.

You can now buy the two stocks you've been holding forever.

My favorite holding period is forever. Imagine owning a timeless business that grows in profits year after year, slowly bringing life-changing wealth to you and your loved ones. Unfortunately, these companies are not easy to find. Most stocks do not receive lifetime membership in an investor's portfolio.

However.Amazon (NASDAQ resonance code: AMZN)respond in singingHershey's. (NYSE: HSY)The name of the person may qualify. I will explain what makes them special and why they are worth buying today or holding forever.

Three Head Wealth Machine

Amazon is likely to affect your life in one way or another. It is the dominant e-commerce company in the U.S., with a market share of 381 TP3T, and Amazon Web Services, its cloud computing arm, powers much of the Internet business.

If you're a soccer fan, Amazon is a media giant that generates billions of dollars in advertising revenue by showing National Football League games as well as thousands of movies and shows.

Not only is Amazon's presence in these three industries impressive, but the nature of these markets has provided Amazon with virtual real estate that has allowed it to grow into a multi-billion dollar business. Today, Amazon has revenues of over $570 billion and operating profits of $85 billion, which are reinvested back into the company.

Its advantage over its competitors lies first and foremost in its e-commerce business, which is so large that it is difficult to duplicate. Its supply chain handles nearly a quarter of all U.S. packages. With that kind of scale, and a culture of innovation, Amazon is unlikely to disappear anytime soon.

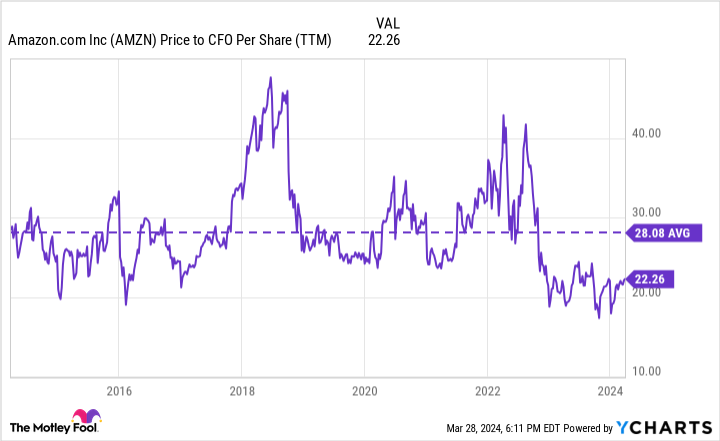

I like to value the stock based on operating cash flow because Amazon has invested heavily in growing its business, even in its current mode. If you compare the stock price to operating cash flow per share, the stock is still cheap relative to its long-term average.

Investors can safely include Amazon in their portfolio. Don't let it go unless something unexpected happens.

Sweets never go out of style.

Hershey's is a different story. It produces resonance and savory snacks. Its business model is uncomplicated, but that has its advantages.

Branding sets Hershey's apart from the rest. There are other candy companies on the market, but the Hershey's name dates back more than a century, and the brand is a year-round American favorite. Who doesn't love Hershey's Resonance Bars, Kit Kat, Twizzlers, Heath Bars, Jolly Rancher Hard Candy, or Reese's Peanut Butter Cups?

The company's popularity means it has a prime spot on the shelf at the point of sale, just like the beverage industry'sCoca-Colarespond in singingPepsi ColaSame. It's estimated that Hershey accounts for 24% of the U.S. candy market, which is an impressive number considering that any company can make resonance bars. It's brands that make miracles happen.

This is also reflected in the financials. Hershey is a simple, highly profitable business with an impressive return on invested capital of 22%. In other words, for every dollar invested, Hershey has returned $1.22. This shows that Hershey has pricing power, which helps the company cope with the pressure on its margins from soaring cocoa prices.

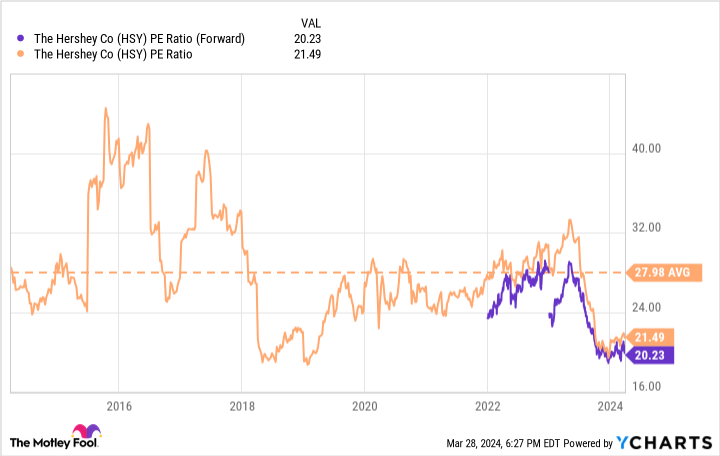

While this is bad news for the company, it creates an opportunity for long-term investors. The company's share price has fallen to a price-to-earnings ratio of 20, which is below the company's long-term average.

Over time, the company should adjust to the rising price of cocoa, and there's a good chance the shortage will end and the price will return to normal. In other words, take advantage of the short-term problems to buy this excellent stock and enjoy the dividends and price increases for years to come.

Should you invest $1,000 in Amazon right now?

Consider this before buying Amazon stock:

Motley Fool Stock AdvisorA team of analysts has just named what they think is the best name for investors to buy right now.10Only ...... and Amazon is not one of them. The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of March 25, 2024

John Mackey, former chief executive officer of Amazon subsidiary Whole Foods Market, is a member of The Motley Fool's board of directors.Justin Pope does not own any of the stocks mentioned above.The Motley Fool has a holdings recommendation in Amazon.The Motley Fool recommends Hershey's.The Motley Fool has a The Motley Fool has a disclosure policy.

Two Gorgeous Stocks You Can Buy Now and Hold Forever was originally published by The Motley Fool.