.

Is it a good time to invest in the stock market? History Proves

With the stock market reaching new heights, it can be an exciting time to invest. However, while many investors are optimistic about the future, others are concerned that perhaps the best time to buy has passed.

Buying shares when they are at their peak is not always the best way to manage your finances, but if the market continues to soar, now may be the best time to invest before the price rises further. That said, no one knows where the market will go, so it is anyone's guess whether prices will continue to rise.

For investors who simply want to maximize the use of their capital, this can be confusing. While past performance is not the same as future returns, it may be helpful to look at what history has to say about such periods.

Is it safe to invest now?

Stock prices have risen sharply over the past 18 months. Since bottoming out in October 2022, stock prices have risen sharply.Standard & Poor's 500The index has risen by 45%, and during this period, tech-dominatedNasdaq ResonanceThe index has risen to 58%. So investing now means paying much higher prices than buying a year or two ago.

But does this mean that it is not a good time to invest in a person? History has shown that this is not the case.

Looking at the historical performance of the stock market, it's not necessarily a bad time to buy, as long as you're looking at the long term. The market can be volatile in the short term (even in times of economic strength), but it has a perfect record of positive returns over many years. The key, however, is to invest sooner rather than later.

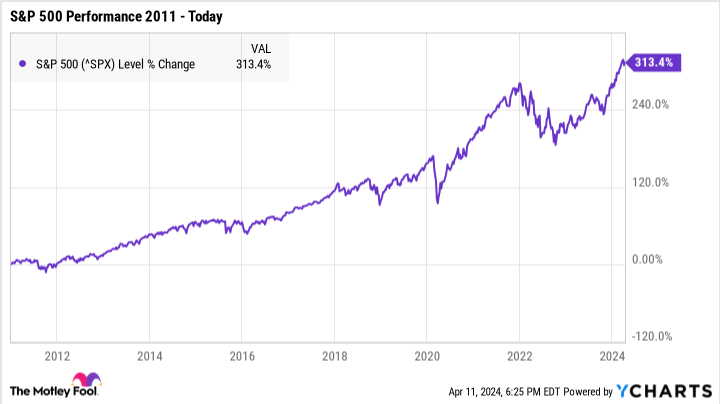

For example, let's say you invested in the S&P 500 Index Fund in January, 2011 when the index was in a post-Great Recession bull market. At the time, the index was in a post-Great Recession bull market, having risen as much as 86% from its 2009 lows.

At the time, it seemed that you missed the best time to buy. However, today, you can still get an aggregate return of over 313%.

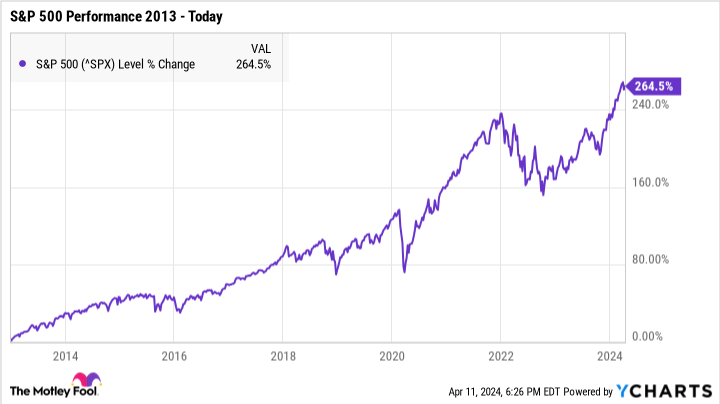

Suppose you did not invest in 2011, but waited a few years and bought in January 2013 instead. Today, you have only received an aggregate return of about 265%.

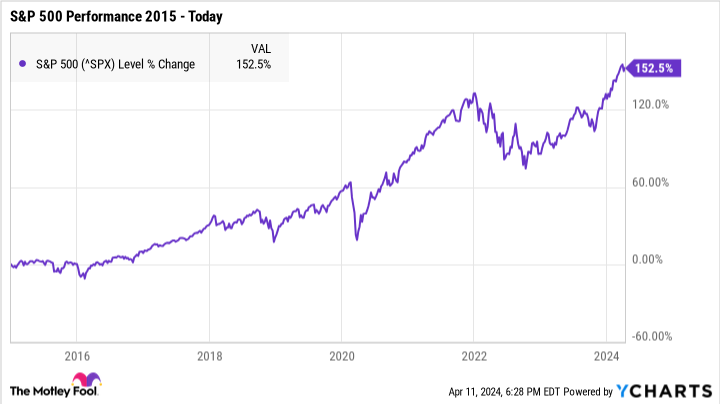

Finally, let's say you decide to wait a little longer and eventually invest in January, 2015, in which case your total return would be down to 153% today. In this case, your totalized return would be down to 153% today.

Granted, the best time to buy was when the S&P 500 hit its lows in 2009. But where no one knew the bull market was about to begin, investing in 2011 was still more profitable than waiting a few years.

Now, this doesn't necessarily mean that the market will follow a similar path. But if history has taught us one thing, it's that investing for the long term is far more profitable than buying at the right time.

The Key to Maximizing Revenue

Taking a long-term view is key to building wealth, but choosing the right investments is equally important. Strong stocks are more likely to deliver sustainable growth over the long term, and they are more likely to recover from the inevitable downturns that the market will experience in the future.

There's no one right way to invest, but the strongest stocks come from companies that have healthy business fundamentals, from solid financials and competitive advantages to knowledgeable leadership.

Where you have a solid portfolio full of healthy stocks, you don't need to worry too much about the future of the market. While all stocks experience short-term volatility, strong companies are more likely to weather the storm and make positive returns over the long term.

Investing can be daunting even when the stock market is booming, but it's still one of the most effective ways to create wealth. By starting to invest early and investing in the right places, you can protect your money as much as possible while maximizing your long-term income potential.

Don't miss out on this second potential earning opportunity!

Ever feel like you're missing out on the opportunity to buy the most successful stocks? Then you'll want to hear this.

On rare occasions, our expert team of analysts will recommend companies that they believe are poised for a major rally."Double Down" StocksIf you're worried that you're missing out on an investment opportunity, now is the time to buy before it's too late. If you're worried that you're missing out on an investment opportunity, now is the perfect time to buy before it's too late. The numbers speak for themselves:

-

Amazon:If you had invested 1,000 dollars in 2010 when the translation was falling, you would have been able to invest in the same amount.dollar(math.) genusYou will have $20,963.! * Apple: If you invested 1,000 in the translation of the fall in 2010, you will be able to get a lot of money.Dollars, you'll have $20,963.! ***.

-

Apple:If you had invested $1,000 when we doubled our investment in 2008, you would have beenWill have $33,315! * *.

-

Netflix:If you had invested 1,000 dollars in 2004 when we doubled our investment, you would have been able to get the same amount of money as you did in the previous year.dollarSo?You'll have $335,887.! * Right now, we're issuing "Double Down" alerts for three incredible companies.

Right now, we're issuing "double dip" alerts for three incredible companies, and an opportunity like this may not come again anytime soon.

View 3 Only "Double Down" Stocks

*Stock Advisor's Circular as of April 8, 2024

The Motley Fool has a disclosure policy.

Is Now a Good Time to Invest in the Stock Market? History Says So was originally published by The Motley Fool.