.

Three Reasons to Buy Shares of NextEra Energy, Inc.

The efficient market hypothesis assumes that stock prices are rational, but as any long-term investor knows, this is not always true in the short term. Now.NextEra Energy (New York Stock Exchange: NEE)It looks like it was mispriced. Wall Street is worried for a reason, but the company's management team seems as confident as ever. Considering the long history of success of this reliable dividend stock, here are three reasons why you might want to side with Koon and buy the stock.

1. NextEra has an attractive business model.

NextEra Energy's approximately 70% operations are substantially the same as those of its regulated utility competitors. Among other assets, the division owns Florida Power & Light, one of the largest utilities in the United States. It's an attractive business, in large part because Florida has benefited over the years from people moving to the Sunshine State for tax and weather reasons. More residents means more customers, and therefore growth.

NextEra Energy operates in a very favorable location for a regulated utility. However, this has to be compared with the need to get rates and investment plans approved by the regulator. So as much as Florida Power & Light has going for it, it's still a slow-growing, stable division. That's where NextEra Energy Resources, which accounts for the remaining 30% of the business, is one of the world's largest producers of solar and wind energy.

As a result, 70% of the Portfolio is a solid "core" business, and the remaining 30% is a high-growth "exploratory" business.NextEra Energy Resources currently has approximately 36 gigawatts of clean NextEra Energy Resources currently has approximately 36 gigawatts of clean energy generating capacity, which it hopes to expand to 41.8 gigawatts by the end of 2026. In short, despite the fact that Koon investors have had a negative baking effect on the company's share price, which is down 33% from its peak in early 2022, the company still has a lot of room to grow in the future.

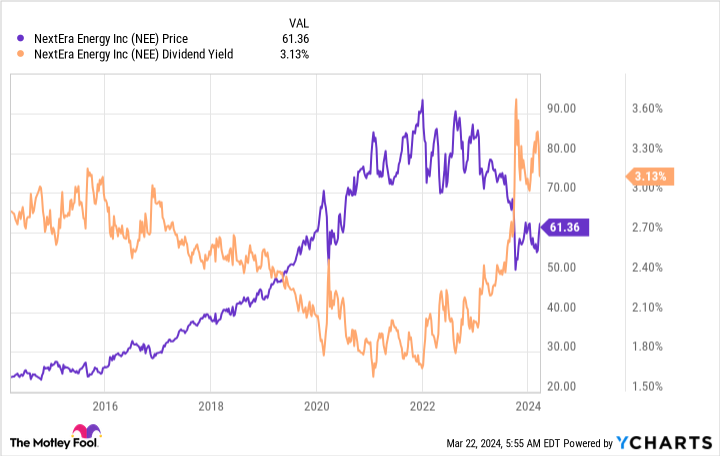

2. NextEra Energy's yields are historically high

Calculating the dividend yield is a very simple mathematical formula that involves dividing the annualized dividend by the market price where it was. If the dividend stays the same and the price goes down, the yield goes up - which is exactly what happened with NextEra Energy. The stock currently yields about 3.31 TP3T, which is near a 10-year high. That suggests the stock is cheap right now.

There are two things to discuss here. First, why did NextEra Energy's stock price drop so much? Rising interest rates are the biggest factor, and it's affecting the entire utility industry. Essentially, rising interest rates make it more expensive for companies in capital-intensive industries to expand their operations. This is a legitimate concern, and as one of the fastest-growing companies in the utility space, NextEra Energy is one of the worst-affected stocks.

Second, the dividend yield of 3.3% may not be that attractive on an absolute level. You can easily find utility stocks with higher yields. But it's the combination of yield and dividend growth that counts, and that's what we're trying to understand here.

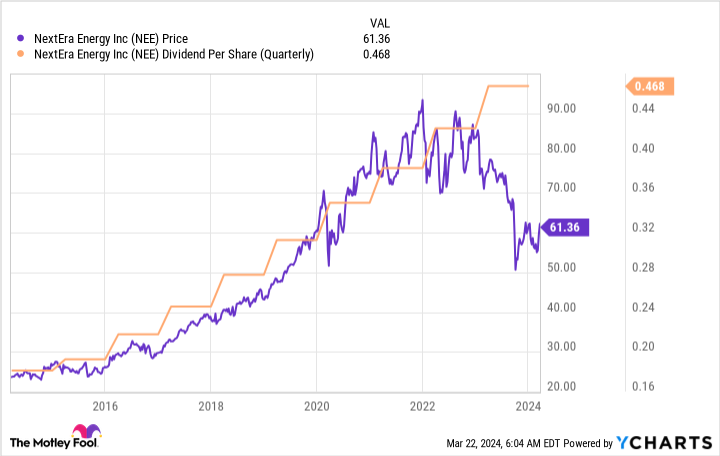

3. Dividend growth of 10% by 2026!

NextEra Energy has increased its dividend annually for 29 consecutive years. Over the past decade, the average annual growth rate has been a whopping 10.91 TP3T, a staggeringly high number for a utility, but one that is supported by NextEra's unique two-growth business model. As 2023 drew to a close, the company promised to raise its dividend by 10% in 2024, but it gave no long-term forecast for dividend growth, casting doubt on its ability to continue to raise its payout ratio. In early 2024, however, the company updated its outlook, projecting a dividend increase of 10% through at least 2026, supported by earnings growth of 6% to 8%.

In other words, despite the unfavorable factors in the interest rate side of the equation, there has not been any change in the dividend growth side of the equation. Considering that the clean energy transition could take decades, there is still plenty of room for future dividend growth.

A range of attractive features

To summarize NextEra Energy in a few words, it's a utility with a solid, growth-oriented business model, and while Koon's future looks bright, the stock is attractively priced. While investors looking for higher yields may pass on this stock, almost any other type of investor will find its story compelling.

Should you invest $1,000 in NextEra Energy now?

Before buying shares of NextEra Energy, consider the following:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10NextEra Energy is not one of the 10 stocks listed on ....... The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of March 25, 2024

Reuben Gregg Brewer does not own any of the stocks mentioned above.The Motley Fool holds a recommendation for NextEra Energy.The Motley Fool has a disclosure policy.

3 Reasons to Buy NextEra Energy Stock Like There's No Tomorrow was originally published by The Motley Fool.