

One of the most attractive things about Ares is that it has consistently outperformed some of the leading exchange-traded funds (ETFs) over the past few years. As the chart above shows, an investment in Ares has crushedSPDR Standard & Poor's500 ETF Trust,Invesco Standard & Poor's 500 Equal Weight ETFs andVanguard StandardS&P 500 ETFs, etc. Focus on S&P500 ETF of the Index.

Ares has a satisfactory track record and it has a different business model than other BDCs. Therefore, now is a great time to grab shares at a yield that exceeds 9%.

Should you invest $1,000 in Hercules Capital now?

Before buying shares of Hercules Capital, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10The 10 stocks selected are ...... and Hercules Capital Corporation is not one of them. The 10 stocks that made the list are poised to generate huge returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 8, 2024

Adam Spatacco does not hold any of the stocks listed above. the Motley Fool holds a recommended Vanguard S&P 500 ETF. the Motley Fool has a disclosure policy.

Here Are My Top3 Ultra-High-Yield Dividend Stocks to Buy in April was originally published by The Motley Fool.