.

Why Renewable Energy Stocks Are Soaring This Week

Renewable energy stocks rebounded this week after receiving some potentially good news on interest rates and energy markets. While the rebound is good for investors, it's not driven by changes in earnings or the fundamentals of supply and demand, but rather by speculation that the sector has finally bottomed out.

According to Standard & Poor's Global Market Intelligence(S&P Global Market Intelligence )The data provided.Bloom Energy ( New York Stock Exchange Stock Code: BE) stock price rose by 14.9%.Sunrun (NASDAQ resonance code: RUN)The total number of people who have risen by 19.71 TP3T.Crystallography renewable energy (New York Stock Exchange: JKS)Shares of these three stocks ended the short trading week up 13.91 TP3T, 16.11 TP3T and 12.31 TP3T, respectively.

Fed strikes again

Interest rates have always been a concern for renewable energy companies, as these projects are often financed over a period of several decades. When interest rates rise, projects become less economical, so the rise in interest rates over the past few years has hit the industry hard.

That's why investors got excited when they heard Fed chief Jerome Powell say that inflation was "in line" with the Fed's expectations, suggesting that a short-term rate cut could be coming in the next few months. The Fed does not control long-term interest rates, but the U.S. government's 10-year bond has fallen 63 basis points in the past year as investors anticipate a rate cut.

Regardless of whether or not short-term rates are falling, long-term rates appear to be stabilizing or falling, which should be a long-term benefit for renewable energy projects.

Will the tariffs be introduced soon?

In other big news, Treasury Secretary Janet Yellen said in a keynote speech that China is dumping renewable energy components and electric cars on the rest of the world. This includes everything from solar panels to lithium-ion batteries.

Over the past decade, the U.S. has used tariffs to try to limit the impact of Chinese subsidies and "dumping." Dumping" refers to the selling of excess products on the international market at artificially low prices. However, the impact of potential tariffs is unknown.

U.S. producers such as Bloom Energy stand to benefit if competitive products such as Chinese cells are restricted in the U.S. market. But if Sunrun can't benefit from low-cost solar panels from China, its costs could rise.

JinkoSolar has built its business on production in China and has now diversified its supply chain to include a plant in Florida, which has been in operation since 2018.

Find the Bottom

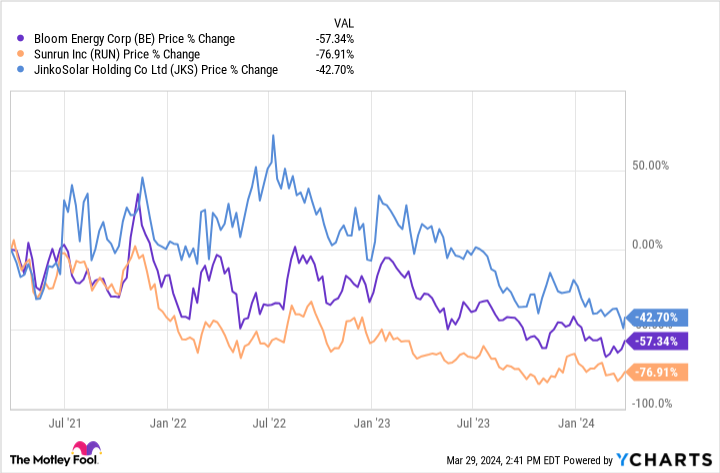

Fourth quarter 2023 earnings reports and conference calls indicate that companies expect growth to resume in the second half of 2024, which is now only three months away. If this happens, the market may turn positive in anticipation of better business results. As you can see from the chart below, all of these companies have seen their share prices fall significantly over the last three years.

That's why investors started to speculate on the Complex before it actually arrived.

I am bullish on renewable energy on an aggregate basis for the long term, but the companies are under tremendous competitive pressure. If the market turns around in the second half of this year, we may see a jump in the stock price, but that is far from certain and I expect volatility along the way.

Should you invest $1,000 in Sunrun now?

Before buying shares of Sunrun, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Sunrun is not one of the 10 stocks listed on ....... The 10 stocks that made the list are poised to generate huge returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

Travis Hoium does not own any of the shares listed above.The Motley Fool does not own any of the shares listed above.The Motley Fool has a disclosure policy.

Why Renewable Energy Stocks Surged This Week