.

4 Things to Look for in Artificial Intelligence (AI) Stocks

Artificial intelligence (AI) has been a hot potato since OpenAI released its ChatGPT platform in November 2022.16 Months later, the AI boom is in full swing, sending many AI stocks soaring.

But in the long run, it's unlikely that every AI stock will be a winner. In my opinion, just getting a piece of the AI pie is not enough. Before I put my hard-earned money into a promising AI investment, the company and the stock must meet my list of four qualifications.

To be clear, under my microscope, a potential AI investor doesn't necessarily have to pass all the tests, because a 耑 advantage in one area can make up for a deficiency in another. But the more checkboxes I can fill, the more likely I am to end up buying a few stocks.

Here's what I'm looking for:

1. Innovations that change the rules of the game

In the fast-paced world of AI, it's critical to separate the true innovators from those who simply repackage old ideas. Look closely for signs of know-how: unique algorithms, models, and frameworks backed by a strong set of patents. These are strong indicators not only of innovation, but also of a company's ability to defend its market position.

In addition, a relentless commitment to research and development (R&D) is essential for companies that want to stay at the forefront of the AI game. Ongoing breakthroughs and publications may not be spectacular, but they signal a company's commitment to long-term development in the field. These are potential game changers worth considering in your portfolio.

2. Practical application cases

Let's be clear: the most notable AI companies aren't just about technology, they're about solving real-world problems. Instead of focusing on buzzwords, look for companies that are addressing the major pain points and inefficiencies facing businesses and industries. Are they helping customers generate revenue, reduce costs or dramatically streamline processes through AI solutions? This is a strong indicator of potential investment value. I would always prefer an actual application or cloud-based platform to a flashy technology statement with no usable version.

In addition to immediate problem solving, scalability is also crucial. Consider the potential for wider application of the technology across industries or its ability to adapt to different needs. This versatility signals a company's ability to achieve significant growth and market leadership. Look for evidence of success, such as widespread adoption of its solutions and an expanding customer base. These are solid indicators of an AI company's long-term success.

3. Financial health

Even the most groundbreaking AI can't save a company with a terrible balance sheet, stagnant job growth and negative cash flow.

That's why savvy investors need to go beyond mere technicalities and scrutinize financial statements. A little homework goes a long way, and the more boring numbers you evaluate, the easier it gets. Whether it has anything to do with artificial intelligence or not, try to get into the habit of checking a few important numbers before taking action on any stock. Over time, you're sure to pick more and more useful data points, giving you more options as you make your way through Wall Street and Silicon Valley.

Some may call this "nitpicking" or "picky", but don't worry. What you have here in Gwen is real money!

The ideal AI company has to be more than just a great idea and promising technology. We look for innovations that are making money, show sustainable (or even accelerated) revenue growth, and most importantly, at least have a realistic long-term roadmap to profitability. Artificial Intelligence is not just a cool science project, but a viable business with realistic profitability goals.

4. valuation of the person

Stock valuations in the AI market are a bit silly.

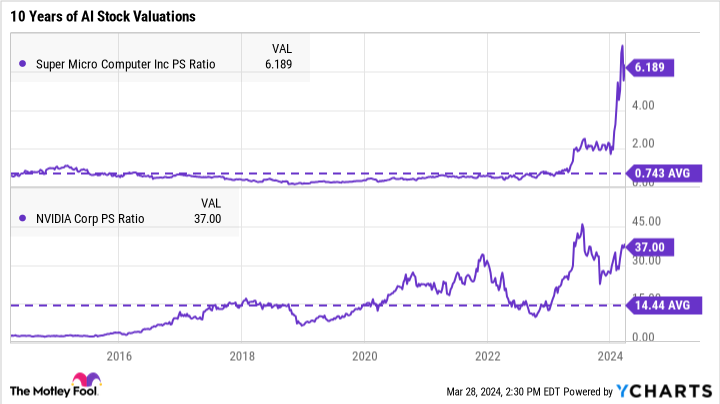

Self-sustaining Digital Computing Chip Design CompanyINVISTA (NASDAQ: NVDA)Since the introduction of the ChatGPT system to the market, its stock price has risen by 4,80%. system makersupercomputerfirms(NASDAQ resonance code: SMCI)Over the same period, the increase was a whopping 9,981 TP3 T. These companies are growing their businesses impressively, and AI-based hardware sales are bringing in big profits, but they still look expensive.

Super Micro's stock is trading at six times sales, and Nvidia has a P/E of 37. That doesn't sound too bad, but these hardware companies usually have much lower P/Es.

These companies are leaders in popular industries, but their high valuations can still cause you to do a double-take.

I mean, Nvidia is a great company with strong business trends and a bright long-term outlook, but its stock price seems to be rising too fast. So I recently took some of my profits from Nvidia and reinvested that lovely cash into some lower-priced growth stocks. Well-known growth investor Cathie Wood is doing the same thing, selling a small portion of her massive Nvidia holdings at ARK Investments every week.

Cathy Wood and I are still happy shareholders of Invicta. We just don't buy that overvalued stock now, and there's no shame in cashing in some of the profits.

Take it easy, dear AI investors.

These are the four things I look for in every potential AI investment. Most of these generalizations apply to any stock, especially technology stocks.

Depending on your personal investment objectives and understanding of the evolving AI opportunity, your criteria may vary. For example, you may be very concerned about ethical AI practices and data privacy, or you may be looking for a top-notch Koon team first and foremost, or you may want a solid technology infrastructure and impeccable security. I want those things too, but only after I've evaluated the four basic qualities mentioned above.

Whatever your investment criteria, remember to keep your feet firmly planted in the AI boom. Focus on companies that demonstrate solid business practices and reasonable valuations. This approach helps ensure that you don't just look at the immediate future, but make capital management decisions that will stand the test of time.

Should you invest $1,000 in Nvidia now?

Before buying Nvidia stock, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Nvidia is not one of the 10 stocks listed on ....... The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

Anders Bylund has a position in Nvidia.The Motley Fool has a position in Nvidia.The Motley Fool has a disclosure policy.

4 Things I Look for in Artificial Intelligence (AI) Stocks was originally published by The Motley Fool.