.

TipRanks' Perfect 10 List: Unveiling the Two Top Tech Stocks with the Highest Smart Ratings

The key to successful stock investing is simple to say, but difficult to realize. It is stock picking, choosing the right stocks that will pay off handsomely. Whether you're Joe Public, a retail investor, or a legendary Wall Street billionaire, if you don't fill your portfolio with the right stocks, you won't make money.

Wall Street legends have dedicated their lives to understanding the market and applying that knowledge to their investments in a way that the rest of us don't have. We need a tool to help us understand market data.

That's where TipRanks' Smart Score comes in. Based on artificial intelligence and natural language micro-algorithms, this data-gathering and organizing tool is designed to collect a large amount of data from the market and distill it into a simple score for each stock. The scores are on a scale of 1 to 10, based on a range of factors that have been shown to predict future performance. 10 out of 10" is the highest possible smart score, indicating that the stock is worth a closer look.

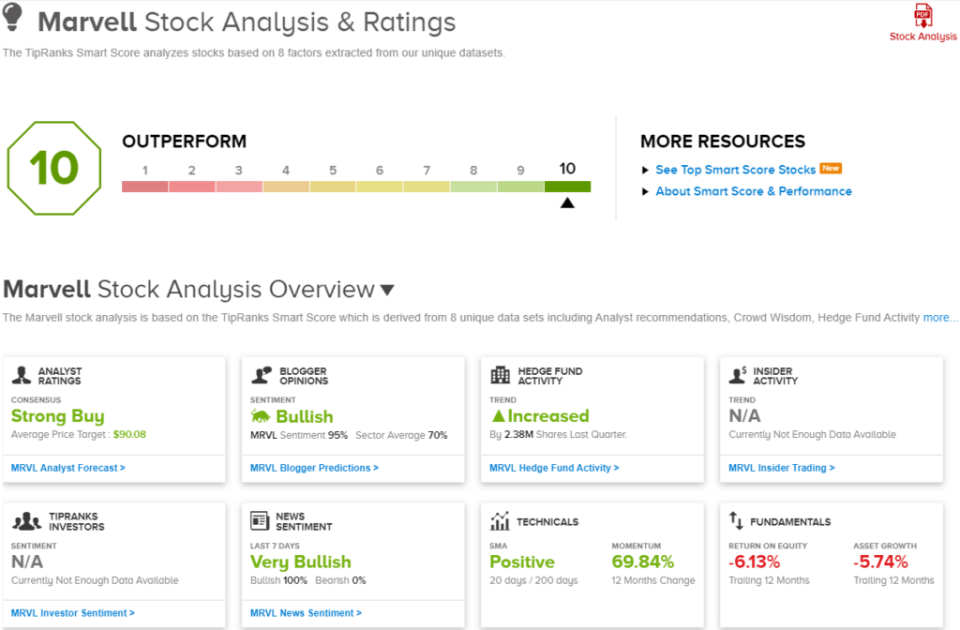

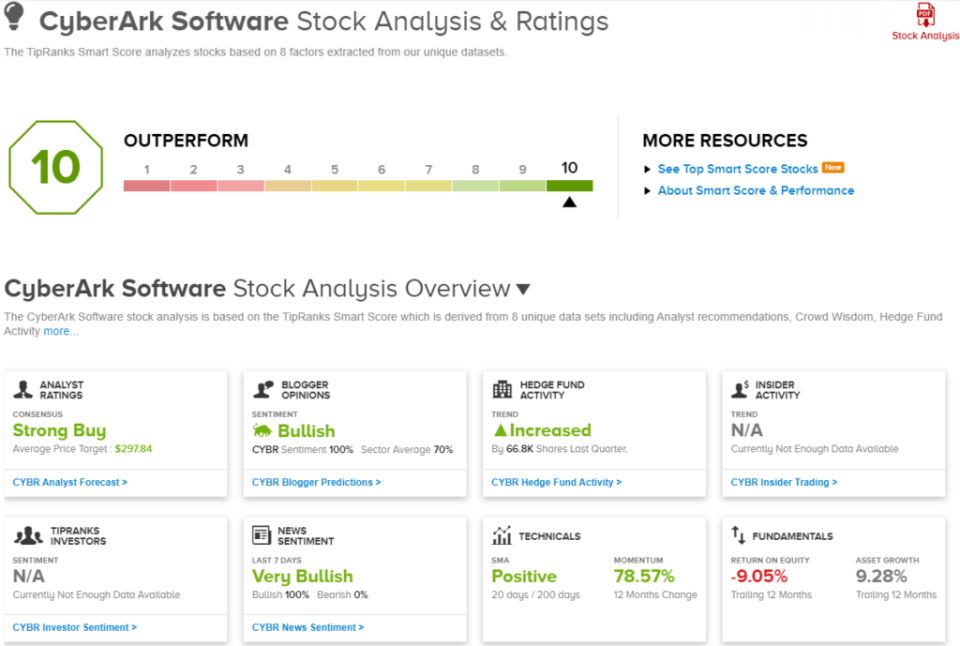

So, let's get started. We've utilized the TipRanks platform to find a pair of "perfect tens," or top-rated stocks in terms of smart ratings; both are tech stocks that also have double-digit upside potential with a consensus "Strong Buy" rating. Here are the details on them, along with some analyst commentary on them.

Marvell Technology Corporation (MRVL)

Let's start in the silicon semiconductor chip space with a look at chip industry giant Marvell Technology Group, a $63 billion designer and producer of data infrastructure semiconductor chips for a wide range of applications, from storage gas pedals to data processing units, from the automotive industry to network operators to artificial intelligence. Marvell combines deep system-level expertise with leading-edge technology to make an impact across multiple industries.

The company's chipsets and other products, especially dry digital signal processors, are rapidly becoming indispensable in the field of artificial intelligence. They provide data centers with the processing speed needed for generative AI applications, even connecting data centers that are up to 1,200 miles apart. This is a transformative capability for data networks. The company made a big splash at OFC 2024 in San Diego, California, in late March, unveiling a wide range of optical technology products needed to optimize the AI and data center space.

As for financial results, Marvell announced in its last quarterly report an aggregate total of $1.43 billion for the 424th fiscal quarter (February quarter). This total was essentially flat year-over-year (up less than 11 TP3T) and only slightly above expectations, exceeding expectations by $10 million. The company's quarterly net profit of 46 cents per share on a non-GAAP basis was also in line with expectations. In the quarterly report, Marvell also announced a $3 billion stock buyback program. However, while the company's stock price has performed well over the past year (up 75%), the weak outlook for the industry has disappointed investors a bit, with first-quarter earnings expected to come in at $0.23 +/- $0.05 per share, a bit below the consensus of $0.40 per share.

But that didn't dampen the positive view of Craig-Hallum analyst Christian Schwab, who sees the chipmaker as a good choice, mainly because of its future artificial intelligence prospects. After a recent investor meeting with Matt Murphy, chief executive officer, and Ashish Saran, director of investor relations, the five-star analyst wrote, "This meeting reinforces our confidence in MRVL: (1) strong leverage to AI growth through e-optics and custom chips; (2) strong leverage to AI growth through e-optics and custom chips; and (3) strong leverage to AI growth through e-optics and custom chips. (1) strong leverage on AI growth through e-optics and customized chips, and (2) the downturn in the legacy enterprise and telecom segments. While the recent EPS estimate cut (for the legacy business) has lowered investor confidence, we expect the upcoming AI event (April 11) to be a positive catalyst.

To quantify his view, the analyst has given a Buy rating to MRVL with a price target of $88, which suggests a one-year upside potential of 20% (click here to view Schwab's track record).

In total, the market is also very bullish on the stock; Marvell's Strong Buy consensus rating comes from 29 recent analyst recommendations, with 28 recommending a Buy and one recommending a "Hold". The company's shares are currently trading at $73.20, and its average price target of $90.08 implies a gain of 23% over the next year. (View)(Marvell's stock forecast)

CyberArc Resonance Softwarefirms(CYBR)

Now let's take a look at CyberArk, a technology company that specializes in identity security and access management software packages. There are few areas of technology that are more important; maintaining online and general digital security is critical to any company that owns a Web site, and protecting data has become an industry in itself. CyberArk's platform allows Koon and Webmasters to control who has access to online Web sites, databases, and software platforms, and furthermore to determine how prospective users or entities can verify their credentials and identities to protect critical information and systems. Protecting critical information and systems.

The Identity Security Platform is CyberArk's flagship product that provides B耑 access security to any digital resource or environment of the user's choice. It operates anywhere or on any device and can be activated by both humans and machines. The platform and its technology have been widely embraced by a variety of industries including financial services, healthcare, retail, energy and government. The common thread is the need to keep private data secure.

In addition to security and input, CyberArk provides tools and platforms for securing privileged access, i.e., managing accounts with different levels of system access. Again, this is an important market segment, as enterprise users have employees with different security needs and different levels of system access. These accounts need to be managed and monitored according to individual privileges to maintain system and network security. Similarly, CyberArk enables Koon to do this both on-site and remotely from a variety of devices.

The continued and growing demand for CyberArk's security in High Point has provided solid support for CyberArk's stock in recent months. So far this year, CyberArk's stock price has risen nearly 21%, or 84% in the last 12 months; this performance has significantly outpaced the Nasdaq Resonance Index over the same period.

In addition to the strong stock performance, the company also recently announced a good financial report. The last quarterly report showed total revenue of $223.1M in 4Q23, an increase of nearly $32% year-over-year, and $13.36M higher than expected. Of this total, $150.3 million came from subscription customers, an increase of $70%. CyberArk reported non-GAAP earnings per share of 81 cents, exceeding expectations by 34 cents.

BTIG analyst Gray Powell commented on CyberArk: "In short, we see a number of factors (increased leaked headlines, SEC law, cyber insurance, digital transformation) driving continued growth in the privileged account processing market, where CYBR has a strong leadership position and growing share. CYBR has a strong leadership position in this market and is expanding its share. In addition, the company has also shown good momentum in related products such as EPM and confidential administration (about 20% of total revenue). Recently, CYBR has also seen high demand for its access koonori product (about 10% of revenue). Looking ahead to 2024, we believe that the market's projected revenue growth rate of 27% is achievable. We believe that on the upside, CYBR could ultimately achieve a CAGR of over 30%.

Powell continues to give CYBR stock a "Buy" rating and a $317 price target, which implies a one-year yield of 20%. (To view Powell's track record, click here)

There are 26 recent analyst reviews for CyberArk, with 25 to 1 analysts preferring Buys over Holds. The company's stock is currently trading at $264.25, with an average price target of $297.84, and a projected one-year stock price increase of 13%. (View)CyberArk's stock forecast)

To find stocks with attractive valuations, visit TipRanks' Best Stocks to Buy, a tool that hosts all of TipRanks' stock views.

Disclaimer: This article represents the views of the contributing analysts. The contents are for informational purposes only. It is important to conduct your own analysis before making any investment.