.

Investors have overlooked a key sector of the stock market. Market professionals cite three reasons why the energy sector has a lot to offer

-

Experts say investors are missing out on the strong potential of energy stocks because of their solid fundamentals based on valuations.

-

The recent rally in energy stocks broke through key resistance to the 2022-2023 peak.

-

Geopolitical risks and macroeconomic factors will push energy stocks further up.

Technology stocks seem to be getting all the attention in the stock market, but investors should be turning on a less glamorous sector that is ripe for a strong upturn amidst a series of bullish positives.

Market experts say energy stocks deserve more attention because of the sector's impressive performance this year, with the S&P 500 Energy Index returning 16.3% year-to-date in 2024. However, top Wall Street economist David Rosenberg says investors have yet to capitalize on the sector's favorable position in the market.

"This is a neglected part of the market as investor positioning is extremely negative (-$2.7 billion in outflows from the SPDR Energy Sector ETF over the past year). This is a counter-trend positive," Rosenberg told Business Insider in an email Friday.

Market watchers see three reasons why energy stocks are poised for more gains this year, and analysts expect the sector to see as much as 20% of upside from previous levels.

Strong basic noodles

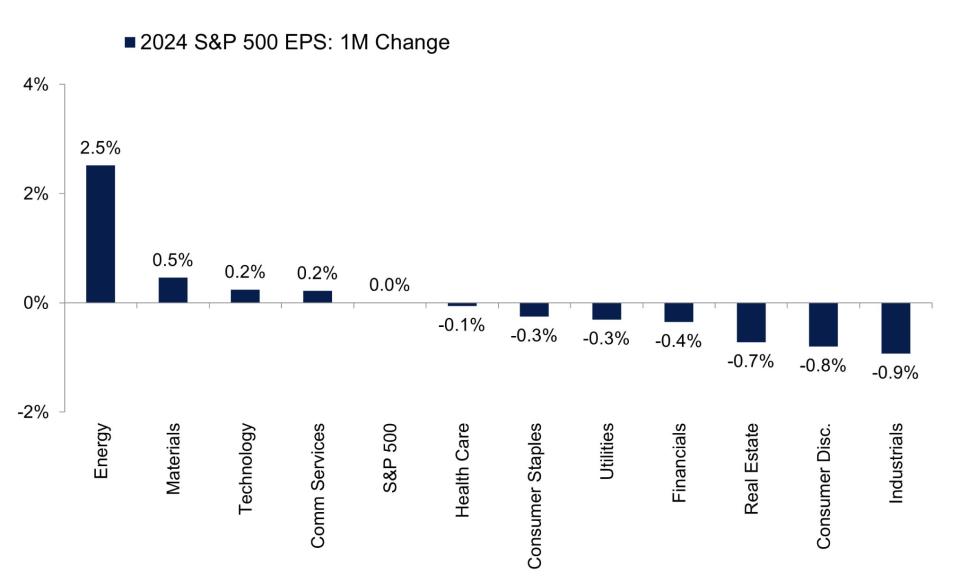

While tech stocks are riding high on strong earnings, LPL Financial noted in a note that energy stocks led all S&P 500 sectors in positive earnings in March, a timely reminder for investors as the first-quarter reporting season kicks off.

"We believe that favorable脩, coupled with rising oil prices, provides solid upside to the industry's expectations. Better capital allocation decisions by producers should help increase the chances that the sector's earnings will be well-received by the market, although the strong dollar may present some short-term challenges," LPL Financial's Jeff Buchbinder and Colby Hesson wrote in a report this week. in a report this week.

Rosenberg said the recent rise in oil prices could mean better business results for oil chain companies and higher sales for exploration and production companies.

"The continued rise in [prices] also implies increased capital spending in the sector, which translates into investment in storage, transportation and equipment infrastructure as a tailwind for these subsectors in the energy sector."

With energy firms eyeing cash flow for more dividends, buybacks and debt reduction, Buchbinder and Hutson expect valuations in the sector to rise, in line with Rosenberg's predictions.

"Rosenberg said, "OurStrategizerThe Energy subsector ranks 55th in absolute valuation in the model and 11th compared to the S&P 500.

Significant technological advantages

The rebound in the energy sector is hitting key resistance at the 2022-2023 peak, Buchbinder and Hesson say, with the breakout confirmed by bullish momentum and broad-based buying pressure.

"More than 90% of the sector's stocks are now trading above their 200-day moving averages, and nearly half of the sector's stocks hit 52-week highs earlier this month. Based on the size of the previous band, the technical minimum price target would be about 20% further up from the previous level," they wrote.

April is the golden time of the season, when energy consumption typically surges in conjunction with the summer driving season, which is one of the reasons for the sector's strength," they wrote. The S&P 500 Energy Sector Index has an average return of more than 3.7%, and based on historical data, there is a 70% chance of a positive return, so this trend will continue into May, Rosenberg said.

"While seasonality remains favorable, we believe the sector's large risk/reward ratio will drive returns in the coming months. Our model focuses on recommendations from a 12-month perspective, and we have recently found the energy sector to be extremely attractive. Therefore, we believe this trend will continue.

Macro-Micro Factors

With hostilities in the Middle East escalating and no end in sight to the conflict between Russia and Ukraine, this geopolitical uncertainty coupled with production cuts in the Euromaidan+ will continue to drive oil demand and prices higher, LPL said.

Rosenberg agrees that this will be another driver for energy stocks to move higher, but warns that the decline in aggregate demand associated with growth poses the biggest risk to the sector.

On the monetary policy side, Buchbinder and Hesson noted the industry's potential protection against persistent inflation and rising long-term interest rates.

They point out that the energy sector is the only one with a positive correlation to 10-year Treasury yields, providing investors with a potential portfolio hedge against higher interest rates.

Read the original article on Business Insider