.

Prediction: 5 Stocks That Will Be Worth More Than Artificial Intelligence (AI) Stock Nvidia in 3 Years

In the last 30 years, no new trend or innovation has matched the emergence of the Internet. However, Artificial Intelligence (AI) has the potential to make the same impact on businesses in this generation that the Internet made on U.S. businesses three decades ago.

Analysts at PricewaterhouseCoopers (PwC) predict that AI, which relies on software and systems instead of human supervision, will add $15.7 trillion to the global gross domestic product by the turn of the century. No company will benefit more directly from the AI revolution than semiconductors.Shares of Inventec (NASDAQ: NVDA)The

INVISTA's share price may be in a bubble

In 15 months, Nvidia's valuation has soared by $1.9 trillion to $2.26 trillion, second only to Nvidia among U.S. public companies.Microsoftrespond in singingAppleThe

Nvidia's strong performance reflects the huge demand for its high-powered A100 and H100 graphics processing units (GPUs). Some analysts believe that Nvidia's top chips could account for more than 90% of GPUs deployed in AI-accelerated data centers this year. The early scarcity of these chips provides Nvidia with exceptional pricing power.

But there are many reasons to believe that Nvidia is in a bubble.

For example, over the last thirty years, every new trend and innovation has experienced an early bubble. It is customary for investors to overestimate the adoption rate of new technologies, and I expect that AI will be no exception.

Nvidia's pricing power may also weaken in the coming quarters as new competitors enter the space and the company's own production reduces the scarcity of AI GPUs. in FY2024 (ended Jan. 28, 2024), Nvidia's datacenter sales grew by 2,171 TP3T, thanks largely to its pricing power.

The most worrisome aspect of this may be simply that its top four customers, members of the "Magnificent Seven," which account for about 40% of its sales, are developing in-house AI chips for their data centers. In any case, Nvidia's orders from its top customers are likely to dwindle over the next few quarters.

If history rhymes again and the AI bubble bursts, Nvidia's market capitalization could shrink (compared to what it is now), thus allowing other companies to overtake it.

Here are five companies (excluding Microsoft and Apple, which are already ahead of Nvidia) that have tools and intangible assets that will be worth more than Nvidia in three years.

1. Alphabet: Market capitalization 1.88 trillion USD (Class A stock, GOOGL)

The first industry giant that should have no problem overtaking Nvidia's market capitalization within the next three years isAlphabet (NASDAQ: GOOGL)(NASDAQ resonance stock code: GOOG)), the parent company of Internet search engine Google, streaming platform YouTube and self-driving company Waymo, among others.

If the AI bubble bursts, Alphabet will have an advantage over Nvidia because it's the de facto monopoly in Internet search. In March of this year, Google accounted for more than 91% of the world's Internet searches. Looking back over nine years of monthly data from GlobalStats, the share of global Internet search that Google gives up to all other companies is as followsmass transit andNo more than 10%. Google is a great choice for advertisers who want to get their message out in front of the user's face, and it will benefit greatly from long-term domestic and international growth.

If Nvidia is struggling, Google Cloud can thrive. Enterprise cloud spending is still in its early stages, and Google Cloud already accounts for 10% of global cloud infrastructure services as of September 2023. Alphabet's cash flow growth could accelerate over the next decade, as cloud margins have traditionally been more lucrative than advertising margins.

2. Amazon had a market capitalization of 1.87 trillion USD beforehand.

Like Alphabet, if the AI bubble bursts, e-commerce giantAmazon (NASDAQ resonance code: AMZN)It may also overtake Nvidia again at some point in the next three years.

Most people are familiar with Amazon because of its world-leading online presence. It is estimated that in 2023, 38% of all online retail spending in the US will come from Amazon's e-commerce site. But the real benefit of having more than 2 billion people visit Amazon.com every month is the advertising revenue it generates, as well as the subscription revenue it generates through Prime, which surpassed 200 million users in April 2021, making it the largest online marketplace in the world since it became one of the most popular websites in the world.Thursday Night Football.This number will almost certainly increase after the exclusive streaming of the carpet is partnered.

However, Amazon's most significant cash flow driver is its cloud infrastructure services platform. While Amazon Web Services (AWS) accounts for only one-sixth of the company's net sales, it consistently generates between 50% and 100% of Amazon's operating revenue. According to Canalys, AWS is the world's highest-spending cloud infrastructure services platform.

3. Meta Platforms: $1.24 trillion in pre-capitalization.

Maximize social media companies.Meta Platforms (NASDAQ resonance stock code: META)Betting on a future fueled by artificial intelligence and augmented/virtual reality, but the company's core business should be able to maintain double-digit earnings growth, which could help its valuation far outstrip INVISTA's by 2027.

Meta's "secret sauce" is no mystery. As ambitious as Metaverse is, and as heavily invested as it is in Reality Labs, the company's mainstay remains its social media empire. It is the parent company of Facebook, the world's most visited social networking site, and its family of apps attracted a total of nearly 4 billion monthly active users in the quarter ending in December. Advertisers are willing to pay a premium for Alphabet's Google because of its dominant position in Internet search, and likewise, Meta's ability to price ads tends to be superior in most economic environments.

Another reason Meta has been able to make a splash and close the roughly $1 trillion valuation gap with Nvidia within the next three years is its balance sheet. meta is a cash flow machine. Last year, it generated more than $71 billion in net cash from operations, and by 2023, it will have $65.4 billion in cash, cash equivalents, and marketable securities. This cash not only provides a hedge against downturns, but also gives Meta the ability to take risks like no other company.

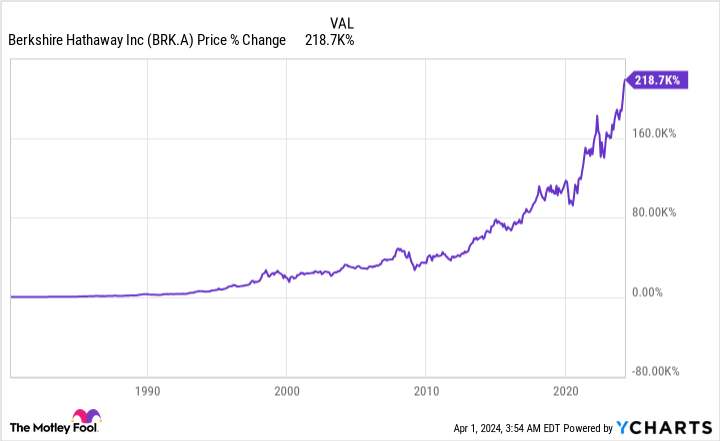

4. Berkshire Hathaway: Pre-market capitalization USD 908 billion (Class A, BRK.A)

The fourth company that could overtake the market capitalization of AI stock INVISTA in the next three years is Enterprise GroupBerkshire Hathawayfirms(NYSE: BRK.A)(New York Stock Exchange: BRK)B). Since Warren Buffett took the helm of Berkshire Hathaway in the mid-1960s, the average annualized return on Koon's Class A stock has been close to 20%!

One of the main reasons why Berkshire Hathaway has been so profitable for investors is the "Oracle of Omaha's" love of dividend stocks. Berkshire is on track to receive about $6 billion in dividends this year, with the total amount of dividend income from the five core holding companies alone approaching $4.4 billion. Since dividend-paying companies are typically profitable and proven on a regular basis, they are exactly the type of businesses we look for to grow in tandem with the U.S. economy over the long term.

Warren Buffett and his investment team also favor brands with trusted management teams. For example, the $155 billion invested in Apple represents almost 42% of resonable Hathaway's investment assets. Apple is one of the world's most valuable brands, and CEO Tim Cook has done a remarkable job of leading the company through innovation in its products while transforming the company into a service-driven future.

5. Visa: Pre-market value $573 billion

Nvidia's stock is a payment processing giant with a market capitalization that's going to exceed that of AI stocks in three years.Visa (NYSE: V)The situation as it stands now is that Visa must close a valuation gap of nearly $1.7 trillion. As things stand, Visa must close the nearly $1.7 trillion valuation gap. But that could happen if the AI bubble bursts and Visa continues to do what it's been doing for decades.

Visa's strength lies in its long-term growth opportunity. Visa is the undisputed market leader in credit card network purchases in the U.S., the world's largest consumer market, and has a decades-long opportunity to bring its payment infrastructure, either organically or through acquisition, to under-banked regions such as the Middle East, Africa and Southeast Asia. Visa should be able to sustain double-digit earnings growth for the rest of the decade, and well beyond.

Another source of Visa's success is its relatively conservative management team. While Visa could have been very successful as a lending company, its leaders chose to focus the company exclusively on payment facilitation. The advantage of this approach is that Visa does not need to recoup loan losses by proceeding to fund it in a recession because it is not a lending company. As a result, Visa's profit margins remain at 50% or above!

Should you invest $1,000 in Nvidia now?

Before buying Nvidia stock, consider the following:

Motley Fool Stock AdvisorA team of analysts have just selected what they believe to be the most popular analysts in the world at the moment.-est (superlative suffix)The name of the person is suitable for the investor to purchase10Nvidia is not one of the 10 stocks listed on ....... The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 1, 2024

John Mackey, former Chief Executive Officer of Whole Foods Market, an Amazon subsidiary, is a member of the Board of Directors of The Motley Fool. Randi Zuckerberg, former Director of Mass Development and Spokeswoman for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool Board of Directors, and Suzanne Frey, an Alphabet executive, is a member of The Motley Fool Board of Directors. (Suzanne Frey, an Alphabet executive, is a member of The Motley Fool's board of directors, and Sean Williams works at Alphabet, Amazon, Meta Platforms, and Visa. The Motley Fool owns shares of recommended Alphabet, Amazon, Apple, Berkshire Hathaway, MetaPlatforms, Microsoft, Nvidia, and Visa.The Motley Fool recommends the following options: long Microsoft January 2026 $395 calls and short Microsoft January 2026 $405 calls.The Motley Fool has a disclosure policy.

Prediction: 5 Stocks That Will Be Worth More Than Artificial Intelligence (AI) Stock Nvidia in 3 Years was originally published by The Motley Fool.