.

1 Growth stock with a drop of 87%, worth buying now

Roku (NASDAQ resonance code: ROKU)Streaming media has been redefined for many households. Shares of this soaring growth stock for 2020 and 2021 have plummeted from their pandemic-induced peak and are now 87% below their July 2021 record price.

If you're looking for a potential bargain at the crossroads of technology and consumer services, Roku's steep price cut may catch your eye. Past performance is no guarantee of future results, but for those who believe in the company's basic noodles and long-term strategy, this steep discount offers a low entry point.

In my view, Roku's long-term business prospects are stronger than ever. In fact, while Roku still appeals primarily to growth-seeking investors, there are many aspects of the stock that should appeal to the committed value investor. So let's take a deeper look at Roku's current market position, financial health, and future outlook to see if this decline is a buying opportunity or an exit signal.

Is Roku the deal of the day?

I am not kidding. In many ways, the Roku looks like a bargain.

Today, its stock trades at just 2.7 times sales, or 4.1 times the company's book value. If you're looking for strong cash reserves, then Roku stock trades at 4.6 times its cash equivalent, with a perfect balance sheet and zero long-term debt.

As a result, the company is cash-rich and debt-free, ready to invest heavily in promising ideas and businesses. At the same time, the company's shares are better suited to slow-growing enterprises in mature industries such as industrial materials or telecommunications services.

Roku Wallet Open to Fund Tomorrow's Growth

At the moment, Roku looks like a low-priced value stock. But that's not the whole story.

The company is also utilizing many useful levers to support growth both internally and in the future. For example, over the past two years, Roku's annual research and development (R&D) budget has increased by $901 trillion, while sales and marketing costs have soared by $1,271 trillion during the same period.

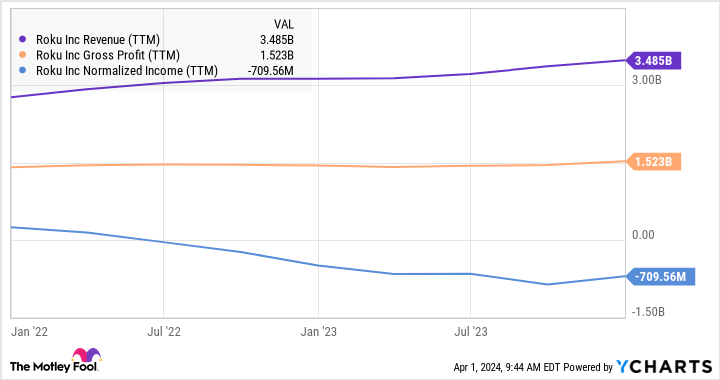

Roku has kept its product and service prices stable while most of its competitors have passed on higher costs to customers. Stagnant gross margins and soaring operating expenses have led to negative bottom-line revenue in the summer of 2022.

So you can think of Roku's declining gross margins as another type of marketing expense in recent years. The company has borne the brunt of rising business expenses, while others have exacerbated inflation by raising prices. Combined with soaring research and development and marketing expenses, Roku's business has continued to grow despite the global economic downturn.

Roku's Secrets to Fighting the Recession

At the end of 2021, Roku had 60 million active accounts and $2.7 billion in annual revenue. Two years later, the number of accounts grew to 80 million and annual sales jumped to $3.5 billion. Not too shabby in an inflation-induced market downturn, is it?

In addition, bottom-line pressure is subsiding. In February's Q4 report, Roku reported its first upward growth since the 2021 swing quarter. Meanwhile, full year sales increased 8% year-over-year and free cash flow for the year was solid at $173 million.

In other words, Roku's growth strategy is paying dividends, and I can't wait to see the company's financial performance soar when the world economy finally resumes growth.

Media streaming is taking the entertainment world by storm, and every digital streamer who cuts the cord is a potential Roku customer. As much as possible.the belt of Orion,Amazonrespond in singinggrain taxWhile competition from world-class technology companies like Roku is fierce, Roku still holds a commanding share of the North American streaming media equipment market. It is also a leader in Latin America and Western Europe, and is expanding globally.

Roku is my favorite stock to buy right now.

However, given the rapidly changing competitive landscape and the current lack of bottom-line margins, market participants are hesitant to recognize Roku's significant long-term upside potential.

I think that's a big mistake, and Roku's business is working well, delivering growth in key areas. Negative earnings may seem painful at first, but management has the ball under control, and can always generate net profits by abandoning this expensive growth strategy.

I hope they don't do this for years to come. The untapped long-term market opportunity is too big to ignore. As the streaming entertainment industry continues to grow, you should be able to make a lot of money buying Roku stock at the current low price.

Should you invest $1,000 in a Roku right now?

Before buying Roku stock, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Roku is not one of the 10 stocks listed at ....... The 10 stocks that made the list are poised to generate huge returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Circular as of April 1, 2024

John Mackey, former chief executive officer of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. suzanne Frey, an Alphabet executive, is a member of The Motley Fool's board of directors. anders Bylund serves on the boards of directors of Alphabet, Amazon and Roku. the Motley Fool owns stock in recommended Alphabet and Roku, Anders Bylund works at Alphabet, Amazon, and Roku. The Motley Fool owns shares of stock that it recommends in Alphabet, Amazon, and Roku.

Buy Now 1 Growth Stock Down 87% was originally published by The Motley Fool.