.

Is it too late to buy Walmart stock?

Inflation appears to be rising again. This could mean a prolonged period of higher interest rates, which would tighten financial conditions and could ultimately push the economy into recession.

In this environment.Wal-Mart (NYSE: WMT)It's a great choice for the defensive investor. It's a consumer powerhouse that does well when people want to tighten their budgets. But investors have gotten a jump on the stock. In the past 12 months, the company's stock has soared, rising 20%.

We can't help but wonder if there's still an opportunity here, or if Walmart is a trap waiting to lure unsuspecting investors. Here's what you need to know.

Wal-Mart is the cornerstone of consumerism

Wal-Mart's volume and retention are impressive. With annual sales of $648 billion, the company attracts merchants from North America and around the world. The mega-retailer is a top choice for U.S. consumers. About 90% of Americans live within 10 miles of a Wal-Mart store, and Wal-Mart accounts for 25% of all U.S. grocery spending.

This model creates a competitive advantage that is hard to match. Wal-Mart's large scale model gives it the unique ability to bargain with suppliers, allowing it to sell at famously low prices that your neighborhood mom and pop store can't match.

Maybe you've seen it or experienced it. With inflation driving up the cost of living, more and more people are shopping at Walmart to save money. Wal-Mart's fourth-quarter comparable sales rose 41 TP3T, driven by food, health and consumer products. Consumer goods were weak. What does this mean? People are shifting their spending from "wants" to "needs".

Wal-Mart is good at this game. Koon believes comparable sales this year will grow 3% to 4%, which doesn't seem like much, but keep in mind that Walmart is promoting a huge revenue number.

The price you pay matters

As impressive as it is that Wal-Mart has continued to grow despite its massive size, that size is also a problem. Wal-Mart is too big to be careless with its stock price. In other words, Wal-Mart has become a slow and steady grower that can't quickly outperform its high valuation. An overpriced stock could mean a poor return on investment.

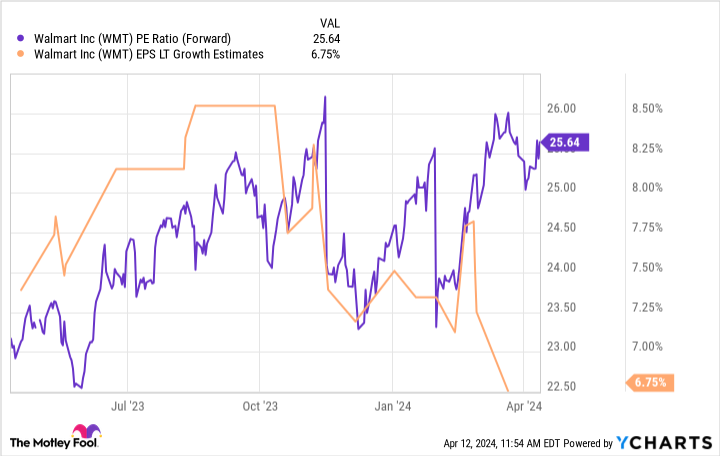

Today, Wal-Mart stock is at a 52-week high. It makes sense. As mentioned above, Wal-Mart will do well in an environment where people are trying to save money. But the current stock price is almost 26 times this year's projected earnings.

How do you determine if the price is expensive? I like to use the price-to-earnings (PEG) ratio, which compares a stock's valuation to its expected earnings growth. Analysts believe that over the long term, Wal-Mart will grow earnings at an average annualized rate of 6% to 7%, resulting in a PEG ratio of 3.8, which is a very high number. As a trader, I like to buy stocks when the PEG ratio is 1.5 or lower. This means that Wal-Mart could fall 50% from now on, but there are still reasons to think the stock is expensive.

Is it too late to buy Wal-Mart?

Good companies are not necessarily good investments. This statement perfectly describes Wal-Mart's current stock price situation. Because the stock is so expensive, investors won't be able to get a satisfactory return on their investment for years to come. But that doesn't mean that those who own the stock have to sell it, as much as I can understand that - it's a stock that's in the market right now, and it's a stock that has a lot of potential to be a good investment.It's so expensive.The

Prospective investors would be wise to look at other investments. LikeAmazon) Such stocks, even at all-time highs, are more attractive today.

Should you invest $1,000 in Wal-Mart now?

Before buying Walmart stock, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Only Wal-Mart, ......, is not one of these stocks. The 10 stocks that made the list could generate huge returns in the years to come.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 8, 2024

John Mackey, former chief executive officer of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors.Justin Pope has no position in any of the stocks mentioned above.The Motley Fool has stock recommendations for Amazon and Walmart.The Motley Fool has a disclosure policy. The Motley Fool has a disclosure policy.

Is It Too Late to Buy Wal-Mart Stock? This post was originally published by The Motley Fool.