.

Two Super-High-Yield Stocks to Buy, One to Avoid

There's no shortage of high-yield stocks in the market, and it's not hard to find them, but which ones better reflect your investment outlook? If you share my view, the outlook for energy prices remains positive, and the U.S. housing market is poised for a timely recovery.Devon Energyfirms(Devon) Energy (NYSE: DVN) (NYSE: DVN)(math.) andWhirlpool (name)firms(Whirlpool) (NYSE:WHR)The Government is now a very good buy. However, as much as possible, the3Mfirms(NYSE: MMM)An exciting investment proposition in its own right, but it's not a stock that high-yield investors should be buying. Here's why.

Devon Energy Corporation (Trailing Dividend Yield of 5)

Devon Energy uses a fixed plus floating dividend to utilize the free cash flow remaining after the payment of the fixed dividend (currently $0.22 per quarter) and the completion of the stock exchange.

This is an active strategy. Koon Management prioritizes stock purchases where they believe the stock is undervalued. For example, in the fourth quarter of 2023, Koon purchased 5.2 million shares for $234 million, paid a fixed dividend of $0.20 per share of $127 million, and paid a variable dividend of $0.22 per share of $140 million.

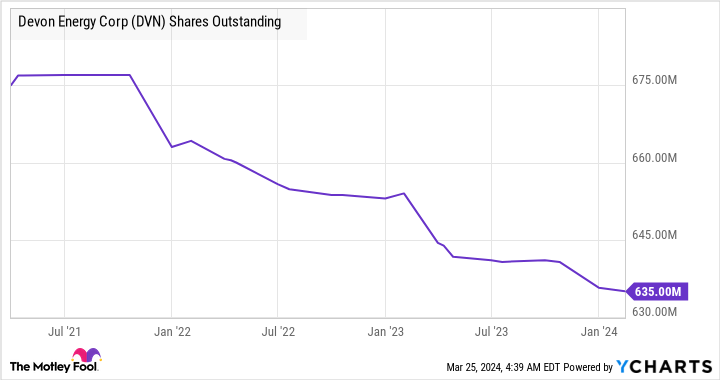

The chart below shows that Devon has had a fairly good track record of reducing its share count. High yield investors should welcome this as it increases their stake in Devon Energy's future cash flows.

Devon Energy also has a strong track record of resource growth, particularly through expansion and discovery.

According to my calculations, based on Koon's 2024 oil price forecast of $80 per barrel and the current stock price of $48.37, Devon's free cash flow (FCF) yield in 2024 could be close to $10%. Since Koon's goal is to return $70% of FCF to investors in 2024, there should be plenty of room to pay a high dividend and buy back stock to increase the dividend per share in the future. There should be enough room to pay a high dividend in the future, as well as to purchase additional shares to increase the dividend per share.

While it is unclear what the variable dividend will be in 2024, at current oil prices Devon has enough potential to pay a sizable dividend this year.

Whirlpool's Real Estate Complex and its 6.3% Dividend Yield

Whirlpool's performance this year has been unsatisfactory in terms of key figures. Relatively high interest rates have slowed the real estate market for a long time, putting pressure on home appliance sales. Given that existing home sales account for 25% of U.S. demand for home appliances, with 15% coming from new home sales, Whirlpool expects comparable sales in 2024 to be flat with 2023 at $16.9 billion, and earnings before interest and taxes (EBIT) margins to be flat with 2023 at 6.8%.

Whirlpool can do little about the 耑 market, but it can change its focus. That's exactly what management is doing, agreeing to transfer its main European home appliance business to Arcelik's European operation, while taking a stake in the new company, 25%. That's a good move, as Whirlpool's European business has lost money in eight of the last 15 years, and its EBITDA margin in 2023 is just 1.8%.

As a result, Whirlpool will increase its focus on its core North American market, which is expected to deliver EBITDA margins of 9% in 2024. In addition, management's cost reduction initiatives have resulted in cost reductions of US$800 million in 2023 and US$300 million to US$400 million in 2024. These initiatives will position Whirlpool well to benefit from low interest rates in North America in the future.

Don't buy 3M 5.7% for its dividend yield.

There is value in buying 3M stock, especially since management's reorganization is expected to turn around its poor margin performance in recent years. In addition, some of 3M's key end-base markets (e.g., consumer electronics, semiconductors, and electronics) are showing some signs of improvement.

Nevertheless, the spin-off of Solventum, its healthcare business, will deprive it of a valuable and reliable source of cash flow. In addition, 3M continues to face significant legal costs in dealing with litigation issues, with billions of dollars in cash coming out of legal settlements each year.

On the other hand, 3M will receive $7.7 billion from the Solventum spinoff and validate 19.9% shares of the healthcare business, which it can sell to raise cash. The bottom line is that 3McanKeep the dividend at its current level, but using cash to restructure a company on the brink of bankruptcy may not be the best use of shareholder funds.

Finally, 3M's current chief executive Michael Roman, who will become executive chairman on May 1, did not explicitly confirm that Solventum's dividend would remain at the same level as before, but promised that "the dividend will be attractive."

So don't be surprised if 3M cuts its dividend in 2024.

Should you invest $1,000 in 3M now?

Before buying 3M stock, consider the following:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10Only ...... and 3M are not among them. The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of March 25, 2024

Lee Samaha does not own any of the stocks mentioned above.The Motley Fool recommends 3M.The Motley Fool has a disclosure policy.

Two High-Yield Stocks to Buy, One to Avoid was originally published by The Motley Fool.