.

Four Reasons to Buy Chewy Stock Now

Pet E-Commerce SpecialistChewy (NYSE: CHWY)With more than 20 million active customers, its share of the $144 billion pet retail industry in the U.S. is growing rapidly from 6% in 2018 to 12% in 2023.While the company's sales have quadrupled over that period, its stock price is still well below its initial public offering (IPO) price.

While a good rule of thumb is to avoid stocks that haven't recovered their IPO price after five years, Chewy is an exception to this theory for four main reasons. Here are four reasons why I think Chewy is worth buying.

1. Steady growth and resilience of the pet industry

According to research firm Packaged Facts, the U.S. pet market has grown 9% annually since 2017 and is expected to reach an annualized growth rate of 7% by 2027.These impressive growth rates are fueled by the pet humanization megatrend, with 96% of pet owners claiming their furry companion as a member of the family.

Thanks to the strengthening of the pet-human bond, pet consumption is virtually recession-proof, as evidenced by the industry's growth during the Great Recession and the COVID-19 pandemic. This industry stability, coupled with the fact that approximately 85% of Chewy's sales are derived from non-discretionary and health-related products, keeps the company's business resilient regardless of economic conditions.

For investors, these aren't the only reasons Chewy's sales have stabilized over time.

2. Autoship accounted for 76% of Chewy's sales.

Chewy's free autoship program now accounts for 76% of its sales, up from 66% at the time of its IPO.This "order-and-forget" option for pet owners has proven to be a hit with customers, who can arrange to make regular purchases of groceries, pet food, medications, or other items they use on a regular basis.

However, these growing automated payment purchases are even more important to investors because they are highly predictable. This predictability is critical for Chewy, as transporting heavy bags of dog and cat food in one of the world's largest countries is a dazzlingly complex task, especially when trying to turn a profit.

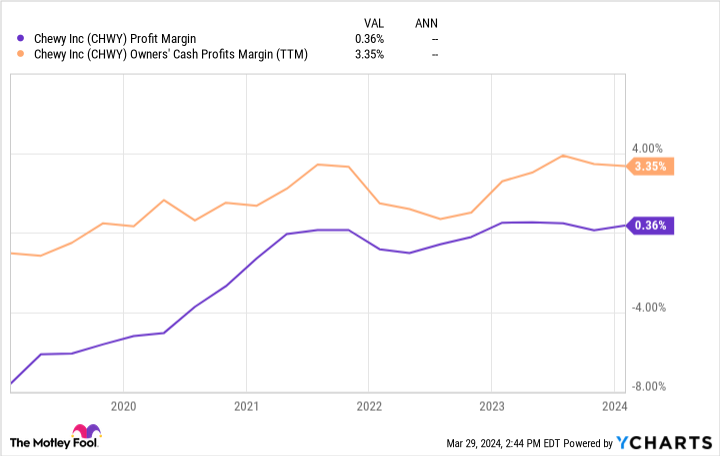

Thanks to the predictability of Chewy's growing auto-ship sales, the Company's logistics network efficiency has steadily improved, with the average mileage per parcel dropping significantly by 28% in the third quarter of 2023.Over the past several years, the Company has begun to generate consistent profitability and free cash flow (FCF) as a result of the increasing efficiency of the entire network.

These margins will continue to improve as Chewy continues to grow its autoship business and expand in higher margin areas such as曏 advertising, private label products, pet services and veterinary clinics.

3. Chewy's expansion of veterinary care is desperately needed in the United States.

Perhaps the most interesting of these higher margin areas for investors is the launch of Chewy's veterinary care business, which plans to open between four and eight physical stores by 2024, and whose veterinary ambitions appear to be a drastic departure from its existing e-commerce business. However, investors have reason to be excited.

First of all, according to the Trade CarnivalVeterinary Business TodayThe average net profit margin for small veterinary clinics in the U.S. is estimated to be between $10% and $15%. Thanks to these attractive margins, private equity firms have flocked to the industry, spending about $45 billion since 2017 to acquire more than 251 TP3T of veterinary stores in the US.

However - and to make a long story short - many pet owners view these private equity owners negatively, believing that they are more interested in profitability than in the health of their pets. Chewy's favored status in the eyes of consumers should help the company differentiate itself from fierce competition and lead to higher profit margins than the existing retail business.

Moreover, in addition to potentially generating higher profit margins, Chewy's consumer-friendly veterinary clinics could serve as a "top channel" for the company's omni-channel operations. If Chewy's Vet Care clinics expand nationally over the long term, they will have natural up-sell and cross-sell potential for new consumers who come in for a one-time veterinary problem only, but then purchase an autosubscription service when they leave.

4. Chewy's historical low valuation

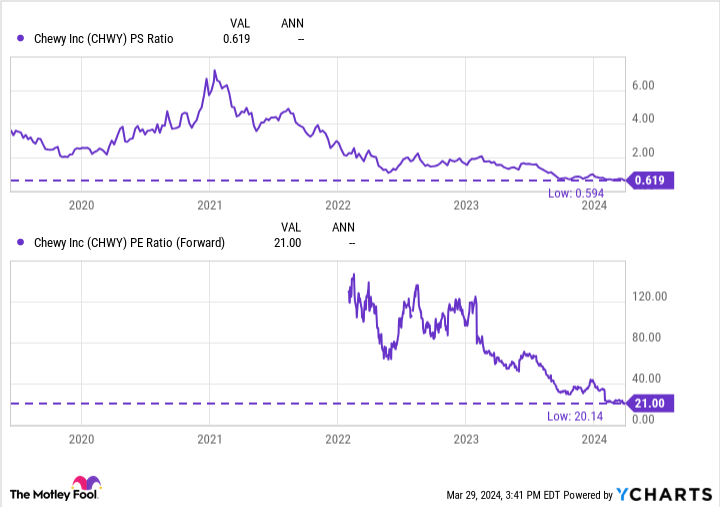

While Koon's 2023 revenues have grown by 10%, Chewy and its valuation are still near historic lows, trading at a price-to-sales (P/S) ratio of approximately 0.6.

Similarly, analysts give the company a forward price-to-earnings ratio of just 21, suggesting they believe Chewy's profitability will continue to improve over the next year. Chewy's operations, driven by a streamlined logistics network and a series of high-margin channel growth points, make me inclined to agree with this view, especially when considering where it will be in 10 years' time.

For these four reasons, I'm happy to keep buying Chewy stock like there's no tomorrow.

Should you invest $1,000 in Chewy now?

Before buying Chewy stock, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Chewy is not one of the 10 stocks listed on ....... The 10 stocks that made the list are poised to generate huge returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 1, 2024

Josh Kohn-Lindquist does not own any of the stocks mentioned above.The Motley Fool holds a recommendation for Chewy.The Motley Fool has a disclosure policy.

No Tomorrow, 4 Reasons to Buy Chewy Stock was originally published by The Motley Fool.