.

Prokis sees market tightening again after rate cuts begin

Uncertainty over the timing of interest rate cuts has led to a short-term slowdown in rental demand, but its favorable long-term outlook remains unchanged, said Koon of Prologis, a logistics real estate investment trust, on Wednesday.

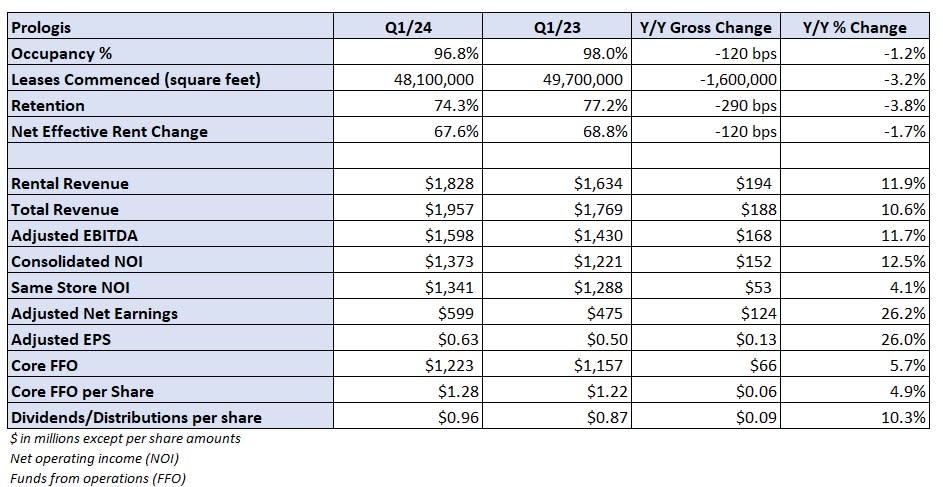

Prologis (NYSE: PLD) announced first quarter core FFO of $1.28 per share, which was in line with consensus expectations. However, the company lowered its full-year guidance by 1% to a new range of $5.37 to $5.47, compared to analysts' expectations of $5.50 at the time of the report.

The slight reversal in the outlook represents some hesitation in the market, which management believes will continue for two to three quarters. Looking two to three years out, the company said it is likely to be more bullish than before as deferred demand continues to grow.

If you sense any sharp change in our outlook, you're not interpreting our call correctly," said Hamid Moghadam, founder and chief executive officer of Union Hewlett-Packard, on a conference call with analysts on Wednesday.

He said that lease signings have been delayed to some extent due to geopolitical concerns and rising interest rates. However, he expects this to change once interest rates start to fall.

"People were just afraid to pull the trigger until the Fed signaled its first rate cut.

Q1 Rental Revenue up 12% to $1.83B. Consolidated Carpet Revenue increased 11% to $1.96B.

Occupancy across the portfolio was 96.8%, down 30 basis points from the fourth quarter and 120 basis points year-on-year. Occupancy across the sector has declined by 310 basis points since its peak two years ago, but only by 80 basis points in Prologis' portfolio, the company said.

Prologis now projects that average occupancy in 2024 will be between 95.75% and 96.75%, down 75 basis points from the previous median. Available supply is down 80% from its peak and one-third below pre-pandemic levels, the company said. It expects the vacancy rate to reach around 6%, which could quickly move lower later in the year.

It considers the vacancy rate of 6% to be the market equilibrium point for rent negotiations.

Net favorable rental rate of change (over the life of the lease) for the quarter was 67.6%, a decrease of 120 basis points from the prior year quarter.

During the period, global market rents declined by 11 TP3T, with most U.S. markets showing little change. Ploegis noted market weakness in Southern California (where rents fell 6% in the first quarter) and in the California Inland Empire due to generally weak demand. However, Moghadam attributes this weakness to the protracted labor negotiations at West Coast ports over the past two years.

However, the rolling rent change on multi-year leases was $1,20% higher nationally and $1,56% higher in the Inland Empire.The company indicated that tying its entire lease portfolio to pre-candidate market conditions would generate $2.2 billion in additional rents, or approximately $50% higher than the pre-candidate lease price.

"Our forecast for the worst case scenario for this period is almost as good as the best case scenario we've seen in other cycles," Moghadam said." We are simply spoiled by the market ...... Vacancy rates are lower than ever.

As of 2:40 p.m. ET Wednesday, PLD stock was down 6.91 TP3T, while the S&P 500 was down 0.21 TP3T.

More FreightWaves articles by Todd Maiden

-

Knight Swift & Co. cuts H1 2024 industry merit estimate by more than half

-

J.B. Hunt's Long-Term Intermodal Growth Plan Impacts First-Quarter Industry

-

Estes to open at least 20 terminals this year

'Plogis sees market tightening again after rate cuts begin' appeared in FreightWaves.