.

Is Iovance Biotherapeutics stock worth buying now?

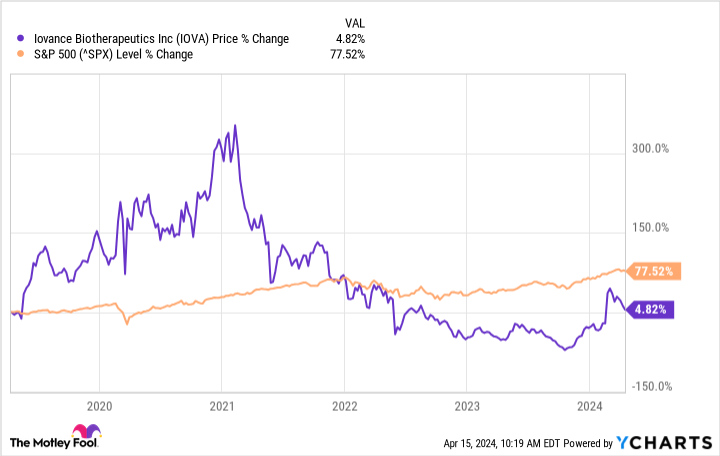

This isIovance Biotherapeuticsfirms(NASDAQ: IOVA)Is it the beginning of a comeback? Although the Koban biotech has lagged Big Pan considerably over the past five years, its shares have risen 50% since its IPO in 2024, and Iovance has made progress on a number of fronts (see below).

It's no wonder that many investors are getting excited about the company's plans. But should long-term investors put their hard-earned money into this stock today? Let's find out.

IOVA data from YCharts

What happened to Iovance Biotherapeutics?

Iovance Biotherapeutics specializes in oncology. The company's platform utilizes human defenses to fight cancer. Tumor Infiltrating Lymphocytes (TILs) are cells that can recognize and kill cancer cells, and Iovance Biotherapeutics' approach is to remove the TILs from the cancer patient's body, multiply them, and then re-implant them in the patient's body.

The most recent approval is for Amtagvi, which belongs to the TIL family and was approved in February of this year, making it the first FDA-approved treatment for advanced melanoma, a form of skin cancer. the production process for Amtagvi takes an average of about 34 days, so revenues don't grow as fast as they would for a simple oral drug.

However, considering that it is currently the only drug available to treat patients with advanced melanoma, it has the potential to be successful. Iovance estimates that there are about 15,000 cases of advanced melanoma and 8,000 deaths in the U.S. each year.

The company is also looking to expand, with plans to file regulatory applications for Amtagvi in Europe and Canada this year, and Iovance will enter the Australian market next year. Some analysts believe Amtagvi could reach $846 million in sales by 2029. Last year, Iovance's sales were only about $1.2 million, so the situation in this area is expected to improve considerably.

What is the future?

Iovance Biotherapeutics is conducting a Phase 3 clinical trial of Amtagvi targeting first-line (or treatment-naïve) advanced melanoma. The company is also conducting several other pivotal studies. For a biotech company with a market capitalization of just $3.39 billion, Iovance's ongoing projects go much deeper than that. That's no guarantee of success, but it's clearly an innovative biotech company.

Iovance Biotherapeutics faces at least two questions. First, will it have enough capital to finance its expensive TIL production process? And second, will the company become profitable soon? On the first question, Iovance had $485.2 million in cash and equivalents as of February. The biotech estimates that the capital it currently has, combined with revenues from Amtagvi, will be enough to run the company through the second half of next year.

It hasn't been a long time, but it seems to me that Iovance should have no trouble finding new sources of funding. But will the company become profitable soon? It's worth noting that Iovance Biotherapeutics improved last year. Its net loss per share was $1.89, which was better than the $2.49 net loss reported for 2022. However, the company's expenses should increase due to manufacturing costs associated with Amtagvi. A portion of the drug's revenues will be enough to cover these costs, so it's still possible that Iovance Biotherapeutics will come close to profitability.

Even so, investors will have to wait at least a few more years to see profits. Against this backdrop, Iovance Biotherapeutics may seem like a risky bet, but it has the potential to pay big dividends in the future if its platform comes to fruition. I wouldn't recommend this stock for risk-averse investors, but mildly aggressive investors might consider taking a small position in this biotech stock.

Should you invest $1,000 in Iovance Biotherapeutics now?

Before buying shares of Iovance Biotherapeutics, consider the following:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10Iovance Biotherapeutics is not one of the 10 stocks listed at ....... The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorProvides investors with an easy-to-learn blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 15, 2024

Prosper Junior Bakiny does not hold any of the aforementioned stocks.The Motley Fool holds a recommendation for Iovance Biotherapeutics.The Motley Fool has a disclosure policy.

Is Iovance Biotherapeutics Stock a Buy Now? This post was originally published by The Motley Fool.