.

1 Invisible Artificial Intelligence (AI) Stocks That Just Might Become Big Macs

There's something special about watching a game live, whether you like sports, concerts or entertainment. I recently went to the T-Mobile Arena in Las Vegas to see the Las Vegas Golden Knights play the Detroit Red Wings. I'll explain the next noodle.

No event is complete without security. Sadly, in the last 20 years, there has been an increase in the number of shootings at Big Bubbles. New York City's subway violence is also on the rise, so the city has turned to this company to help keep people safe.

Regardless of our personal experiences, we are all at least indirectly affected by unfortunate events when we go through tight security and wait in long lines. However, there are a few problems with traditional metal detector screening-Evolv Technologies (NASDAQ: EVLV)is trying to solve these problems using Artificial Intelligence (AI) technology.

What is Evolv Technologies?

Evolv Technologies designs and sells scanners that utilize artificial intelligence technology to detect guns and other weapons based on their shape and other unique characteristics. With this technology, people can enter the venue without waiting in line to be scanned. Wallets and keys won't set off alarms like metal detectors. It also helps mitigate the huge crowds waiting to enter the venue, which can be targeted.

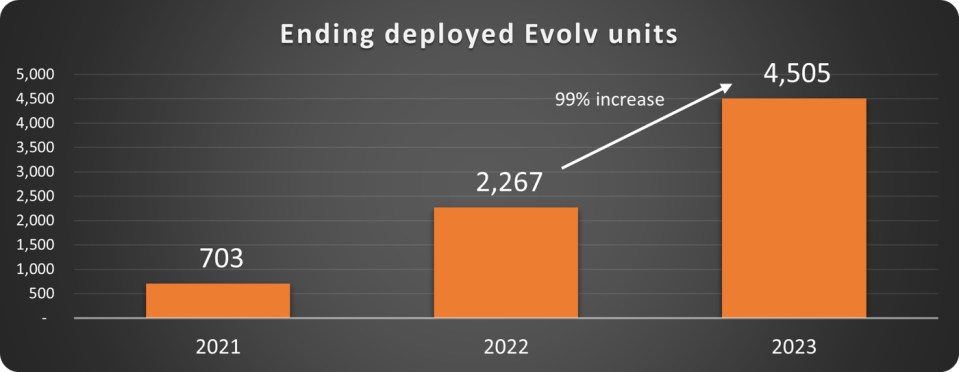

That was my experience at the T-Mobile Arena. There was security as we entered the arena, but I made it through without emptying my pockets. I noticed that the name on the device was Evolv, a stock I own, and it was not a unique experience. By the end of 2023, there will be more than 4,500 Evolv machines in use.

It works like this. Security personnel place a tablet-like device on the side of the person entering the venue. If a gun or other weapon is detected, it is displayed on the device, which identifies the location of the gun or weapon on the person's body (pocket, backpack, etc.). The security guard will then ask the customer to step aside and proceed to the next step. The devices are also used in schools and hospitals, and Evolv reports that its 40% business comes from schools,10%-15% from hospitals,10%-15% from vocational training, and the rest from amusement parks, tourist attractions, places of worship, and workplaces.

Is Evolv stock worth buying?

Evolv's customer base is growing rapidly. Between 2021 and 2023, its customers will grow from 200 to 800 schools, from 30 to 300 hospitals, and from 10 to 40 professional sports teams. New York City's recent announcement that it will use the devices could be a major catalyst for the company's stock, with other cities likely to follow suit.

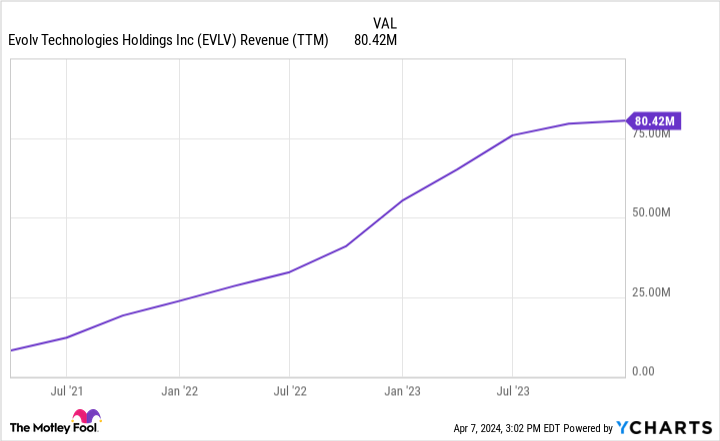

The company's revenue model is partly recurring. Customers pay a software subscription fee after purchasing a machine. As you can see in the chart below, the company's revenue has soared as adoption rates have grown.

Revenue growth has been excellent, but annualized recurring revenue (ARR) is critical to long-term success, and ARR is significant because it means Evolv can continue to make money once the market is saturated. The company reports impressive ARR growth of $1,20% to $75 million in 2023.

There's a lot to like about this company. However, Evolv is still a relatively small company, with a market capitalization of only $700 million. It is in a high growth phase, so it is not profitable and is more risky. It's not a stock to invest in as a whole portfolio. But in my opinion, it is worth investing in.

The company's stock has a price-to-sales ratio (P/S) of 9, which is reasonable for a growing technology company. This technology is both necessary and innovative, and is a valuable tool that many people are adopting as part of the All Face Security program. No one thing will solve the problem. It is time for an "all hands on deck" approach, and Evolv is one of them.

Invest $1,000 now

irregularityOur team of analystsIt pays to listen to stock investment advice. After all, they've been running the newsletter "The New York Times" for more than a decade.Motley Fool Stock AdvisorThe market has almost tripled*.

They have just announced what they think investors are doing now-est (superlative suffix)Worth Buying10Only stocks...

View these 10 stocks

*Stock Advisory Rates as of April 8, 2024

Bradley Guichard owns shares of Evolv Technologies. the Motley Fool does not own any of these shares. the Motley Fool has a disclosure policy.

1 Invisible Artificial Intelligence (AI) Stocks That Just Might Become Giants was originally published by The Motley Fool.