.

Chewy Stocks: Buy, Sell or Hold?

Pet E-Commerce CompanyChewy (NYSE: CHWY)It will go public in 2019 and trade at about $35 per share on its first day of trading. Considering it's trading at about $18 today, I'm betting investors will want to sell their Chewy shares on day one.

At the beginning of 2021, Chewy stock was trading at approximately $120 per share.be convinced (that sth. is true)Investors also want them to sell out often.

But in deciding what to do with Chewy stock, selling should be ruled out completely. There are many good things about this company, and shareholders will at least want to hold on to it. But there are also good reasons to buy, which I'll explain below.

Chewy has done (and is doing) the right thing.

Retail e-commerce can be a surprisingly low margin business. The world's largest e-commerce companyAmazonThe company's North American and international business units will generate net sales of $484 billion in 2023. The company's North American and international business units will generate net sales of $484 billion in 2023. These businesses are primarily e-commerce.

For the full year, Amazon's operating income from these two business units was only $12 billion. The operating margin was only 2.5%. Considering that Amazon has the necessary model to be more profitable than its peers, other e-commerce companies are not in such a good position. Other e-commerce companies are not in such a good position.

In short, e-commerce margins are slim because consumers expect low prices, abundant supplies, and fast transportation. As a result, transportation and logistics costs for companies are high. But Chewy found a way to overcome this challenge.

In 2020, Chewy started automation upgrades at one of its fulfillment centers and has been upgrading its facilities ever since. Its fifth automated fulfillment center will open in the first half of this year.

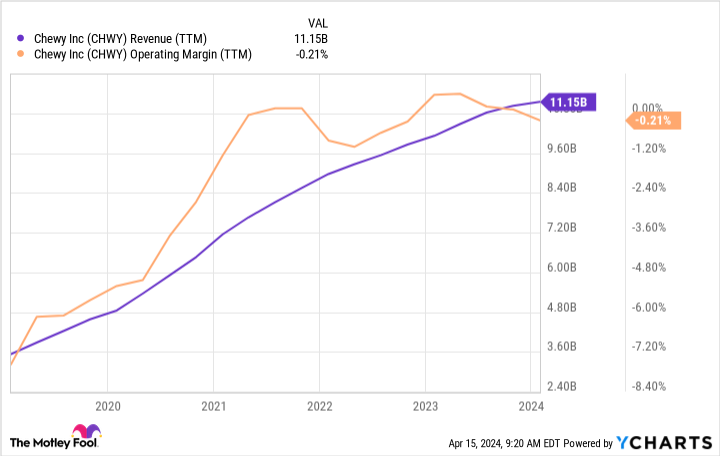

Automation efforts have brought Chewy higher efficiency operations and have been an undeniable catalyst for profit improvement. The chart below shows the dramatic increase in profitability after the first automated fulfillment center went live.

On the balance sheet, Chewy has $1.1 billion in cash, cash equivalents and marketable securities and no long-term debt. This is a very favorable position. Right now, the company's business is essentially break-even. In other words, Chewy can at least maintain its current financial position. As operations improve further, it will become even stronger.

The future of its core e-commerce business remains bright. According to a recent survey by the American Pet Products Association, 87 million households in the U.S. have pets. In comparison, Chewy has only 20 million active customers.

So, as a top pet e-commerce company, Chewy clearly has room to grow. So (given its financial strength), I see no compelling reason to sell this stock today.

Chewy plays a strong wild card.

Its e-commerce business has room to grow. Admittedly, growth has stalled - its active customer base has fallen by nearly 2% in the past year, which is worrisome. But the company also has the opportunity to generate more capital from existing customers by offering new products and services.

Chewy is indeed launching new products and services in the pet healthcare sector, which is an attractive long-term card for investors. This includes the launch of a clinic called Chewy Vet Care. Our carefully designed clinics will be unlike any other in the market," said Sumit Singh, Simmons Executive Officer. The company will open at least four clinics this year.

Another new business for the company is the fledgling software business. The company wanted to provide operating system software for veterinary clinics. Not only is this an opportunity in itself, but it will also lead to better sales for its e-commerce business due to the purchase incentives built into the software.

The pet healthcare sector is huge and growing and Chewy wants to grow the business meaningfully by winning more sales from existing customers. This is called "wallet share" and if it goes well, it could lead to significant growth for the company.

It's because of this potential that I think Chewy shareholders should continue to hold, at least for now, while other investors should consider buying. Not only is the company financially strong and has upside potential, but the stock is also cheap, trading at less than 0.7 times its trailing sales.

It is difficult for investors to find good opportunities at such cheap prices. Therefore, Chewy's stock is worth holding for the long term.

Should you invest $1,000 in Chewy now?

Before buying Chewy stock, consider the following:

Motley Fool Stock AdvisorThe analyst team has just selected what they think is the best name for investors to buy now.10Chewy is not one of the 10 stocks listed on ....... The 10 stocks selected are expected to generate strong returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisor's Report as of April 15, 2024

John Mackey, former Chief Executive Officer of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's Board of Directors. jon Quast has no position in any of the stocks mentioned above. the Motley Fool holds recommendations for Amazon and Chewy. the Motley Fool has a disclosure policy.

Chewy Stock: Buy, Sell or Hold? Originally Posted by The Motley Fool