.

Is it too late to buy Amazon stock?

E-Commerce and Cloud Computing LeadersAmazon (NASDAQ resonance code: AMZN)A true stock winner, its value has continued to increase at a compounding rate. Its stock price is near an all-time high, and a $1,000 investment in its May 1997 initial public offering has turned into more than $1.9 million.

New investors will naturally ask if they missed their chance to invest in this stock. At a valuation approaching $2 trillion, is there still room for Amazon's stock to grow in value? The answer.This one.The problem is that we have to ask two different questions:

-

Can Amazon still grow?

-

Is there room for the stock's valuation to rise?

After doing some homework, I was surprised at the answers I found. Here's what you need to know.

Can Amazon still grow?

Granted, if you're a large corporation with $574 billion in annual revenue, growth naturally becomes more challenging. But to borrow a phrase from my kids, Amazon'sThe way of construction is different from the others.The

This is because Amazon is involved in three huge markets that have more room for growth and opportunity than most companies: e-commerce, cloud computing and digital advertising. It is the leading e-commerce company in the US, with a market share of 38%. In cloud computing, Amazon Web Services (AWS) leads with a market share of 31%. By 2025, Amazon is expected to account for 15.2% of total digital advertising spending in the US.

This leadership position helps Amazon win the competition because it has a model and scale that most of its competitors can't match. It can offer better products for less money.

Most importantly, these megatrends are working in Amazon's favor. Today, e-commerce still accounts for only 15% of total retail sales in the U.S. This means that trillions of dollars of consumer spending have yet to move online.

Cloud computing has become the foundation of the Internet, and now Artificial Intelligence (AI) is adding several new dimensions to it. Just recently, Amazon announced a $50 billion investment in new data centers in Virginia and Japan, underscoring just how much computing power will be needed for AI and an increasingly digital world. Some believe that the public cloud, such as AWS, could become a $10 trillion market in the coming years, which is a bullish scenario.

Third, Amazon has amassed a huge presence in the media space with its Prime subscription program, which has about 200 million paid accounts, Prime members have access to streaming media content, and Amazon has acquired the rights to Thursday Night Football through the National Football League. Thursday Night Football through the National Football League. Amazon also generated billions of dollars in advertising revenue through Prime and its affiliate sales program. In the fourth quarter, advertising grew 27% year-over-year, outpacing the rest of Amazon's business. On an annualized basis, advertising revenue in the fourth quarter was nearly $60 billion. Amazon's strong growth rate seems to imply that there is still a lot of room for expansion in the advertising business.

Arbitrarily speaking, Amazon seems to have a lot of opportunities to continue to grow.

Is the valuation reasonable?

Amazon founder Jeff Bezos once said that companies are "notoriously unprofitable." What he meant was that you have to look at the cash flow of a business because it reinvests all profits back into the company. In other words, valuing a stock based on bottom-line earnings doesn't tell the whole story.

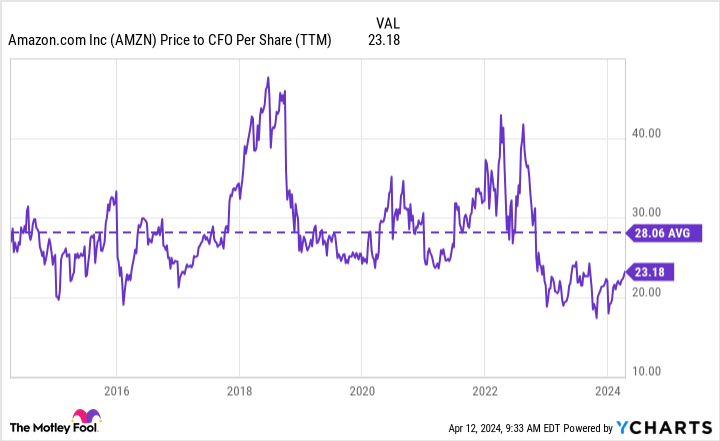

So, I looked at Amazon's stock price to cash from operations (CFO) ratio to see if it's still attractive today. After all, Amazon's stock price is at an all-time high and has risen 88% in the past year.

The eye-catching thing is that the stock price almost translated in just one year, the valuation of the staggeringly low. At less than 20 times operating cash flow, such a low price is rare. The good news is that the stock is still significantly below the average valuation of the past decade.

So yes, there is still some value in the share price right now.

Is it too late to buy Amazon?

Whether or not you buy any stock depends on the company's future growth prospects and the price you pay for that potential growth. If you get these two things right, you're likely to make money over time.

Amazon's core e-commerce and cloud computing businesses have room for continued growth. In addition, it has also ventured further into the media and advertising space, which offers a third potential growth avenue for the company.

As mentioned above, Amazon's current prices (at worst) are still justified.

So, to answer that question, long-term investors can still buy the stock now. Even though Amazon has had a strong year, it's not too late to buy.

Therefore, you may consider adopting a dollar-cost averaging strategy to build up your position slowly to avoid the dilemma of being left with no money to invest when the market adjusts.

Should you invest $1,000 in Amazon right now?

Before buying Amazon stock, consider the following:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10Only ...... and Amazon is not one of them. The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of April 8, 2024

John Mackey, former Chief Executive Officer of Whole Foods Market, an Amazon subsidiary, is a member of the Board of Directors of The Motley Fool.Justin Pope has no position in any of the stocks mentioned above.The Motley Fool owns shares of Amazon and recommends Amazon.The Motley Fool has a disclosure policy. The Motley Fool has a disclosure policy.

Is It Too Late to Buy Amazon Stock? This post was originally published by The Motley Fool.