.

Bullish Trend Lines Never Fail Crispr Therapeutics stock

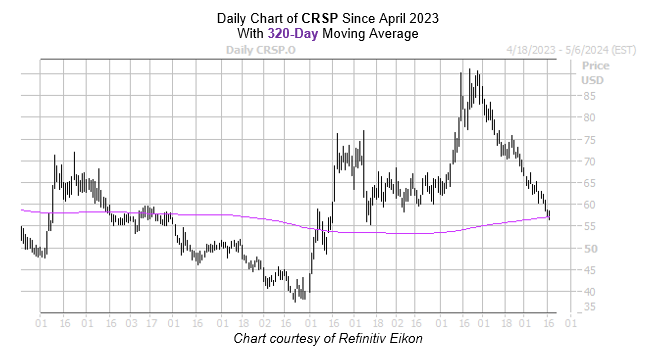

Crispr Therapeutics AG (NASDAQ:CRSP) It was down 2.81 TP3T this afternoon at $56.35, continuing its slide from its Feb. 22 two-year high of $91.10, and has lost 20.81 TP3T over the past month. Over the past month, CRSP has lost 20.81 TP3T, and is down 9.61 TP3T year-to-date.

However, for those looking to buy on the downside, the recent reversal has made it difficult for the market to move to the lower end of the market.Crispr Therapeutics Share PriceIt is within one standard deviation of its 320-day moving average, which is a historically bullish trend line. According to Rocky White, a senior quantitative analyst at Schaeffer's, the stock has had two similar signals in the past three years, each time moving higher a month later, with an average gain of 13.3%. A similar magnitude of volatility would bring the stock price to about $63.85.

Shares of Crispr Therapeutics stock have a 14-day Relative Strength Index (RSI) of 18.2, deep in "oversold" territory, which usually signals a short-term rebound. Additionally, shorts account for 17.61 TP3T of the stock's available float, which would take eight days to cover at CRSP's average trading speed.

In addition, the Unit'sSchaeffer's Volatility Scorecard(SVS) scored a whopping 86 out of 100, indicating that the stock's volatility over the past 12 months has exceeded options traders' expectations - a plus for premium buyers.