.

AST SpaceMobile Stock: Buy, Sell or Hold?

AST SpaceMobile (NASDAQ: ASTS)A major milestone was reached in 2023, when the company sent a functioning cellular broadband satellite into space in 2022, and tests in 2023 proved that the satellite was indeed capable of doing what Mr. Koon said it would do.

In fact, AST SpaceMobile has proven itself capable of competing with Elon Musk's resonant, larger and more established Starlink. Will that be enough for investors to buy into the company, or is it best to stay away until it's further along?

AST SpaceMobile's model is different from others.

Mars Resonance's private company, Starlink Services, owns a network of satellites that provide global broadband cellular and Internet services. The company is affiliated with SpaceX and is a stand-alone product that must be ordered by the customer.

Users will also need to install equipment where the satellite antenna is located in order to connect to Starlink's satellite array. AST SpaceMobile wants to compete with Starlink, but it's taking a very different path.

First, AST SpaceMobile's service works with regular cell phones without the need to purchase and install any additional hardware. Second, and perhaps more importantly, the company is attempting to work with mobile phone providers to make its service an add-on to their service.

Notably, this allows the company to capitalize on its existing customer base while enabling mobile operators to compete with Starlink without having to build their own standalone services. Additionally, AST SpaceMobile will have access to corporate cash to fund the development of the satellite array.

That's the problem: AST SpaceMobile currently has only one test satellite in space. Although the company has proven that it can provide this service, it does not yet have a true space-based cellular broadband service.

In other words, more money will have to be invested before AST SpaceMobile can truly compete with Starlink. So what's an investor to do?

Sell AST SpaceMobile?

Looking back at AST SpaceMobile, the fact that it still doesn't have a working service means that it's still only a big idea. More satellites are needed to support real customers from now on, not just for testing.

The next five satellites will not arrive at the launch site until July or August. After that, they will have to wait for the launch window. In the meantime, it will take much more than five satellites to provide a full spectrum of services.

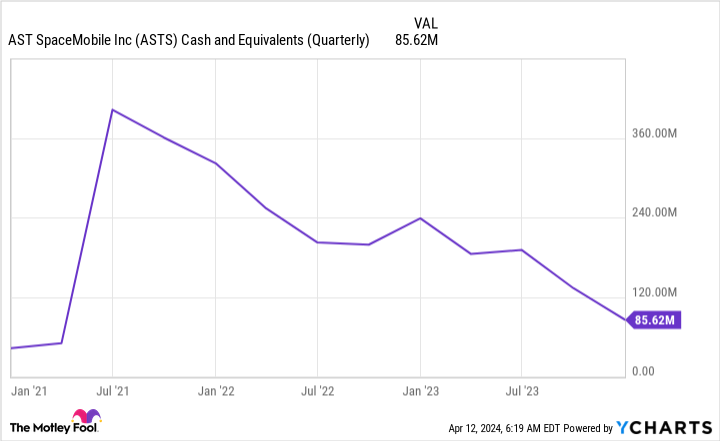

Investing now means investing before it's too late. Even good ideas don't always materialize as planned. For example, AST SpaceMobile spent $168 million in 2023 on engineering, research and development, and general operating costs. The company generated no revenue and ended the year with less than $86 million in cash on its balance sheet.

The company was able to raise additional capital in the first quarter of 2024. But while the company won't run out of money anytime soon, it still ended the first quarter with only about $211 million in cash. Judging by the rate of spending, that won't be the case for long.

AST SpaceMobile is in danger of not realizing its ambitious goals. Moderate and conservative investors would do well to watch the situation unfold before jumping in.

Buy AST SpaceMobile?

The only reason to buy AST SpaceMobile at this point is if you believe that it will eventually be able to create a space-based cellular broadband network. As mentioned, there's still a lot of work to be done before that goal can be realized, but investing now means getting a head start.

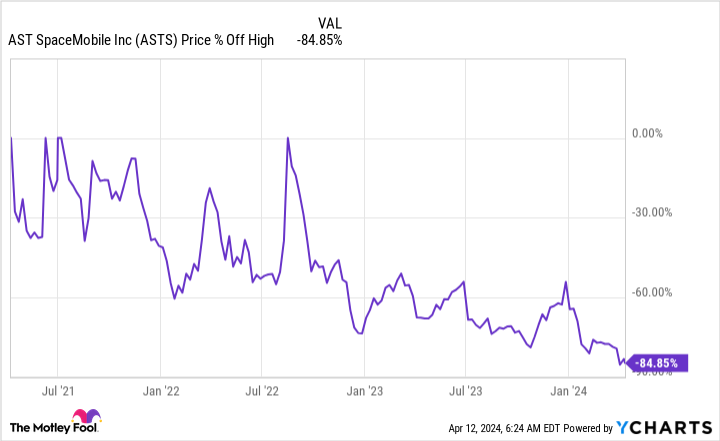

That's not just a myth - the company's stock price is about $85% below its peak, and it's been less than three years since the company went public.

That said, the ability to raise capital in early 2024 is noteworthy. In fact, AST SpaceMobile has already received a $4.5 million grant from theAT&T (New York Stock Exchange Code: T)respond in singingVodafone (NASDAQ resonance code: VOD)The company has received capital investments from large companies, such as the BTX, and has thus established relationships with cellular providers who plan to work with the company on a long-term basis.

If one assumes that the company can continue to raise cash in this manner, there is no particular reason to think that it cannot continue to meet its substantial capital expenditure requirements. However, this is clearly a "glass half full" view.

Holding AST SpaceMobile?

The reason for holding AST SpaceMobile is essentially the same reason you bought it. You believe it will ultimately deliver what it says it will.

That is, if you bought the stock shortly after the company went public through a special-purpose carrier, you could face a significant loss in paper flour. If you sell the stock, you can use the loss to offset gains elsewhere in the portfolio.

But if you sold AST SpaceMobile now, would you be willing to buy it again later on when the service is actually up and running? What gains might you give up between now and then, because once the company starts generating some revenue, Wall Street might reward it with a higher price?

The company has reached an agreement with the U.S. government and is expected to begin generating revenue in the first quarter of 2024. In fact, the company appears to be at an important turning point, and selling now would mean potentially missing out on the company's success.

AST SpaceMobile is not for the faint of heart

If you own AST SpaceMobile, you know that it takes a lot of guts to invest in a business that is more of a big idea than a full-fledged operation. If you're considering buying it, don't discount the realistic possibility that the company won't succeed.

As exciting as the company's attempts to build a space-based cellular broadband service are, only the most aggressive investors will want to own the stock. In all likelihood, most investors will want to wait to buy until the company achieves some more milestones, such as a full-span service.

Should you invest $1,000 in AST SpaceMobile right now?

Before buying shares of AST SpaceMobile, consider the following:

Motley Fool Stock AdvisorThe analyst team has just selected what they think is the best name for investors to buy now.10Only ...... and AST SpaceMobile were not included. The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 15, 2024

Reuben Gregg Brewer does not own any of the aforementioned stocks.The Motley Fool recommends Vodafone Group Public.The Motley Fool has a disclosure policy.

AST SpaceMobile Stock: Buy, Sell or Hold? Originally Posted by The Motley Fool