.

Which has more staying power, stocks or gold?

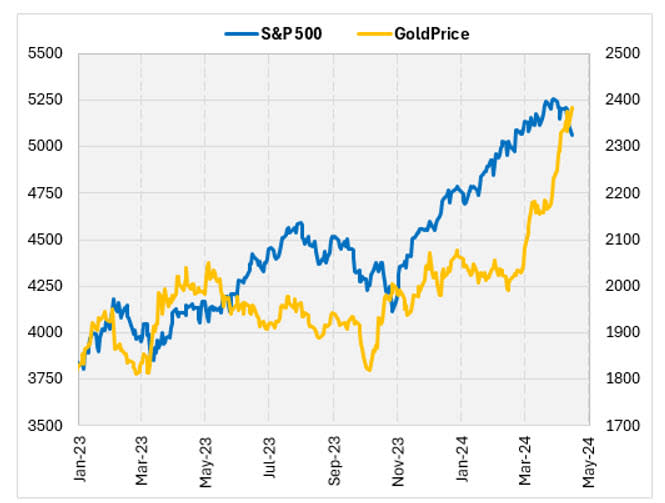

As impressive as Koon's stock performance has been in recent months, it pales in comparison to gold. Prior to the recent correction, stocks had risen over 10% in the last three months and over 20% in the last six months. Gold, on the other hand, has risen more than 151 TP3T in the past three months and more than 251 TP3T in the past six months. That's a lot of money flowing into what are often considered competing asset classes. This week, I'm going to look at how stocks and gold have risen together in the past to see if history favors one or the other in the future, or both, or neither.

Gold and stocks are flying.

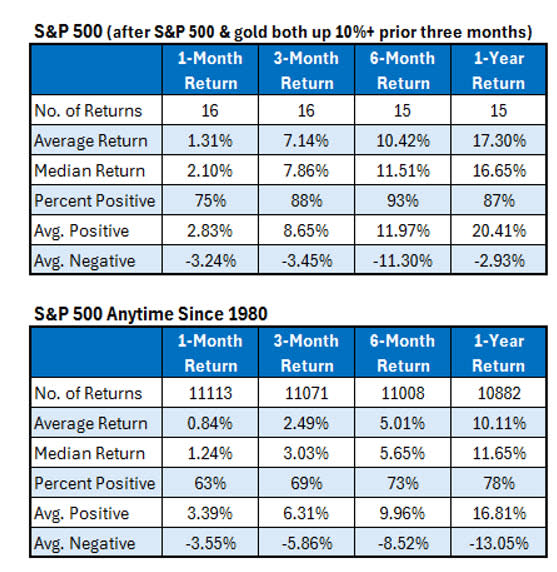

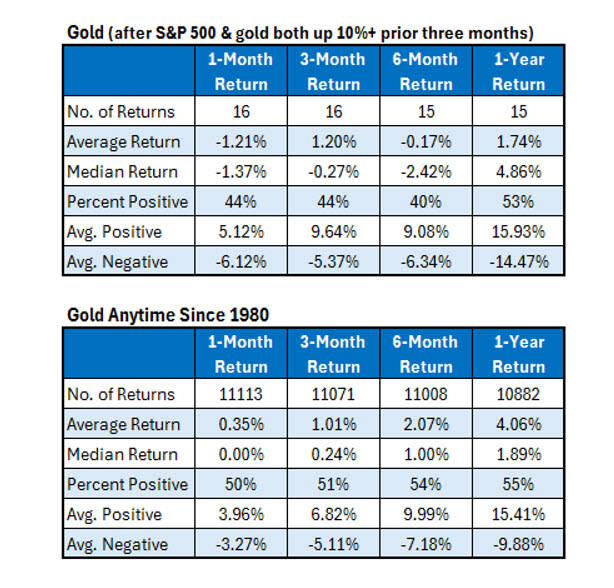

Going back to 1980, I found that the S&P 500 (SPX) and gold had both risen at least 10% in a three-month period. 16 times before that, with the last one occurring in December of last year. The following table summarizes the S&P 500's rate of return after these episodes. For each time period studied, from one month to one year, stocks tended to outperform their benchmarks after these events. For example, in the six months following the three-month rebound of 10% for both assets, the S&P 500 Index rose an average of 10.4%, with a positive return of 93%. Typically, the S&P 500 rises about 5% in a six-month period, with a positive return of 73%.

Next, let's look at how gold has performed following the same signals. History clearly favors buying equities over gold after these signals; safe-haven assets usually underperform after a strong rebound in equities. Six months after the signal, gold has averaged a slight loss, with only 40% posting a positive return. Since 1980, gold has typically risen 2% in six months, with a probability of a positive gain of 54%.

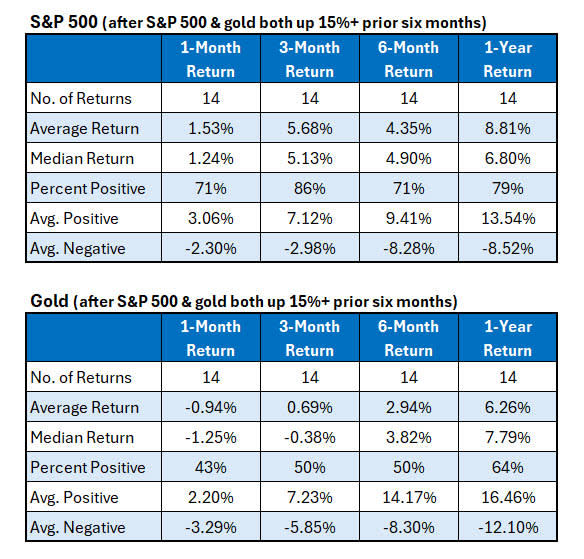

I did a similar study to the one above, except that instead of looking at the three-month increase of 10% or more for both assets, I looked at the six-month increase of 15%. The first table shows the rate of return of the S&P 500 on these updates, and the second table shows the rate of return on gold. Stocks tend to rebound strongly immediately after these signals, rising an average of more than 51 TP3T over the next three months, but on a six-month and one-year long-term basis, the SPX Index underperforms the typical returns since 1980. On the other hand, gold underperformed in shorter time frames, but outperformed its benchmark in the 6-month and 12-month periods.

Based on the above historical data, equities have performed much better than gold after a strong rebound in both assets.