.

Should investors be concerned about Beyond Meat losing market share?

Over the past few years.Beyond Meat (Nasdaq Resonancestock (market)(Code: BYND)From industry newcomer to beaten-down stock, its shares are down a staggering 97% from the highs it hit shortly after its 2019 IPO.

The company's sales have been declining quarter over quarter and losses have been heavy, but investors have been encouraged by its fourth quarter results and shares have risen by 60%. However, these gains have been short-lived, and Beyond Meat is down 25% year-to-date, with a low price-to-sales ratio of 1.2. However, even if investors were initially excited about the company's recent progress, there are reasons to be concerned about Beyond Meat's future. Meat's future.

Beyond Meat May Be Losing Market Share

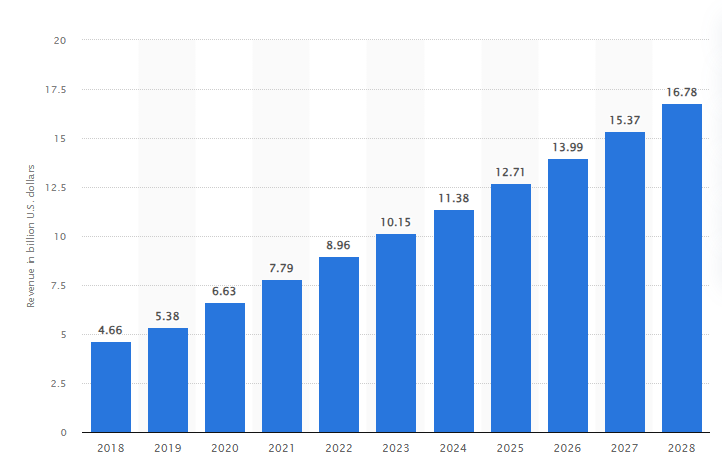

According to Statista, the meat substitute industry has been growing and will continue to do so for years to come.

But the fourth quarter of 2023 marked the seventh consecutive quarter of revenue declines for Beyond Meat. The company's full-year sales contracted by $18% to $343.3M, while overall industry sales grew by $13%.

The most popular updates from investors during the quarter included price increases and new product introductions. Management developed a plan to improve profitability, including cutting $70 million from the operating budget. These actions should help the situation.

Buying Beyond Meat stock now is a bet on management's ability to execute its turnaround plan, but success is far from guaranteed. The company's fourth-quarter net loss widened to $155.1 million from $66.9 million year-over-year, and it even posted a negative gross margin of 113.81 TP3T. Excluding non-cash charges, Beyond Meat's gross margins were still down compared to the same period last year.

Goon expects revenues of $315 million to $345 million this year, which means that 2024 will likely be another year where Beyond Meat is left behind in the industry.

Should you invest $1,000 in Beyond Meat right now?

Consider this before buying shares of Beyond Meat:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Beyond Meat is not one of the 10 stocks listed on ....... The 10 stocks that made the list could generate huge returns in the coming years.

Consider April 15, 2005Nvidia) on the list at ...... If you invest $1,000 at the time of our recommendation, theYou will have 540,321dollar! *Stock Advisor provides easy-to-use stock investment tools for investors.

Stock AdvisorIt provides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 8, 2024

Jennifer Saibil does not own any of these shares. the Motley Fool holds a recommendation for Beyond Meat. the Motley Fool has a disclosure policy.

Should Investors Be Worried About Beyond Meat's Declining Market Share? This post was originally published by The Motley Fool.