.

Intel just revealed why it can't spin off its manufacturing model and why its stock can only be held at most.

A new bull market is booming, driven by the accelerating development of computing infrastructures, the artificial intelligence (AI) systems built on top of those infrastructures, and the heightened interest of the world's governments in "re-sourcing" chip manufacturing to their own countries.Intel (NASDAQ: INTC)seems poised to be the biggest beneficiary of these growth trends.

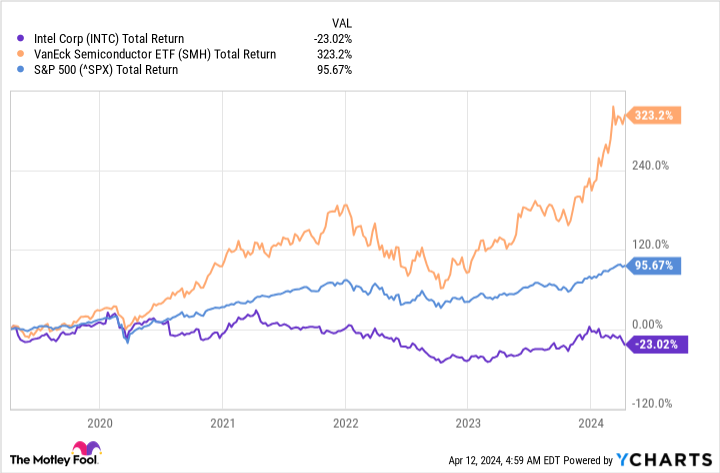

Despite this apparent enthusiasm, the stock has underperformed Daban and other leading chip stocks.

The company appeared to rebuild some momentum last year, but the latest financial data from its manufacturing division were so bad that many investors had to take a second look.

Intel's Current Status

Intel is trying to become a "national hero" in the U.S. chip manufacturing industry. It has received billions of dollars in grants and tax breaks from the U.S. CHIPS Act, similar assistance from the European Union's Chip Act, and from infrastructure investorBruchfeldPrivate investment was secured.

Intel's reduced focus on chip manufacturing is due to the fact thatTaiwan Semiconductor Manufacturer firms(NYSE: TSM)This giant third-party foundry currently manufactures approximately 90% of the world's most advanced semiconductors (including many of Intel's most advanced chips). Many investors are concerned about the impact of a possible Chinese invasion of Taiwan. In addition, Western governments want more chip manufacturing bases, i.e., more semiconductor manufacturing bases to be moved outside of China's potential sphere of influence and onto their own shores.

As a result, Intel is seeking these government funds to build a manufacturing infrastructure that can compete with TSMC's, in order toNvidia),Advanced Micro Devices(math.) andQualcommThe company also provides an alternative factory to top chip designers such as the U.S. Department of Defense (DOD).

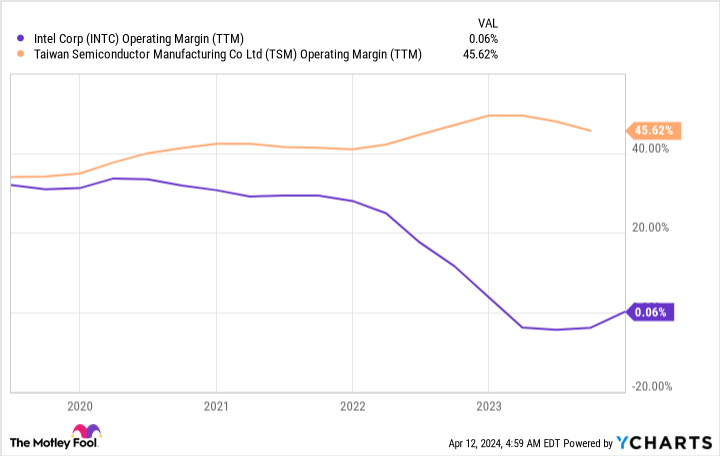

One glaring issue, however, is that Intel has just confirmed what some investors have long feared: that its manufacturing business (the business unit now known as "Intel Foundry") is seriously losing money. in 2023, Intel's Foundry business had revenues of $18.9 billion and operating losses of $7 billion. (The majority of these sales came from Intel's "Products" division, which has been realigned as a non-manufacturing design company.)

This is nothing new. Under these new reporting standards, Intel revealed that even during the previous chip-making boom, Foundry incurred operating losses of $5.1 billion in 2021 and $5.2 billion in 2022.

Is this chip-making money, or a bailout?

While Goon's chief executive officer, Pat Gelsinger, has said that the foundry division should break even in the next couple of years, Intel Goon's management is not sure about the timetable for the foundry division to get out of its struggles. That's not encouraging news. While Intel is using government money to fix its business model, other semiconductor makers, including TSMC, are already making healthy profits.

One way to look at it, however, is that Intel is going to grow from here on out as it works out the kinks and gets enough money to build a strong chip manufacturing operation out of Taiwan. But Intel isn't the only company to receive government funding. So is TSMC. TSMC just received a whopping $6.6 billion in direct funding from the U.S. CHIPS Act, plus another $5 billion in loans and other tax incentives to strengthen and expand the facilities it is building in Arizona.

Intel isn't even a cheap stock, given the mountains it has to climb. It trades at 28 times expected earnings per share (EPS) in 2024 and more than 16 times EPS in 2025. It's also important to remember that EPS doesn't include the huge capital expenditures the company will need to make in the next few years, which are sure to outweigh the government aid it's receiving.

In total, Intel is now a very difficult stock to own. Investors looking to bet on a rebound should adjust their positions in the company accordingly. Meanwhile, many other semiconductor companies are doing very well as the bull market kicks in.

Should you invest $1,000 in Intel now?

Before buying Intel stock, consider the following:

Motley Fool Stock AdvisorA team of analysts have just named what they think are the best values for investors.10Only ...... Intel is not one of these stocks. The 10 stocks that made the list could generate huge returns in the coming years.

Consider April 15, 2005NvidiaWhat it was like when it was on the list ...... If you invested $1,000 at the time of our recommendation.You will have 540,321dollar! *Stock Advisor provides easy-to-use stock investment tools for investors.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 8, 2024

Nicholas Rossolillo and his clients own shares of Advanced Micro Devices, Nvidia and Qualcomm. The Motley Fool owns and recommends shares of Advanced Micro Devices, Brookfield Corporation, Nvidia, Qualcomm and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Advanced Micro Devices, Brookfield Corporation, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing, and the Motley Fool recommends Brookfield Corporation and Intel Corporation for the following options The Motley Fool recommends the following options: Long Intel Corporation January 2023 $57.50 Calls, Long Intel Corporation January 2025 $45 Calls, and Short Intel Corporation May 2024 $47 Calls. The Motley Fool has a disclosure policy.

Intel Just Revealed Why It Can't Separate Itself From Its Manufacturing Model, and Why the Stock Is Best Held was originally published by The Motley Fool.