.

The market dynamics are as follows: April 17

Markets hovered between green and red on Wednesday, with investors looking for optimism in corporate earnings after Fed chief Jerome Powell's comments on rate cuts soured investor sentiment.

SPDR S&P 500 Index ETF TrustFund (SPY(math.) andSPDR Dow Jones Industrial Average ETFTrust (DIA) all turned higher from modest afternoon losses, while the Nasdaq Resonance Index, which reflects tech-heavy stocksInvesco QQQ TrustThe QQQ fund fell further than a wide range of other exchange traded funds. Investors withdrew funds from the SPY and DIA yesterday, while QQQ saw inflows.

On Tuesday, Federal Reserve Chairwoman Janet Powell released a dose of pessimism for investors hoping to end the market's losing streak at an event on the Canadian economy. In his speech, Mr. Powell pointed out that "so far this year, there has been a lack of further progress in returning to the 2% inflation target", which shattered hopes that the Fed would soon begin to cut interest rates.

According to the CME FedWatch tool, traders are not expecting a rate cut until September, and their bets on rates holding steady at the Fed's May policy meeting are almost 100%.

So far this year, fixed income traders have been swayed by the "higher rates are better" environment. At the start of the year, most investors thought the Fed was going to cut rates six times-an idea that quickly disappeared in the first quarter. Bond yields, which had been on the upswing a few days before, fell on Wednesday, with the yield on the benchmark 10-year bond slipping to about 4.64%.

With bond prices rising iShares 20+ Year Treasury Bond ETFTLT was also in the green on Wednesday. Bond prices and yields are related to the anticlimax.

Despite Powell's comments, the earnings reports from giant companies (those with a market capitalization of about $200 billion or more) injected optimism into the market on Wednesday.

Shares of United Airlines Holdings Inc. jumped more than 10% on Wednesday after the company's strong earnings report. holdings in major U.S. and overseas airlinesU.S. Global Jets ETFJETS went up 2.5%.

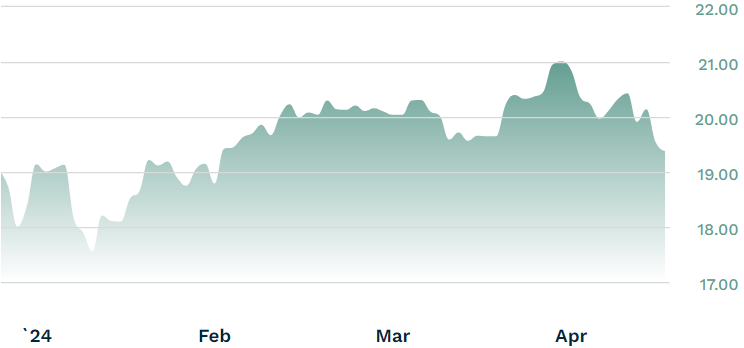

This is a good boost for airline investors, who have seen the sector underperform Big Pan so far this year.

JETS YTD

Source: ETF.com

For cryptocurrency investors, a big Bitcoin rally may be on the horizon. The Bitcoin Halving, or the halving of Bitcoin mining incentives, is likely to happen this week. This event will reduce the supply of Bitcoin in the market and increase its scarcity. In the past, halving events have usually preceded a major Bitcoin rally.

This is the first halving event since the launch of the Spot Bitcoin ETF at the beginning of the year and could provide a buying opportunity for cryptocurrency investors.

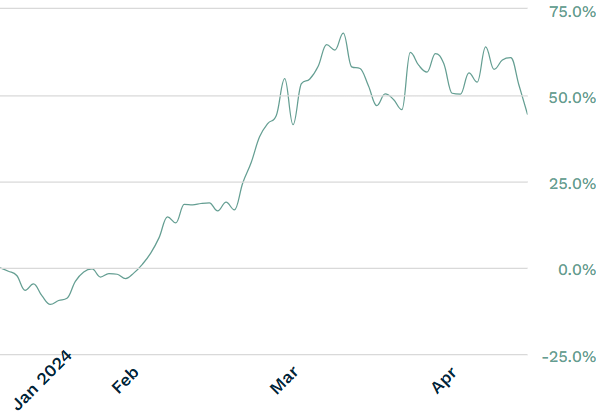

Blackrock. iShares Bitcoin TrustFund IBIT drifted into the red on Wednesday, slipping more than 2.7% before halving. etf.com data shows the fund has seen huge inflows since its launch, drawing $15.3bn since January. The fund has risen nearly 45% since it began trading.

IBIT Massachusetts Newspaper

Source: etf.com

While cryptocurrencies may rebound in the coming weeks, this year's halving comes at a time when Bitcoin prices are at record highs, which could limit further gains in Bitcoin and spot ETFs that track digital currencies.

Permalink | © Copyright 2024etf.com Press validate it