.

Why does the stock market in 2024 still look like 2023? Morning Briefing

Here's the "revelation" from today's Morning Briefing that you can existRegistrationLater. Receive in your inbox every morningThe presentation ::

-

Chart of the Day

-

What are we looking at?

-

What we're reading

-

Economic Data Distribution and Benefits

About a third of the way through the year, investors may notice something odd about 2024: it looks a lot like 2023.

"Rotation trading has become more complicated," Royal Bank of Canada strategists led by Lori Calvasina wrote in a note to clients this week.

"One of the best questions we received [last week] was what the hot inflation numbers meant for the rotation of leadership in the U.S. stock market, which seems to have finally begun. Our answer: In general, we believe that rising inflation and concerns about rising interest rates favor large-cap growth stocks.

Going into 2024, one of the biggest things investors will be looking for is an expansion of last year's rally.

This is not entirely untrue.

The energy sector was the best performing sector in the S&P 500 in March and the second best performing sector in the first quarter.

Additionally, the S&P 500's first quarter gain of approximately 10% was outpaced by 5 of the index's 11 sectors, suggesting that the leading sectors are more broadly based than those focused on technology (XLK) and communication services (XLC).

However, as in 2023, the concentration of a few giant tech companies has played an important role in driving the market higher.

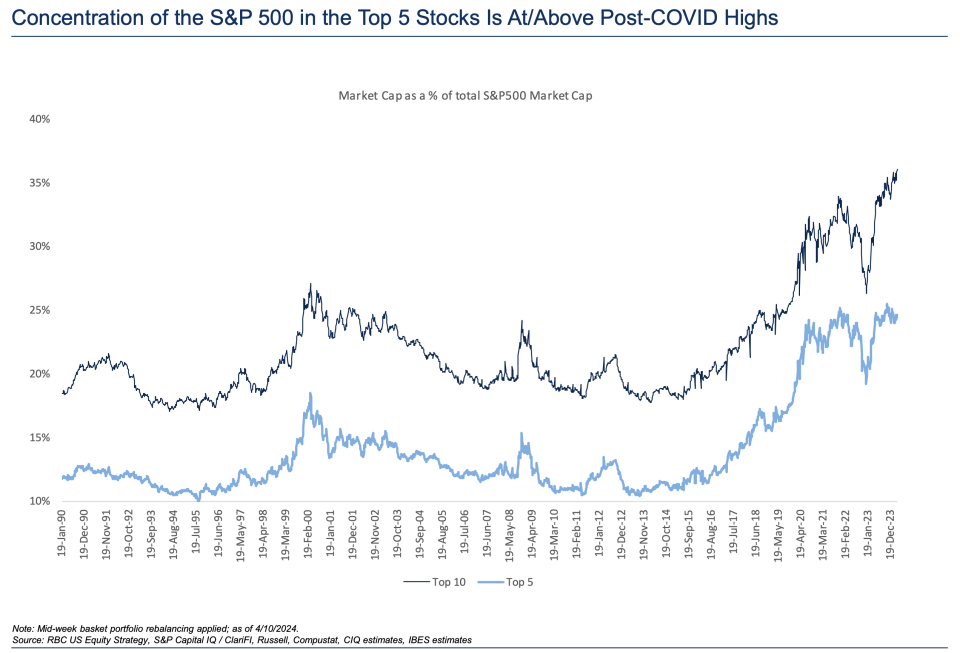

Even as the number of "flashy" market leaders dwindled from seven to four, new superstars emerged, and the proportion of stocks in the S&P 500 with only 10 stocks reached a new high.

The top 10 stocks in the S&P 500 account for an even higher percentage of the index's market capitalization today than they did at the peak reached in 2021 and at the beginning of last year's rebound, according to RBC Capital Markets.

Looking ahead, the Royal Bank of Canada notes that "the crosscurrents of old leadership, like the broader market itself, are simply intricate."

Better economic growth expectations may continue to drive a shift from high-growth tech stocks to more value-oriented stocks. However, higher interest rates may be more challenging for companies whose balance sheets are not as clean (i.e., more leveraged) as those of giant tech stocks.

And the Fed has delayed its rate-cutting timetable, making both of these factors - stronger growth and higher interest rates - a reality at the same time.

This sleepy dynamic reminds us that 2024 is mirroring 2023 in a different way: investors are still chasing the market.

Click here for the latest stock market news and in-depth analysis, including events affecting the stock market.

Read the latest financial news from Yahoo!