.

The market dynamics are as follows: April 16

Markets wavered on Tuesday as investors continued to digest corporate earnings reports in hopes of ending the Dow's losing streak.

SPDR S&P 500 Index ETF TrustFund SPY Flat as S&P 500 Moves In and Out of Red Rock. The S&P 500 is trading in the red as a result of UnitedHealth Group Inc.SPDR Dow Jones Industrial Average ETF TrustsThe fund DIA was up about a third of a percentage point. The Nasdaq Resonance Index also faltered on Tuesday, remaining flat for the day. Technical LongsInvesco QQQ Trust Fund QQQReflecting the trend of the index, it struggled in the green.

Bank of AmericaCorp reported earlier today that profit fell more than 18% from a year ago, a decline that underscores the challenges banks face in a high interest rate environment. While rising interest rates typically boost profit margins for financial companies, they also erode margins on consumer accounts.

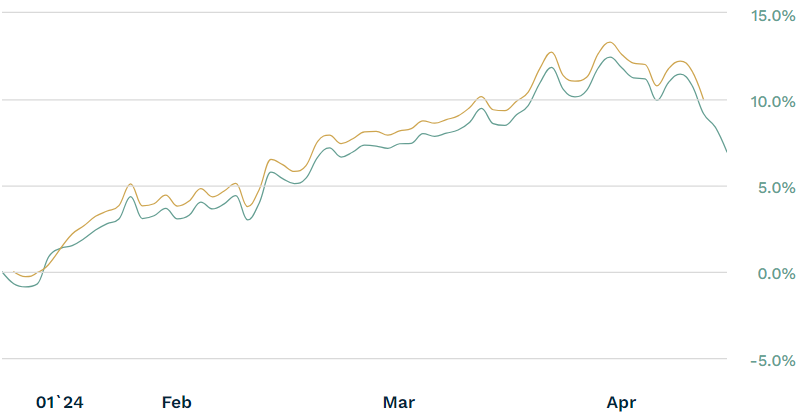

As investors digest the impact of interest rates on the financial sector, theFinancial Select Sector SPDR FundThe XLF has fallen by more than a quarter of a percentage point. Despite the recent decline in the financial sector, the sector has been strong so far this year, jumping nearly 7% since the beginning of the year.

XLF 3 Months Arbitrage Report

Source: etf.com

XLF was one of the most active ETFs on Tuesday, with an aggregate volume of about 29 million as of 1 p.m., etf.com data showed.

Corporate earnings will continue to be a strong market driver in the coming weeks as investors look to see clarity on the strength of the U.S. economy amidst concerns about the Fed and the path of future interest rate cuts. According to FactSet, so far, about 6% of S&P 500 companies have released their earnings reports, of which 83% have exceeded earnings expectations, and more than half have exceeded revenue expectations.

For investors looking to raise rates on their portfolio carries, they'll have to look abroad. European Central Bank President Dr. Christine LaGarde said on CNBC that the bank will "ease restrictive monetary policy" if inflation continues to develop as expected.

represents investors' largest exposure to EuropeVanguard FTSE Europe ETF (Vanguard FTSE Europe ETF)) closed in the red on Tuesday.

In the U.S., according to the CME FedWatch tool, the market forecasts that the Fed is 99.5% likely to keep interest rates stable at the June policy meeting. traders do not expect a rate cut before September.

Permalink | © Copyright 2024etf.com Press validate it