.

Got $1,000? These 3 Artificial Intelligence (AI) Stocks Are Still a Good Value

Over the past 18 months, investors have moved into artificial intelligence (AI) stocks in a big way.2022 In November, OpenAI released a much-improved version of ChatGPT, which forced the stock-holding public to rethink the power of AI, and a number of stocks have seen significant gains.

However, the market is not treating all AI stocks equally, and some are struggling because they are perceived to have fallen or will fall behind. Some of these market perceptions may be too negative, creating opportunities for three AI stocks, even for those with a $1,000 investment budget. Let's take a look at why these three AI stocks are cheap right now.

1. Alphabet

Google Parent CompanyAlphabet (NASDAQ: GOOGL) (NASDAQ: GOOG)It has long been synonymous with artificial intelligence. It has been a leader in AI since 2001 when it first used machine learning to correct spelling. It also became an "AI-first" company in 2016, meaning it has incorporated AI into all of its products since then.

Nevertheless, the release of the improved version of ChatGPT has changed people's minds. Google Search CompetitorsMicrosoftBing's integration of ChatGPT into its search tool starting in 2023 has investors questioning whether Alphabet can maintain its lead in search. In addition, the release of its competing product, Google Gemini, has received mixed reviews.

However, the company recently consolidated its efforts by placing its AI research division with Google DeepMind. In addition, it has about $111 billion in liquidity. So if it can't innovate in this area, it may be able to acquire a company that can. These resources should help the company stay competitive in the field of artificial intelligence.

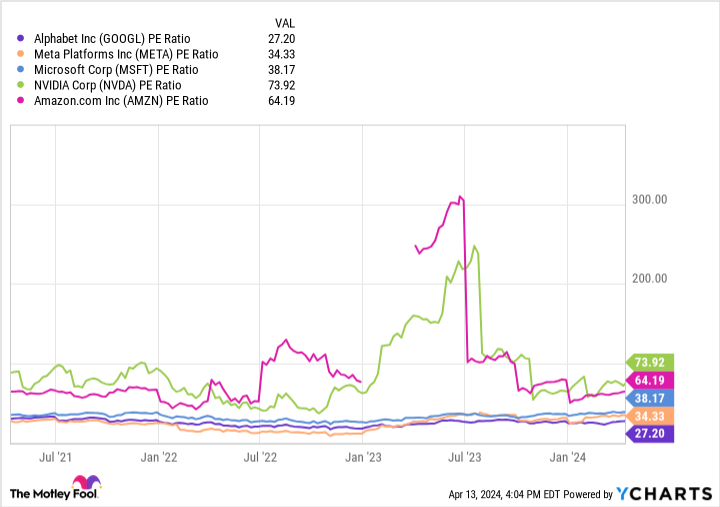

In addition, as much as the company is "struggling," as of this writing, its stock price has risen nearly 50% over the past year to just under $160 per share. Additionally, the company's price-to-earnings (P/E) ratio of 27 is lower than the valuation of all "Fab 4" stocks (see chart below). With its valuation and great optionality, the negative perception is likely a buying opportunity rather than a harbinger of the company's long-term decline.

2. Apple

As far as possible, it may not occur to Gwen's investors thatApple Inc. (NASDAQ resonance code: AAPL)It is also an artificial intelligence company. It has invested heavily in AI-related research, and product features such as iPhone's Siri, FaceID, and KeyPan are just a few examples of AI microfunctions.

However, Apple hasn't released a "major" new product in several years, and its fastest-growing revenue division is Apple Services. This strategy could lead to the perception that Apple's competitiveness in the technology side of the business is weakening.

Apple plans to release some generative AI tools in June, Benzinga reports. Moreover, even after accounting for unrealized gains and losses, Apple still held about $173 billion in liquidity at the end of the first quarter of fiscal year 2024 (which ended on December 30th). With such resources, the company is likely to find a way to compete in the AI space.

Under the weight of pessimism, Apple's stock depreciated during 2024, 鈥竝e largely missed the AI-driven rebound of 2023. But during that period, its P/E ratio fell to 28, which is cheaper than all of the Big Four stocks. If investors were to buy at today's price (about $175 per share at the time of this writing), they could get a handsome return as they see a clearer and more viable strategy for generative AI.

3. Alibaba

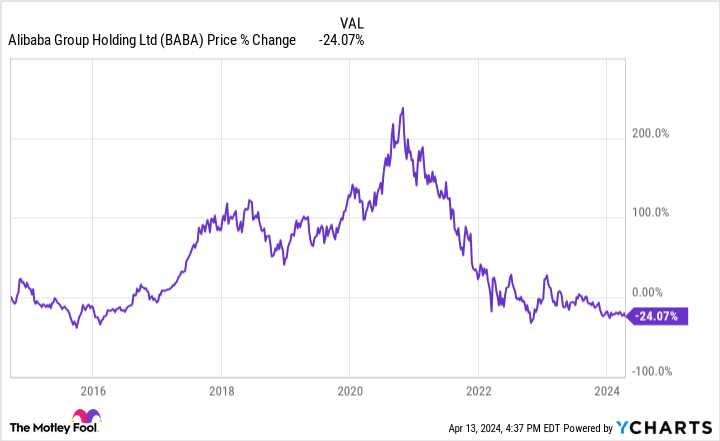

Speaking of cheap AI stocks.Alibaba, capital of Pakistan (Tw) (NYSE: BABA)Hardly undervalued. Alibaba's valuation is down to 13x P/E. Alibaba is China's largest e-commerce company and also operates a cloud infrastructure platform, which is similar to that ofAmazonVery similar.

However, there are several reasons why it is cheap. Alibaba's stock is an American Depository Receipt (ADR), which means that Alibaba's shareholders own proxy shares rather than actual company stock. While this is a common arrangement for international stocks, it becomes risky when relations with the company's government deteriorate.

Unfortunately for U.S. investors, the fragile U.S.-China relationship led directly to the 2022 delisting of Wakefield, where the SEC was unable to access the company's internal auditing reports. Although the U.S. and China resolved the issue, it was a reminder of the risks of the stock.

In addition, these problems have led to a decline in the share price to the extent that Alibaba's share price has fallen from around $70 per share at the time of its initial public offering (IPO) 10 years ago to around $70 per share at the time of writing this article.

While there are risks associated with Alibaba, its share price may mean that investors are overpricing the risk. If things turn around, this could lead to a sharp rise in the share price, and this potential gain could attract some investors to invest in the stock regardless of the risk.

Should you invest $1,000 in Alphabet now?

Before buying Alphabet stock, consider the following:

Motley Fool Stock AdvisorA team of analysts have just selected what they believe to be the most popular analysts in the world at the moment.-est (superlative suffix)The name of the person is suitable for the investor to purchase10Only ...... and Alphabet is not one of them. The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorProvides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 15, 2024

Alphabet executive Suzanne Frey is a member of The Motley Fool's Board of Directors. Randi Zuckerberg, former Facebook Marketplace Director of Mass Development and Spokeswoman, and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's Board of Directors. John Mackey, former chief executive of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's Board of Directors, and Will Healy has no position in any of the stocks mentioned. The Motley Fool recommends Alphabet, Amazon, Apple, MetaPlatforms, Microsoft, and Nvidia. the Motley Fool recommends Alibaba Group, and also recommends the following options: Microsoft January 2026 $395 Call Option Long and Microsoft January 2026 $405 Call Option Short. the Motley Fool has a disclosure policy.

Got $1,000? These 3 Artificial Intelligence (AI) Stocks Are Still Cheap was originally published by The Motley Fool.