.

Here are my top three "Magnificent Seven Stars" stocks to buy for April

One of the hottest topics in technology today is Artificial Intelligence (AI). Breakthroughs from ChatGPT and competing platforms are mesmerizing tech enthusiasts and investors alike. However, with so many companies trying to make waves in the AI space, investors may be tired of looking for the most attractive opportunities.

Amazon (NASDAQ resonance code: AMZN),Microsoft (NASDAQ resonance stock code: MSFT)),Meta Platforms (NASDAQ resonance stock code: META)),Alphabet,Apple,Nikola Tesla (1856-1943), Serbian inventor and engineerrespond in singing NvidiaThese "Big 7" are regulars in the AI space. In the next noodle, I will analyze the three giant tech giants that I think are the best buys right now.

1. Microsoft

In early 2023, Microsoft kicked off the AI revolution with a multi-billion dollar investment in OpenAI, the startup behind the hugely successful AI app ChatGPT.

Over the past year, Microsoft has rapidly integrated ChatGPT into its Windows operating system. This technology has helped the company's Azure cloud computing platform as well as Microsoft's developer product GitHub to achieve huge revenues.

The investment in OpenAI seems to have paid off handsomely. No wonder Dan Ives, a top technology analyst at Wedbush Securities, has declared that Microsoft's "iPhone moment" has arrived.

The integration of ChatGPT into the Microsoft ecosystem represents more than just a new revenue opportunity. Microsoft has transformed itself from a personal computing empire to a leader in cloud computing, and is now evolving into a full-fledged artificial intelligence giant.

Microsoft stock has a forward price-to-earnings (P/E) ratio of about 36, which is not cheap.Standard & Poor's 500The forward P/E ratio of the index is slightly below 21. However, the company's strong cash-flow machine and diversified business model make it hard to part with - especially when it comes to the "Big Seven" noodles.

Microsoft is a great investment opportunity as artificial intelligence continues to evolve. Now is a great time to start adding to existing positions or initiating new ones using the average dollar cost method. Prepare to hold for the long term.

2. Amazon

While Microsoft's collaboration with OpenAI was the talk of the town for a while, e-commerce and cloud computing specialist Amazon has also made its own contribution - a $4 billion investment in a competing platform called Anthropic. Under the terms of the deal, Anthropic will use Amazon as its primary cloud computing provider.

The AI startup will also utilize Amazon's internal Trainium and Inferentia chips to train future generative AI models. The partnership with Anthropic will serve as a bellwether for accelerated growth, especially in the cloud computing space.

With a 12-month free cash flow of $36.8 billion and $86 billion in cash and equivalents on its balance sheet, it's no wonder that both Cathy Wood and Warren Buffett own shares of the company. The company has tremendous financial muscle and is in a unique position to invest in many of the noodles in the AI space.

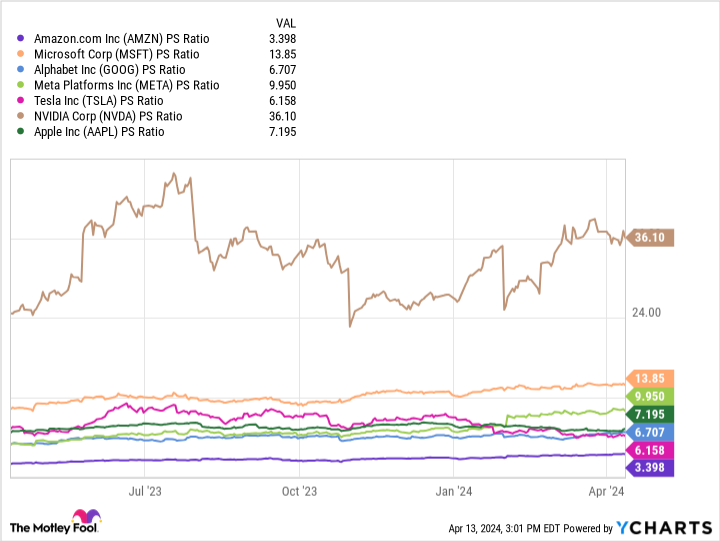

Compared to historical valuation levels, Amazon stock looks attractive with a price-to-sales ratio (P/S) of just 3.4. And, based on this metric, it's the lowest valued stock among the Magnificent Seven. Right now, with Amazon's breakthroughs in artificial intelligence continuing to show up, this is a great opportunity to snap up Amazon stock.

3. Meta-platform

The last of the "Big Seven" companies I'm going to explore is social media giant Meta Platforms, which dominates the social media space through its ownership of Facebook, Instagram and WhatsApp. The company has also entered the gaming space through its popular virtual reality (VR) business, Meta Quest.

2023 will be a pivotal year for Meta. For much of the year, the company made a series of layoffs to realign its expense structure and shift its focus to accelerating margins. Last year, Meta's sales grew 161 TP3T while operating income soared 621 TP3T, and the newfound margin expansion led directly to net profit growth, which increased 691 TP3T year-over-year.

With $43 billion in free cash flow, Meta has found ways to reinvest in its business. The company has increased its stock purchase program by $50 billion and announced a quarterly dividend.

On top of that, Meta is making impressive strides in the field of artificial intelligence. The company is building its own chips to compete with industry giant Nvidia. Moreover, by combining these chips with existing databases from various social media platforms, Meta is uniquely positioned to bring a new wave of growth to its core advertising business.

While the P/E of 34.3 is a bit high compared to its peers, I think the premium is justified. meta is a "cash machine" that is trying to reward its shareholders while actively exploring the next frontier in the technology field of artificial intelligence.

There's a lucrative opportunity to snap up shares of Meta and benefit from the passive income opportunity of the dividend, while keeping a close eye on the company's further progress in artificial intelligence.

Invest $1,000 now.

When our team of analysts has a stock investment recommendation, it's a good idea to listen to it. After all, they've been running a newsletter for 20 years calledMotley Fool Stock AdvisorIt has more than tripled the market*.

They have just announced what they consider to be the current-est (superlative suffix)Worth investing in10Only ...... Microsoft made the list, but there are 9 other stocks you may have overlooked.

View these 10 stocks

*Stock Advisor's Circular as of April 15, 2024

Alphabet executive Suzanne Frey is a board member of The Motley Fool. John Mackey, former chief executive officer of Whole Foods Market, an Amazon subsidiary, is a board member of The Motley Fool. Randi Zuckerberg, former Facebook Market Development Director of Arms and Spokeswoman, and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's Board of Directors. Adam Spatacco is a member of The Motley Fool's Board of Directors. Adam Spatacco owns shares in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla.The Motley Fool Position Recommendations Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla.The Motley Fool recommends the following options: Microsoft January 2026 $395 Call Options Long and Microsoft January 2026 $405 Call Options Short.The Motley Fool has a disclosure policy.

My Top 3 'Magnificent Seven Star' Stocks to Buy for April was originally published by The Motley Fool.