.

Jefferies Says It's Time to Pull the Trigger on These Two CRE Stocks

Inflation in March showed an annualized CPI of 3.5%, the highest in six months, but there is still debate about whether this will deal a blow to the argument that inflation is falling. Yes, prices are still high, but the rate of increase is declining - even when March's headline figure is taken into account. Common sense tells us that the Fed is still on track to lower interest rates later this year - probably not as soon as previously hoped.

A report by investment bank Jefferies says the real key is that interest rates are unlikely to rise again, and in the business world, interest rate stability is almost as important as interest rate cuts. Companies want predictability in their pricing, and they can do that in a stable rate environment.

Jefferies analyst Peter Abramowitz said: "With the Fed signaling that inflation is close to being manageable, we think the conditions are ripe for a recovery to begin in 2H24. First and foremost, interest rates are expected to stabilize and/or decline ...... Regardless of the number of rate cuts, we believe interest rate stabilization is the most important factor in the thawing of the investment sales market, as the increased visibility of financing costs will allow buyers/sellers to re-value real estate with greater confidence.

To that end, Abramowitz identified two CRE services stocks that investors should buy now. We used the TipRanks database to find out what the industry thinks about these two stocks. Let's take a closer look.

Jones Lang LaSalle (JLL)

We will start with Jones Lang LaSalle, a real estate services company with a truly global reach, founded in the United Kingdom and now headquartered in Chicago, Illinois, JLL operates in 80 countries. The company works with commercial clients to buy, build, occupy and maintain a wide range of commercial properties and investments, combining its global presence with local expertise.

Even after several years of difficult times in the commercial real estate sector, some of the numbers speak to the scale of JLL's business. JLL's client base includes a wide range of investors, from institutional and retail investors to corporate investment clients and high net worth individuals. JLL tailors its real estate activities and investment portfolios to clients who have readily available capital for immediate investment.

Over the past year, JLL's revenues and earnings have been on an upward trend. The company's revenue for the last quarter came in at $5.88 billion, an impressive 5% year-over-year increase and $110 million above estimates. On a non-GAAP basis, these revenues supported a bottom line of $4.23 per share. While lower than the $4.36 reported in the same period last year, EPS beat estimates by 50 cents.

Abramowitz, an industry analyst at Jefferies, believes JLL is well-positioned to continue to improve, writing: "As the CRE service provider most closely tied to the recovery of capital markets and leasing activity, JLL is poised to benefit the most from the recovery. While the market is optimistic about a soft landing and a more stable interest rate environment, it is still hesitant to expect the economy to recuperate, with annualized growth in leasing/capital market service fee revenues projected at +1.6%/+2.7% in FY24, compared to our expectation of +5.3%/+3.9%, and further deviating from our expectation in 2025 (JEF capital market service fee revenue growth). The expectation for 2025 will further diverge (JEF Capital Markets Service Fee Revenue growth rate of +21.6% per annum versus the consensus of +12.3%). Hence, as the economic recovery unfolds, we expect the stock to be revalued on the back of upward earnings revisions ......"

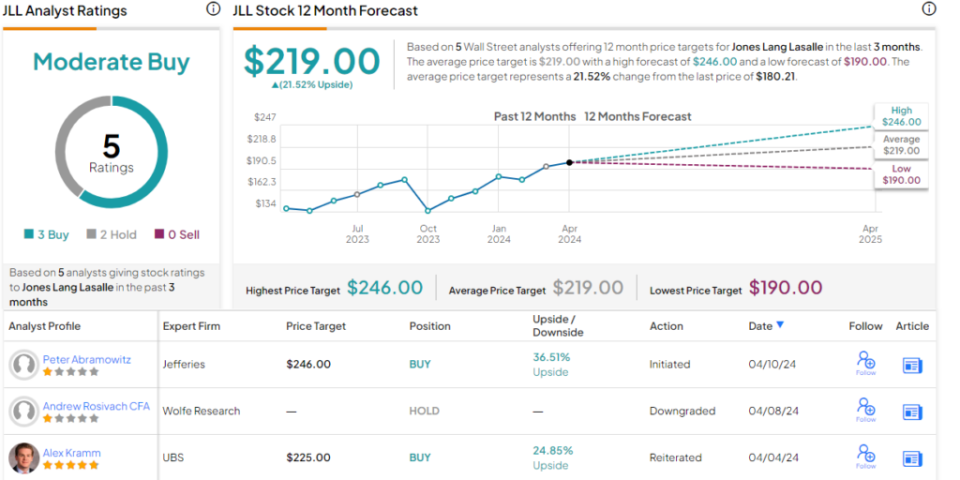

After quantifying his expectations, Abramowitz rated the stock a "Buy" and set a target price of $246, which implies a one-year upside potential of 36.5%. (To view Abramowitz's track record, click here.)

In total, these stocks have a consensus rating of "Moderate Buy" based on 5 reviews (including 3 "Buy" and 2 "Hold"). The company's stock is trading at $180.21 and its average price target is $219, which implies a 21.5% upside over the next year.(ViewJLL Stock Forecast)

Cushman & Wakefieldglobe(CWK)

Cushman & Wakefield, the second stock on our list, is another global entity engaged in commercial real estate services. The company provides commercial real estate management and investment services with the goal of creating value for property owners and renters. Cushman & Wakefield has approximately 400 offices in 60 countries and had total revenues of US$9.5 billion last year. The company's revenues are derived from the businesses of property, facility and project management, leasing, capital markets, valuation and other services.

In a recent report on the outlook for urban office space, Cushman & Wakefield took a cautiously optimistic view of the near-term outlook. The firm acknowledged that new builds will slow down and that supply is currently outstripping demand, but argued that there is scope for translating new office space and "assets a little lower down the value chain". The firm notes the growth in demand, pointing out that there is still a large number of people who want to live in vibrant urban cores and who need to be physically located to work, shop and play. Not to be outdone, Cushman & Wakefield believes that the post-pandemic 'slack' in urban office space - vacancies caused by the increase in remote working - has been filtered through the system. Demand should increase, the company believes, as urban property owners "adjust" their portfolios and begin to expand where they have done so.

Looking at CWK's last financial report for 4Q23, we see that the company reported revenues of $2.6 billion. This was flat year-over-year, but $170 million higher than expected. On a non-GAAP basis, earnings per share for this total revenue amounted to 45 cents, which was 5 cents higher than expected.

According to analyst Abramowitz, this is another stock that is growing steadily. He writes of Cushman & Wakefield: "Cushman & Wakefield has taken steps to improve its operating efficiency, reducing its cost base by $140 million over 23 years. The company's revenue breakdown is similar to CBRE's (55% of fee income from Property, Facilities and Project Management); however, we believe the consensus estimate underestimates the potential for capital market activity to rebound in the second half of the year (24/2025), resulting in our FY25 EPS estimate being 7.1% higher than the market's estimate. As a result, we anticipate that the upward revision to earnings will help the company's share price to match that of its peers (who are currently in the same position). the company's share price to be more in line with its peers (current P/E and EV/EBITDA discounts of -44%/-35%, respectively)".

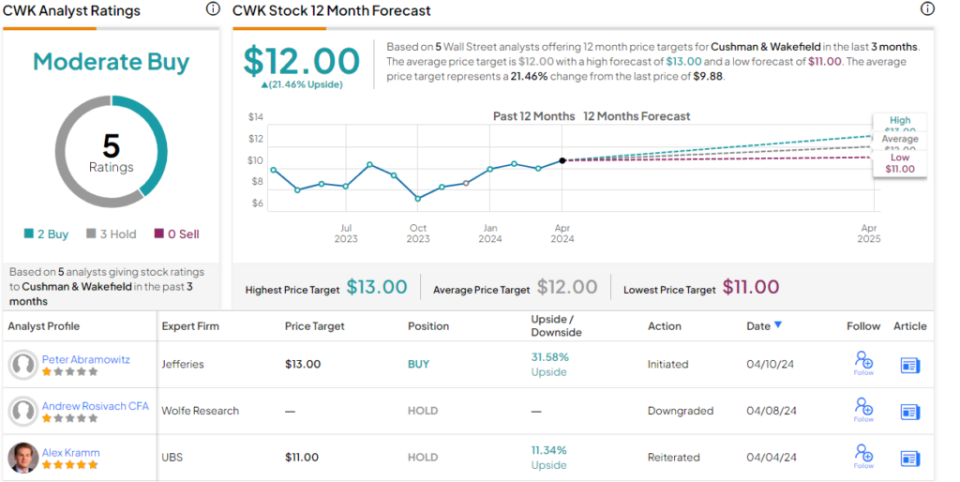

Looking ahead, the analyst has rated the stock with a "buy" rating and a $13 price target, which suggests an upside potential of 31.5% in one year.

Analysts unanimously rate this Sci-Tech company a "Moderate Buy," based on 2 recent "Buy" and 3 "Hold" calls. The stock is currently trading at $9.88 with an average price target of $12, suggesting an upside of 21.5% over the next few months.(Check out theCWK stock forecast)

To find stocks with attractive valuations, visit TipRanks' Best Stocks to Buy, a tool that carries all of TipRanks' stock quotes.

Disclaimer: This article represents the views of the contributing analysts. The contents are for informational purposes only. It is important to conduct your own analysis before making any investment.