.

Should You Buy Palantir Stock Before the S&P 500's Next Rebalance in June?

Standard & Poor's 500 An index of the 500 largest companies in the U.S. Often considered a checkpoint for the overall health of the market, the index provides a detailed view of the performance of the world's largest corporations.

Being named to the S&P 500 is an important milestone, representing significant recognition for a company. However, the qualifications for inclusion in the index are quite demanding.

Artificial Intelligence (AI) SpecialistPalantir Technologiesfirms(Palantir) Technologies ) (NYSE: PLTR)has been eligible for inclusion in the S&P 500 for some time, but the company is currently not included in the index.

Should you consider buying Palantir stock now, when the next index adjustment is scheduled for June? Let's analyze the reasons for Palantir's inclusion in the S&P 500 and assess whether it's a good time to buy this stock.

How does a company get included in the S&P 500?

There are many factors that go into determining a company's eligibility for the S&P 500. Factors such as the exchange on which the stock is listed and the aggregate market capitalization of the company are all general variables used to assess a company's eligibility.

However, one of the most important variables is profitability. Specifically, the aggregate sum of the company's earnings over the last 12 months must be positive.

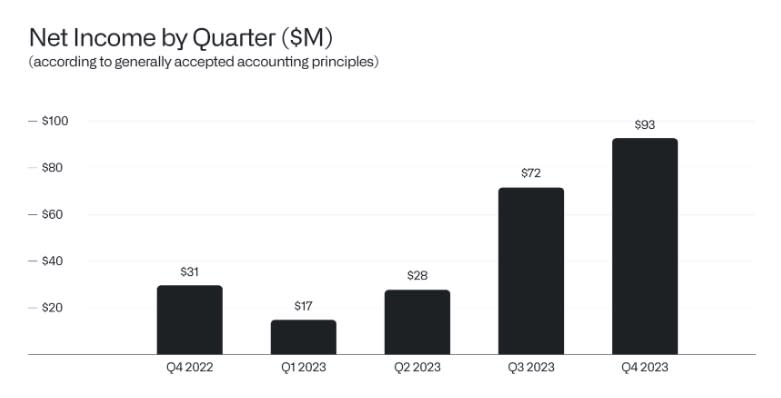

The chart below shows Palantir's GAAP net income for the past several quarters. Investors can see that Palantir's earnings have been positive for five consecutive quarters.

Should I buy Palantir stock before the next S&P 500 correction?

If Palantir is finally included in the S&P 500 later this year, I suspect the stock will rise. Why?

Because of this, Palantir is likely to be included in the S&P 500 index, which will attract more attention from institutional investors. As a result, interest in the company from investment banks and hedge funds may begin to increase.

However, buying stocks on any speculative basis is not sound financial judgment.

Palantir Is Becoming a Superstar in Artificial Intelligence (AI)

Artificial intelligence (AI) has been one of the biggest themes driving the capital markets over the last year. While many investors have beenMicrosoft,Alphabet,Amazon,Nvidia,Nikola Tesla (1856-1943), Serbian inventor and engineer,Meta Platforms respond in singingAppleThe progress of these "Big 7" is fascinating, but there are many other companies that are becoming powerful disruptors in the AI space.

Last year, Palantir hit the ground running in the AI space with the release of its fourth software suite: the Palantir Artificial Intelligence Platform (AIP). Since its release in April of last year, customers have publicly demonstrated how AIP can impact their business-giving investors a preview of the vast number of use cases covered by Palantir's products.

Palantir's position in the artificial intelligence space hasn't gone unnoticed. The company's stock has risen nearly 1,70% in the past year and trades at a 23.5 price-to-earnings (P/S) ratio - no doubt a premium compared to other software-as-a-service (SaaS) companies.

That said, I still think Palantir is a compelling long-term buy. The company's continued profitability has really helped Palantir stand out from other high-growth SaaS stocks - many of which are still burning cash. Moreover, I am optimistic that revenue growth will accelerate further as the company leverages AIP with other leading AI and cloud developers.

Although the stock is not cheap, I think the premium is justified and I am bullish on Palantir's growth prospects as the long-term secular themes driving AI development are emerging.

While a move to the S&P 500 is a nice milestone, more importantly, Palantir represents a strong, compelling opportunity in the high-growth, competitive artificial intelligence industry. While I think it's likely that Palantir will make it to the S&P 500 this year, the themes explored in this article suggest that there are even more prudent reasons to buy Palantir stock, and those reasons are tied to the actual fundamentals of the company's business.

In total, I think Palantir is a solid business with strong long-term growth ahead. The dollar cost averaging approach is a prudent strategy for adding to existing positions or initiating new ones.

Should you invest $1,000 in Palantir Technologies now?

Before buying shares of Palantir Technologies, consider the following:

Motley Fool Stock AdvisorThe analyst team has just selected what they think is the best name for investors to buy now.10Only ...... and Palantir Technologies were not included. The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of April 8, 2024

Suzanne Frey, an Alphabet executive, is a member of The Motley Fool's Board of Directors. Randi Zuckerberg, former Facebook Marketplace Director of Mass Development and Spokeswoman, and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool Board of Directors. John Mackey, former chief executive of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool. Adam Spatacco owns shares of Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Palantir Technologies, and Tesla. The Motley Fool's recommended positions are in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Palantir Technologies and Tesla. The Motley Fool recommends the following options: Microsoft 2026 January $395 Calls The Motley Fool recommends the following options: Microsoft January 2026 $395 Call Options Long and Microsoft January 2026 $405 Call Options Short.The Motley Fool has a disclosure policy.

Should You Buy Palantir Stock Before the S&P 500 Rebalances in June? This post was originally published by The Motley Fool.