.

Got $25? You can buy one of the hottest artificial intelligence (AI) stocks on the market!

some of the most talked about artificial intelligence (AI) stocks.Such as Nvidia ) orSuper Micro Computer ), the stock price is approaching $1,000, making it unaffordable for many investors who can't afford to buy fractional shares. Fortunately, another top AI stock is trading for less than $25, which investors should consider if they want to increase their exposure to AI without overweighting their portfolio to one company.

Palantir Technologies (NYSE: PLTR)It's a great AI investment stock at under $25. But is it a good time to buy?

Palantir's New Artificial Intelligence Products Are Taking the U.S. by Storm

Palantir has been in the AI business much longer than many of its peers. As a result, it has accumulated years of experience that no one else can replicate.

Initially, Palantir's AI product line was developed for governments to receive massive streams of data to provide those in charge with the best information to make real-time strategic decisions. Eventually, the software was used beyond government departments, greatly increasing Palantir's market opportunities.

These products involve AI in the traditional sense, but the AI that most people are talking about today is different from the AI of yesterday. Now, where most people talk about AI, they are talking about generative AI, the technology behind products like ChatGPT. This is a powerful branch of AI that has many use cases, but integrating it into internal systems is not easy.

However, Palantir's AIP (Artificial Intelligence Platform) can help customers do just that.

AIP provides developers with the tools they need to bring AI to all levels of the organization, using proprietary data without worrying about information leaking into the public domain. With the tools to implement AI within the organization, it has become a very popular product. I've never seen the level of customer enthusiasm and demand for AIP in the U.S. business sector before," said Ryan Taylor, Simmons Revenue Officer, on Palantir's Q4 earnings call.

As AIP has flourished in the U.S. business sector, it has been a huge driver of Palantir's financials.

Palantir's business is doing well

In the fourth quarter, U.S. commercial revenue grew 70% year-over-year to $131 million. While this is an impressive result, it still does not account for the majority of Palantir's revenue. Government revenue remains Palantir's largest business, accounting for $324 million of the $608 million total revenue.

U.S. commercial revenue is not even half of its commercial mass revenue, with Palantir's global commercial revenue at $284 million. However, if the U.S. commercial sector can maintain its growth rate, which should be possible given the high demand for AIP, then the picture could change in the second half of the year.

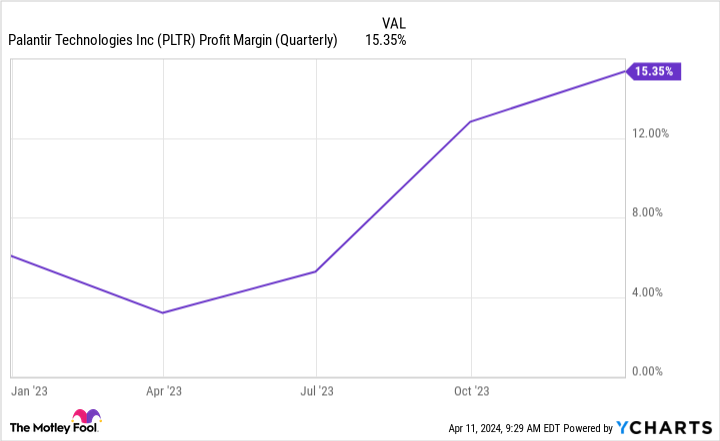

Unlike many software companies, Palantir has always emphasized running a profitable business.2023 Palantir has been profitable in every quarter, with the fourth quarter being its most profitable period.

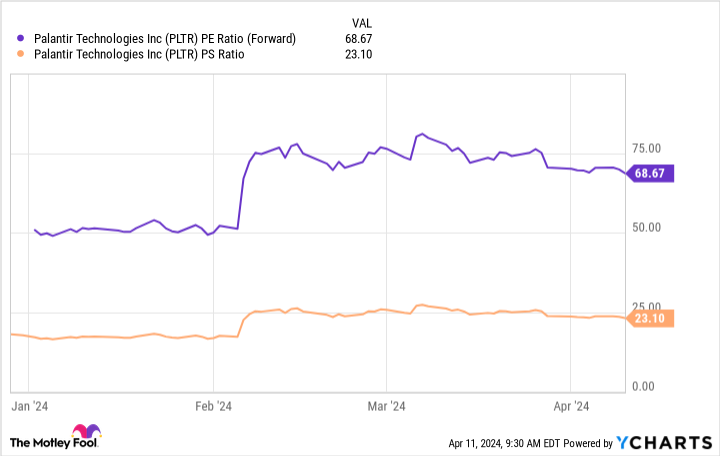

However, business success and increased profitability come at a price, as Palantir's shares are far from cheap from a valuation perspective.

Palantir's forward price-to-earnings (P/E) ratio is high, which makes sense as it is unlikely to maximize earnings in 2024. Its P/E of 23 is also very expensive, especially considering Palantir's fourth-quarter overall revenue growth rate of 20%.

For Palantir to maintain this premium valuation, it must realize growth in government revenues and maintain the level of growth in U.S. business revenues. If this can be achieved, then the premium will be worth it.

But if you're looking to get into artificial intelligence at a lower stock price, there's no better stock than Palantir. The stock is expensive, but that's because expectations for Palantir's success are high. If it can maintain these stellar results over the next three to five years, the premium you pay today may be worth it in a few years as the results grow.

Should you invest $1,000 in Palantir Technologies now?

Before buying shares of Palantir Technologies, consider the following:

Motley Fool Stock AdvisorThe analyst team has just selected what they think is the best name for investors to buy now.10Only ...... and Palantir Technologies were not included. The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of April 8, 2024

Keithen Drury does not hold any of the stocks mentioned above.The Motley Fool holds recommended Nvidia and Palantir Technologies.The Motley Fool has a disclosure policy.

Got $25? You Can Buy One of the Hottest Artificial Intelligence (AI) Stocks on the Market was originally published by The Motley Fool.