.

Goldman Sachs Profits Surge as Wall Street Complexes

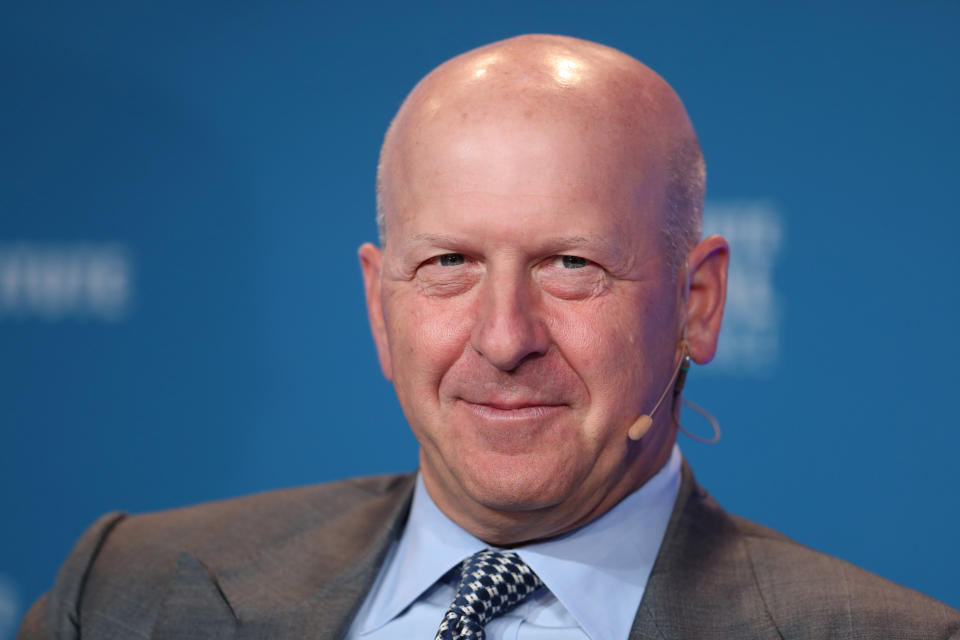

Goldman Sachs, due to a surge in investment banking revenues(GS)The company's first-quarter profit grew 28%, giving Simmons CEO David Solomon some much-needed momentum to start 2024.

Net profit of US$4.1 billion exceeded analysts' expectations. The company's $14.2 billion in revenues was also up from the same period last year, partly due to a 32% increase in investment banking fees, growth in asset and wealth management revenues, and growth in trading revenues.

Shares of Goldman Sachs were up 3% in pre-panel trading Monday.

The year before the improvement in business was Solomon's most challenging since 2019, his first full year at the helm of Goldman Sachs.

Trading across Wall Street has slowed, and he's also grappling with a costly exit from consumer banking and a series of high-profile departures at the company.

In 2024, the pressure on Solomon's noodles will not diminish. Two prominent proxy advisory firms have recommended that shareholders vote this month to limit Solomon's power, and the results will be tallied at the company's annual meeting on April 24th.

The proposal, which was approved by Institutional Shareholder Services (ISS) and Glass, Lewis & Co., would have split the positions of chief executive officer and chairman of the board, currently held by Solomon. A similar proposal last year failed, receiving only 16% votes.

Glass Lewis also recommended that shareholders vote against Goldman Sachs' KPMG program because of the "significant disconnect between pay and merit. "ISS provided "prudential support" for the KPMG program.

Solomon's 2023 payroll increased by 24% to $31 million, while Koon's profits declined by the same amount.

That's not only an increase from the $25 million he'll receive in 2022, but it's also higher than the salaries of his competitors Brian Moynihan, Charles Scharf and Jane Fraser at Bank of America (BAC), Wells Fargo (WFC) and Citigroup ( Citigroup.

Only JPMorgan Chase (JPM) Mat Executive Jamie Dimon and outgoing Morgan Stanley (MS) Mat Executive James Gorman were rewarded more for their performance in 2023.

With the departure of the main Gao Guan, Goldman Sachs has seen a lot of changes, which also brought new problems for the competition to ultimately replace Solomon.

Jim Esposito, a surprise departure in 2024, is leaving after nearly three decades as Co-Managing Director of Goldman Sachs' Global Banking and Markets Group. Esposito had been touted by Wall Street as one of Solomon's likely successors.

In March, Stephanie Cohen, global director of Goldman Sachs' platform solutions division, also left the company.

Even Goldman Sachs' board of directors is changing. This year, former Goldman Sachs matriarch David Viniar was appointed as the board's first matriarch, replacing Adebayo Ogunlesi.

Solomon is poised to face shareholders later this month, and first-quarter results may help him. The surge in investment banking included a 24% increase in advisory fees, a 38% increase in debt underwriting fees and a 45% increase in equity underwriting fees.

Both fixed income and equity trading revenues also grew by 10% compared to the same period last year.

"Our first-quarter karma reflects the strength of our world-class, interconnected franchises and Goldman Sachs' profitability," Solomon said in a press release.

Click here for in-depth analysis of the latest stock market news and events affecting stock prices.The

Read the latest financial news from Yahoo!