.

3 Buy Dow Jones Dividend Stocks Now If They're Less Than 6% From 52-Week Low

Even with the recent market turmoil, the total mass of the stock market this year is not bad. ButDow Jones Industrial AverageYear to date (YTD) it has only risen by 2.4%, behindNasdaq ResonanceThe YTD echo rate of 7% is nearly as high as the YTD echo rate of 7% and the YTD echo rate of 7%.Standard & Poor's 500 The index rose by nearly 8%.

The Dow Jones Index contains many blue chip companies that are leaders in their industries. However, there have been a number of declines in the Dow this year, especially among large companies that are within 6% of their 52-week lows, includingApple (NASDAQ: AAPL),resonance (NYSE: NKE)(math.) andUnitedHealthcare (NYSE: UNH)The following are the reasons why these three dividend stocks are down, and why they are worth buying now. Here's why these three dividend-paying stocks are down, and why they're worth buying now.

From industry leader to underperformer

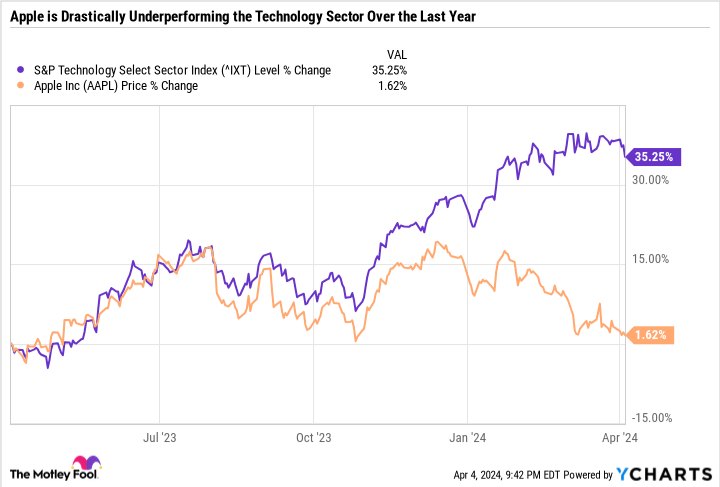

Apple is arguably the most surprising stock on this list. It accounts for more than 7% of the NASDAQ Resonance Index. Despite Apple's drag, the Nasdaq Resonance Carbide Index hit a new all-time high on March 21st and has continued to rise sharply so far this year. Investors have become accustomed to Apple leading the market, not lagging behind it.

The underperformance was even worse when looking at the technology sector. Apple Inc.Technology Select Sector SPDR Fund (TSSSPDR Fund)Apple's shares accounted for 19.2% of the total value of Apple's shares, which is an exchange-traded fund that mirrors the performance of the technology sector. However, over the past year, Apple's stock price has been essentially flat, while the technology sector has risen by more than 35%.

It would be one thing if Apple was just part of a broader sell-off in the NASDAQ resonance and technology sectors. But any time you see an industry leader move in the opposite direction of its peers, it's usually a sign that investors have specific concerns about a company.

For Apple, most of these concerns are valid. Growth isn't obvious. Sales in China, Apple's second most important market, are declining. Compared with Microsoft( Microsoft corporation(math.) andNvidia) and other large tech stocks, Apple's lack of Artificial Intelligence (AI) monetization and, frankly, innovation, is a bad sign compared to other large tech stocks.

Apple looked out of touch, so investors were right to hit the sell button. To make matters worse, the U.S. Department of Justice has filed a civil antitrust lawsuit against Apple for monetizing the smartphone market.

It's comforting to know that Apple's price-to-earnings ratio is only 26.1, which is much lower than the 38.7 P/E ratio of the technology sector. Apple has a lot of cash, which allows it to buy more stock and raise its dividend even when growth slows.

Looking at Apple's meager 0.6% dividend yield, you might think that the company's capital recycling program is weak. In fact, it simply chooses to distribute the vast majority of its capital through buybacks rather than dividends. Apple's buybacks have been an excellent investment in terms of stock price performance. They are especially effective when the stock is depressed, and the company can buy back stock at a low price.

Counting on Apple has been a losing bet in the past. The company's brand and vertical capabilities remain strong, so value investors may want to step in and consider the stock now.

It's time for resonance's temporary earnings spike to go away.

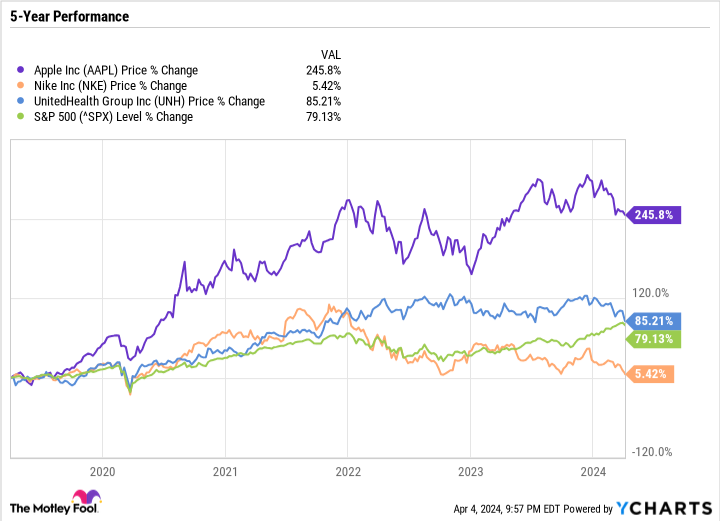

Despite its poor performance, Apple has outperformed the market over the past five years. That's not the case with resonance. While Koon has made impressive gains in 2020 and 2021, its share price has already reversed and is now at about the same level as it was five years ago.

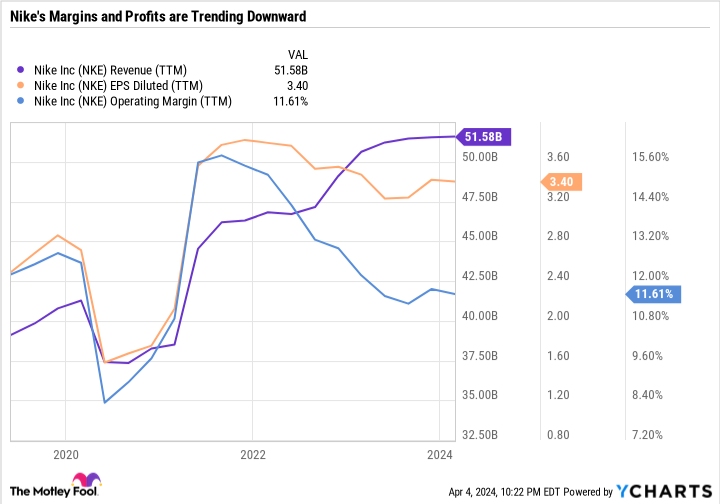

Resistant is a good example of why it's not good to anchor a stock at a price it probably shouldn't have reached in the first place. At the height of the epidemic, people had limited choices for services, so they switched to commodities. Resonance benefited from this. However, this growth proved to be short-lived.

As you can see from the chart, Resistant's earnings per share and operating margins initially plummeted during the COVID-19 pandemic, but then surged in 2021, and the stock hit record highs along with it. Sales rose at the expense of lower earnings and margins. Resistant's business is much closer to where it was before the pandemic than it was in 2021, so it's understandable that the share price has moved back.

It's commendable that resonance has prioritized its capital-return plan in the face of slower growth. Admittedly, resonance's stock yields only 1.6%, but resonance is becoming a dividend-worthy company, rather than relying on growth as it has in the past.

Along with Apple, Resistor is one of the most influential brands in the world. Resonance currently trades at a price-to-earnings ratio of 26.2, which is lower than the S&P 500's 27.9. The short-term outlook is not optimistic, but patient investors have the opportunity to buy Resonance at a compelling price.

Getting Involved in the Healthcare Industry with UnitedHeatlh

Like Apple, Medicare provider UnitedHealth has continued to outperform the market over the past five years. However, the stock has recently sold off, mainly due to lower-than-expected payment rate increases in 2025.

UnitedHealth's growth is heavily dependent on its medical insurance business, so the sell-off makes sense. To make matters worse, UnitedHealth was also the victim of a cyberattack that caused the company to default on claims.

Short-term challenges aside, it would be a mistake to underestimate UnitedHealth's role in health care. Drugmakers drive the limits of innovation, but insurance is the glue that holds the U.S. health care system together. The industry has ballooned to become the third largest in the U.S. after finance and technology.

For those who want to invest in the medical and healthcare industry but do not want to go through thecome with a giftUnitedHealth is a good choice for investors who want to invest in such a high profile drug maker. UnitedHealth is one of the more robust names in the healthcare industry, focusing more on modest growth and raising its dividend - which has risen by 4,00% over the past decade - and with a P/E ratio of 19.1, it's a good choice for those who are looking for a lower-priced stock.

Should you invest $1,000 in Apple now?

Before buying Apple stock, consider the following:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10Only ...... and Apple is not one of them. The 10 stocks that made the list could generate huge returns in the years to come.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 8, 2024

Daniel Foelber is long the July 2024 $95 call on resonance. the Motley Fool recommends Apple, Microsoft, resonance, and Nvidia. the Motley Fool recommends UnitedHealth Group, and suggests the following options: long the January 2025 $47.50 call, long the January 2026 $395 call on Microsoft, and short the January 2026 $405 call. the Motley Fool also recommends resonance. The Motley Fool has a disclosure policy.

Buy Now 3 Dow Jones Dividend Stocks Not Far From 52-Week Low 6% was originally published by The Motley Fool.