.

Is it time to buy Chipotle before its big stock split?

A lot of people seem to be concerned about stock splits, so much so that we even have a calendar dedicated to stock splits on The Motley Fool.Chipotle Mexican Grill (NYSE: CMG)A major stock split is imminent, with a 50-for-1 exchange expected to take place on June 26th. Investors are excited, pushing Chipotle's stock price to near record highs of about $3,000 per share.

I am here to tell you that the stock split is not important. The value of the stock is the cash that will be distributed to the shareholders in the future, discounted to today. For Chipotle, it doesn't matter whether you trade one share at 80 billion dollars (where the market capitalization is) or 80 billion shares at 1 dollar.

Irrelevant stock splits aside, how does Chipotle perform when analyzed on a fundamental basis? Should you buy this stock at its current price? Let's take a closer look.

Large room for growth in store numbers

As the premier Mexican food fast food chain, Chipotle currently has 3,437 stores, most of which are in the United States. In the long term, it plans to open 7,000 stores in North America and begin its international expansion. Specifically, it has opened several stores in Western European markets and has just launched a plan to bring Chiptole to Dubai and the Middle East.

While it's unclear how many international locations Chipotle plans to open, I think it's reasonable to expect the company to reach several thousand locations within the next decade or two, especially if it enters other markets such as Australia. This would bring the company's total number of addressable markets to at least 10,000 studios, which I don't think is crazy. For the record.McDonald'sThere are more than 40,000 locations worldwide.

How much sales does that mean? Currently, the average Chipotle Studio sale is $3 million per year, and that number has been growing at a single-digit rate in recent years as inflation has increased. Eventually, the average Chipotle Studio sale should reach $3.5 million. Applying that figure to 10,000 stores would bring annual sales to $35 billion, compared to the current $10 billion. Granted, it will take many more years of development to reach these sales figures, but Chipotle has a clear idea of how to achieve these growth goals.

Can profit margins continue to rise?

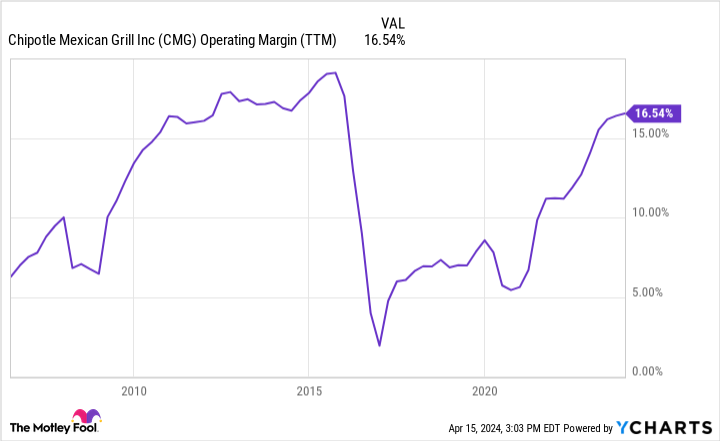

Okay, so we have some estimates of Chipotle's sales potential. Now, let's talk about what investors really care about: profits. Chipotle has done a good job of expanding its operating margins in recent years, recovering to 16.5% in the last 12 months, after taking nearly a decade to recover from a foodborne illness outbreak where margins were closer to 20%.

Over the long term, as Chipotle expands further globally, investors should see some small operating leverage. However, don't stretch the Studio Studio margins too far. Labor and food costs will always be big for Chipotle, which will likely keep its margins at 15%-20%.

Assuming that Chipotle can achieve a consolidated carry margin of 18% on its estimated $35 billion in future sales from its 10,000 locations, the company will have annualized profits of $6.3 billion at some point in the future.

Don't worry about stock splits, focus on valuation

Similarly, investors shouldn't worry about a 50-to-1 stock split for Chipotle. It doesn't matter what Chipotle's intrinsic value is, how many people will visit its stores, or any of its investment costs. What matters is how much cash it can generate for shareholders over the next few years.

I think Chipotle could generate over $6 billion in revenue once it reaches 10,000 locations. With a current market capitalization of $80 billion, Chipotle's stock has a price-to-earnings ratio (P/E) of 13, making it look like a bargain. The problem is that it will take years for Chipotle to reach this level of profitability. Even if it increases its store opening rate to 400 stores per year (271 stores by 2023), it will take more than 16 years for Chipotle to open 10,000 stores globally.

It's not a likeNvidia Chipotle is a great company, but its 10+ years of earnings growth have been overestimated. Stock splits aside, this is why you should avoid buying Chipotle stock. The stock is currently overvalued, and investors who buy today will likely be disappointed.

Should you invest $1,000 in Chipotle Mexican Grill now?

Please consider the following before purchasing shares of Chipotle Mexican Grill, Inc:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10Only ...... and Chipotle Mexican Grill were not included. The 10 stocks that made the list could generate huge returns in the coming years.

Consider April 15, 2005Nvidia) on the list at ...... If you invest $1,000 at the time of our recommendation, theYou will have $526,933.! * *The

Stock AdvisorProvides investors with an easy-to-follow blueprint for success, including guidance on building an investment team, regular updates from analysts and two new stock picks each month. Stock Advisor The rate of return for the service since 2002 has been the same as that for the S&P 500 index, but the rate of return for the service has been the same as that for the S&P 500 index.quadruple*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 15, 2024

Brett Schafer does not own any of the stocks mentioned above. the Motley Fool holds recommendations for Chipotle Mexican Grill and Nvidia. the Motley Fool has a disclosure policy.

Is it time to buy Chipotle before its big stock split?