.

RH stock just went up. Here are 3 reasons why this growth stock should continue to rise

As with most stocks involved in the real estate market, home furnishings retailer formerly known as Restoration Hardware has been a major player in the market.RH (NYSE: RH)It has struggled in recent years.

The company's stock price is down more than 50% from its pandemic highs, and revenues and profits have plummeted over the past year. The company faces "the most challenging real estate market in three decades," as Chief Executive Officer Gary Friedman said in a recent shareholder letter.

RH's fourth-quarter results confirmed these unfavorable factors, with revenues falling 4.41 TP3T to $738.3 million and adjusted EPS dropping 751 TP3T to $0.72. Both of these results fell short of expectations, but the company's stock reacted surprisingly well to the report. Both of these business results fell short of expectations, but the company's stock reacted surprisingly well to the report. On Thursday, the company's stock jumped 17.3% after the report was released, as Friedman expressed optimism that the company's business was recovering and guidance indicated that the company would also return to growth.

Investors are suddenly bullish on this stock. Let's take a look at a few reasons why RH stock could continue to climb.

1. The real estate market will recover.

Home furnishings sales are associated with housing transactions, as buying a new home and moving often means buying new furniture.

The real estate market is cyclical, with existing home sales falling to a 29-year low last year, but there are signs of a recovery. However, there are signs of a recovery, with February home sales up nearly 10% from January and mortgage rates back down from their peak.

RH acknowledged in its shareholder letter that it expects the company's operating conditions to remain challenging until interest rates fall, but expects rates to fall later this year. The Fed is expected to cut rates three times this year.

In the longer term, the housing market is likely to normalize as the lock-in effect on the interest rate on the chargeback loans eases and new housing construction fills the gap between housing supply and demand.

RH did say that despite the tough conditions in the real estate market, it expects the demand trend to accelerate this year, suggesting that it has outperformed the market.

2. Its stock volume has dropped significantly

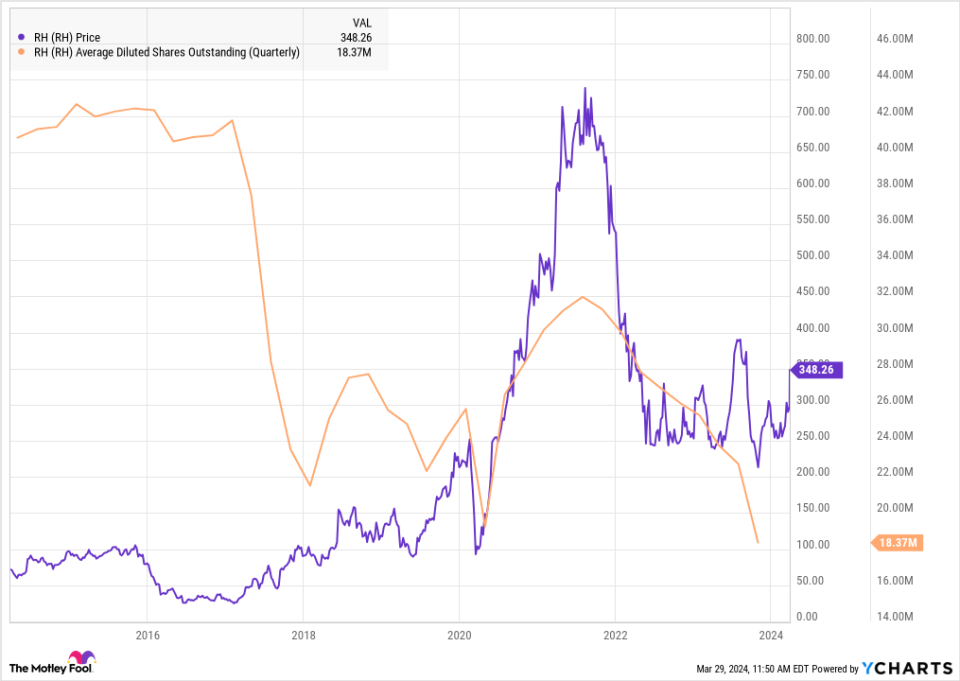

RH has a history of taking advantage of opportunities to buy back stock, and it has done so again over the past two years as its stock price has fallen sharply.

The company has reduced its outstanding shares by more than 20% over the past year, 35% over the past two years, and by an average of 19.9 million shares in the fourth quarter.

As you can see from the chart below, the company's outstanding shares have decreased by more than half over the past decade.

It's hard to see the impact of these purchases on EPS when the business is struggling, but a 35% decrease in shares outstanding equates to a 53% increase in EPS for the same net income.

In the first quarter of 2022, the company reported net income of $750 million, and it won't be easy to return to that peak 竝. However, RH can achieve this level of EPS with a 35% reduction in net income, or about $500 million in net income, which is significantly easier to achieve in the near term.

3. The most recent investment cycle is about to pay off.

Over the past two years, RH has been developing new product categories called "transformative," redoubling its efforts in areas such as outdoor, opening new galleries in North America and Europe, and pushing into new international markets.

The company is also expanding the RH brand into luxury lifestyle categories such as Studio, Guesthouse, Jet and Yacht rentals, as well as a soon-to-be-launched media business focused on architecture and design streaming media services.

In keeping with the new range, the company is stepping up its marketing efforts to help it win market share. The company, which has doubled its booklet circulation this year, said the initial response to its outdoor booklet had been "very good".

The company has also increased its advertising spend on home design publications to drive demand. As a result, the company expects demand growth of 12% to 14% and revenue growth of 8% to 10% this year due to order backlog.

Revenue growth is likely to accelerate over the next few years as the real estate market recovers and the opening of new galleries pays off.

Like the real estate market, RH is a cyclical business, and it seems poised to begin another growth cycle. The stock is expected to continue to move higher as revenues grow and profits increase.

Should you invest $1,000 in RH now?

Before buying shares of RH, please consider the following:

Motley Fool Stock AdvisorA team of analysts have just named what they think are the best values for investors.10RH is not one of the 10 stocks listed at ....... The 10 stocks selected will bring substantial returns in the years to come.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

Jeremy Bowman owns shares of RH. The Motley Fool recommends RH. The Motley Fool has a disclosure policy.

RH stock just went up. 3 Reasons This Growth Stock Can Continue to Rise was originally published by The Motley Fool.