.

Ditching Inventec: Consider These Two Millionaire Stocks

Last year.INVISTA (NASDAQ: NVDA)The 2,25% surge in the stock price has created many millionaires. The company has become the poster child for the artificial intelligence (AI) boom, grabbing a market share of about 90% of AI chips and exciting investors.

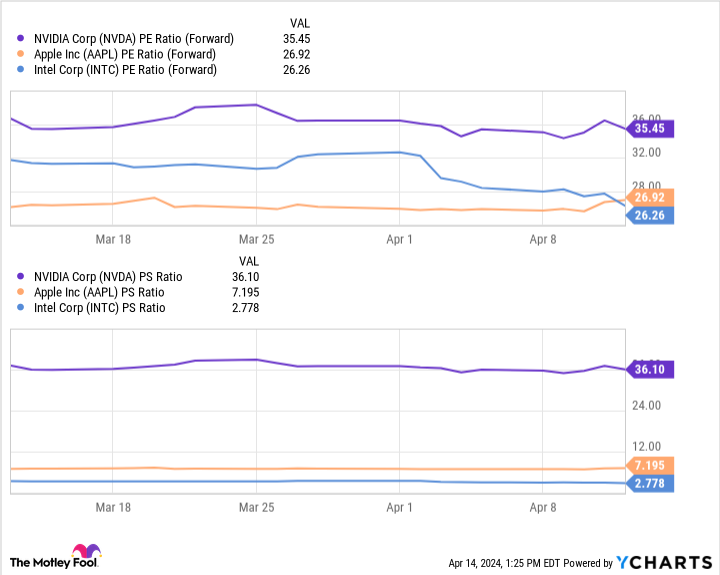

However, the chart above shows that Nvidia's meteoric rise has made it an expensive option compared to other tech stocks, and Nvidia's forward price-to-earnings (P/E) and price-to-sales (P/S) ratios are significantly higher than those of other tech stocks.Intel(NASDAQ: INTC(math.) andApple (NASDAQ: AAPL)The same kind of indicators.

Forward-looking P/E ratio is calculated by dividing a company's stock price with its future expected earnings per share. Meanwhile, the P/E ratio is calculated by dividing the market capitalization by its revenue for the last 12 months. These are useful valuation metrics because they take into account the financial health of the company along with the stock price.

For both indicators, the lower the number, the higher the value. As a result, Intel and Apple shares are cheaper compared to Nvidia.

So forget Nvidia and consider these two millionaire stocks.

1. Intel

Since its IPO in 1971, Intel's stock price has risen more than 1,35%, creating many millionaires along the way.

However, the company has encountered some obstacles in recent years. After a decline in CPU market share and the end of a more than decade-long relationship with Apple, the company's stock price has fallen about 45% in the last three years.

Intel has made significant structural changes in response to recent headwinds, and these changes could pay off in the coming years. Last June, Intel announced a "fundamental shift" to an in-house foundry model for its business, which it believes will save $10 billion by 2025. This will allow Intel to utilize the sameTaiwan Semiconductor Manufacturing Co.Similarly, the company has become a major provider of foundry capacity in North America and Europe.

In addition, Intel is moving into artificial intelligence, a market valued at about $200 billion last year and expected to reach nearly $2 trillion by 2030.

In December 2023, the company debuted a range of AI chips, including the graphics processing unit (GPU) Gordy 3, designed to challenge similar products from market leader Nvidia. Intel also showed off its new Core Ultra processor and Xeon server chips, which include neural processing units that can run AI programs more efficiently.

Intel has a forward P/E of 26, making it one of the most highly valued AI chip stocks available, while INVISTA has a P/E of 35, and theAMD The P/E ratio is even higher, at 45. As such, the company's stock is a low-risk way to invest in the AI chip industry and an excellent choice for long-term holding.

2. Apple Inc.

Apple's stock has a reputation for providing investors with a steady and substantial income. In fact, Warren Buffett's holding company, Apple Inc.Dr. Konrad HathawayCompany (Berkshire Hathaway) has dedicated 43% of its investment portfolio to Apple Inc. Meanwhile, shares of the iPhone company have soared 5,71% since Berkshire first invested in it in 2016.

Apple has created many millionaires, and that trend is unlikely to stop as the company continues to dominate consumer tech and expand in emerging areas like artificial intelligence.

On April 11th, Apple's stock jumped 4%, its best performance in nearly a year. Apple shares soared after a Bloomberg report revealed that the company would overhaul its Mac computer lineup to center on artificial intelligence capabilities.

Apple is a dominant player in the consumer technology sector, with market share leadership in most of its product categories. Consumers' strong brand loyalty to Apple could make the company a major driver of public adoption of AI, giving Apple a lucrative position in the market. Therefore, the news that future products will be more focused on generative technologies is promising.

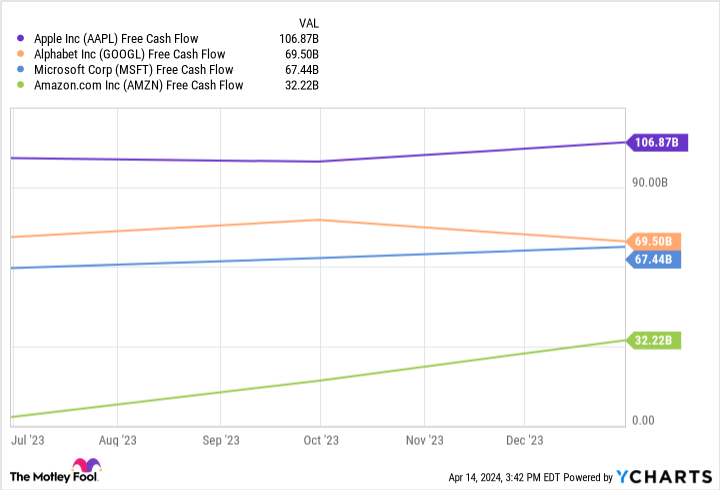

In addition, despite the recent unfavorable factors, Apple still achieved a free cash flow of US$107 billion last year, which was much higher than that of the previous year.Microsoft,AmazonmaybeAlphabet This figure shows that Apple has the financial strength to continue investing in the business to overcome potential downsides. This figure shows that Apple has enough financial strength to continue to invest in the business and resonate with the potential disadvantages.

With substantial cash resources, an expanding position in artificial intelligence, and a relatively low forward P/E, Apple stock is currently a better bet than Nvidia.

Should you invest $1,000 in Intel now?

Consider this before buying Intel stock:

Motley Fool Stock AdvisorA team of analysts have just selected what they believe to be the most popular analysts in the world at the moment.-est (superlative suffix)Worth investing in10Only ...... and Intel is not one of them. These 10 stocks could generate huge returns in the coming years.

Consider April 15, 2005NvidiaWhat it was like when it was on the list ...... If you invested $1,000 at the time of our recommendation.You will have $526,933.! *Stock Advisor provides easy-to-use stock investment tools for investors.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View these 10 stocks."

*Stock Advisor's Circular as of April 15, 2024

Suzanne Frey, an Alphabet executive, is a member of The Motley Fool board of directors. John Mackey, former chief executive officer of Amazon's Whole Foods Market, is a member of The Motley Fool's board of directors. Dani Cook has no position in any of the stocks mentioned above. The Motley Fool's holdings include Advanced Micro Devices, Alphabet, Amazon, Apple, The Motley Fool recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Berkshire Hathaway, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel, and recommends the following options: Intel January 2023 $57.50 Calls Long, Intel January 2025 $45 Calls Long, Microsoft January 2026 $395 Calls Long, Microsoft January 2026 $405 Calls Short. The Motley Fool has a disclosure policy.

Forget INVISTA: Consider Buying These Two Millionaire-Making Stocks was originally published by The Motley Fool.