.

Where will Annaly Capital Management stock be in 3 years?

Over the past three years, we have made a significant contribution to theAnnaly Capital Management(math.) genus(New York Stock Exchange: NLY)It was a difficult period for the company, a real estate investment trust (REIT) that invested primarily in mortgage-backed securities (MBS) backed by government subsidies such as Fannie Mae and Freddie Mac. During this period, Annaly's total return, including reinvested dividends, was approximately negative 20%, while its market capitalization shrank by nearly half.

However, as they say about great stocks, past performance is not necessarily indicative of future performance. That's the case with Annaly, which could do even better over the next three years.

Why has Analysys underperformed over the last three years?

The reason for Annaly's underperformance over the past three years is simple. At its core, the company is an investment firm that holds leveraged portfolios of institutional MBS, which are essentially bonds collateralized by homes and guaranteed against default by government-backed institutions. The fact that these securities are guaranteed by an organization such as Fannie Mae eliminates much of the credit risk associated with these investments, but does not reduce the Company's interest rate risk, which is only magnified by the leverage employed by the Company.

When interest rates rise, the interest rate on collateralized loans tends to rise as well, which reduces the prevalence of Annaly's securities. Beginning in March 2022, the Fed began to aggressively tighten its policy, raising interest rates 11 times. The target for the federal funds rate went from 0.25% to 0.50% to the current 5.25% to 5.50%.

In addition to rising interest rates, the widening spread between 10-year Treasury yields and yields on agency MBS has put pressure on Annaly's MBS portfolio. Over the last three years, spreads have widened to twice the historical average. As a result, during this period, the increase in the interest rate on the Resistance Loan has outpaced the increase in treasury yields, causing even greater damage to the value of the MBS securities.

Mortgage REITs like Annaly are usually valued based on the value of their investment holdings. This makes sense, since when you buy Annaly shares, you are essentially buying its MBS portfolio.

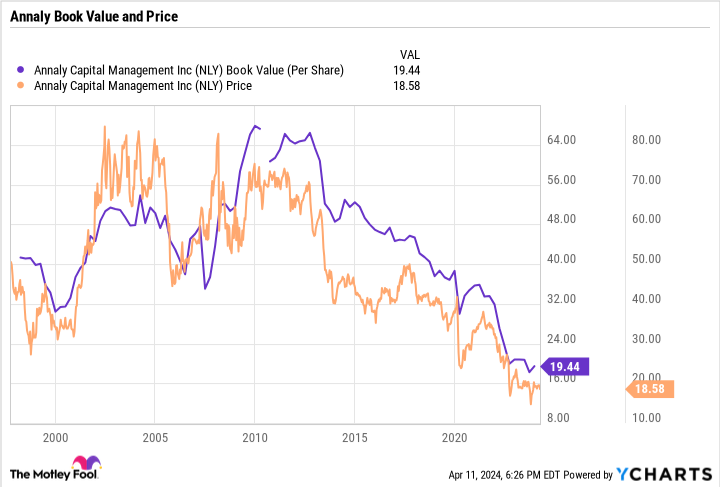

Given the pressure on Annaly from rising interest rates and widening spreads, it is not surprising that the value of its investment portfolio has declined. The value of the company's investment portfolio, as reflected in its book value, fell from a split-adjusted USD 35.68 at the end of 2020 to USD 19.44 at the end of 2023.

As a result, Annaly's stock has basically fallen in line with the book value over the past three years.

There are better days ahead.

The good news for Annaly going forward is that the Fed has stopped raising interest rates.

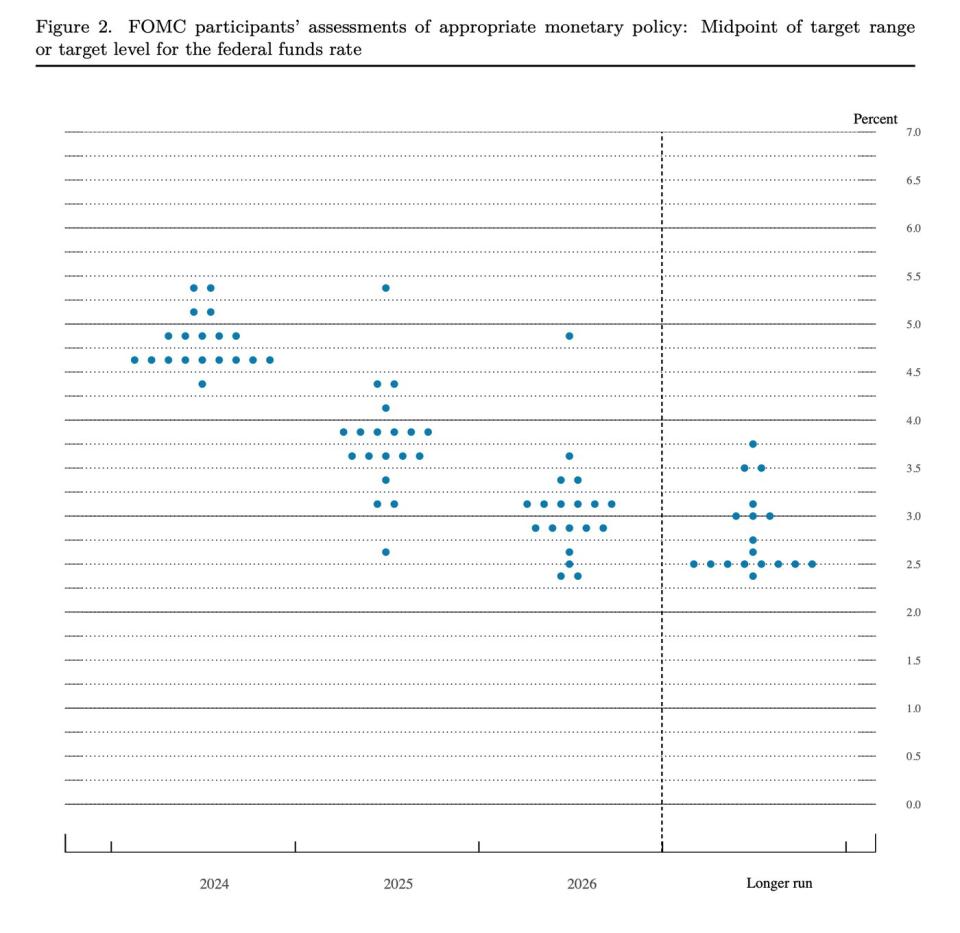

Although some Fed officials have recently indicated that they are in no hurry to cut interest rates, most Fed officials still expect to cut rates by 75 basis points this year, according to the March Fed dot plot. The chart shows each FOMC member's forecast for interest rates over the next few years.

More importantly, the chart shows that Fed officials want the federal funds rate to fall from the current 5.25% to 5.50% to 3.00% to 3.25% by the end of 2026.

This bodes well for Annaly's investment portfolio, which is focused on 30-year fixed-reserve mortgages with coupon rates ranging from 4% to 6%. This portfolio will allow the company to benefit from lower interest rates while avoiding the prepayment risk that often occurs when a large number of homeowners begin to refinance. The RML REIT has also shifted nearly 8%'s investment portfolio to high-quality non-corporate MBS to help improve the rate of return. The other 4% portfolio is in mortgage servicing rights (MSRs), which should be less affected by interest rates. The greatest risk to these assets is often early repayment, which is why Annaly invests in low-interest MSRs.

Annaly was also able to increase its leverage ratio as the MBS market began to improve. at the end of 2023, the company ended the year with an economic leverage ratio of 5.7x. Prior to the pandemic, the company ended 2019 at 7.2x leverage and ended 2018 at 7.0x. The increase in leverage will allow Anari to generate more net investment to help support its dividend.

Anari's recipe

Although there have not been many interest rate cuts in recent years, Amway's book value and share price have performed very well during the interest rate cut cycles of 2001 to 2003 and 2007 to 2008.

Interest rate cuts are not expected to be as large in the next few years, but Amway will still benefit greatly from this change. As you can see in the chart above, NLY's stock price has almost doubled between the two rate cuts. If the Fed cuts interest rates by about 2% over the next three years, Amway's stock price will be much higher than its current level. Combined with the current strong dividend yield of 14%, the stock looks like an attractive buy at current levels.

Should you invest $1,000 in Annaly Capital Management now?

Before buying shares of Annaly Capital Management, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Only ...... and Annaly Capital Management were not included. The 10 stocks that made the list are likely to generate huge returns over the next few years.

Stock AdvisorProvides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 8, 2024

Geoffrey Seiler owns shares of Annaly Capital Management. the Motley Fool does not own any of the above shares. the Motley Fool has a disclosure policy.

What Will Annaly Capital Gruen's Stock Price Look Like in 3 Years? This post was originally published by The Motley Fool.