.

Toyota Stock (NYSE:TM): Benefiting from the Electric Vehicle Explosion

In the business world, gaining a first-mover advantage is one of the main focuses. No one talks about the merits of entering the market in second place. However, for Toyota, the traditional automobile giant, the first mover in the market is the best way to enter the market.(NYSE:TM).In other words, not jumping on the bandwagon may end up being a fortuitous move. With the electric-vehicle industry imploding, the automaker looks wise, if not prescient. That's why I'm bullish on Toyota stock, which is carefully approaching the electric-car market.

Toyota Shares Rise as Electric Cars Attack Each Other

Toyota executives probably couldn't have imagined a better situation. Toyota has been slow to make the switch while its major competitors have made a concerted effort to go electric. In fact, the company's former chief executive officer went so far as to say that most automakers are skeptical about pursuing all-electric vehicles.

Now, the Japanese automaker's inertia is paying off handsomely. The Japanese automaker's inertia has paid off handsomely.(NASDAQ:TSLA)The traditional companies that pushed hard for electrification in the face of competition have now begun to scale back or postpone their electric vehicle plans. In addition, Tesla launched a nasty price war last year amid a variety of unfavorable factors that have hurt demand. This undercutting is hurting the entire industry, including Tesla.

The facts are irrefutable. As mentioned earlier, TM's stock price has risen 32% year-to-date, in stark contrast to TSLA's decline of 33%. frankly, Elon Maas resonance's company has been one of the better performers in the pure electric vehicle space.

There are two main reasons why price wars are so helpful for TM stocks. First, any price war centers on a lack of demand. That dynamic is especially strong where Tesla, the leader in the electric car market, is launching a fierce competition. That would be understandable if Tesla were an upstart looking to make a name for itself.

What about Tesla? This company shouldn't be doing this because it has a huge social impact. So something must be very wrong with the entire electric car market.

Second, in theory, a price war should help Tesla eliminate its competitors. But it will also help Toyota. Where the automaker is ready for electrification, it will have less competition to deal with. In the meantime, aggressively low pricing has wreaked havoc on Toyota's mainline competitors, many of whom have jumped in a little too deep.

Toyota's Road to Success: More Than Just an Electric Vehicle Explosion

To be clear, the bullish argument for Toyota stock is not just about Toyota's competitors slugging it out. There's no doubt that it helps, and the company doesn't have to lift a finger to make this mess happen. However, Toyota is not just a beneficiary of the automotive Passover.

Instead, the company has carved out its own path to the top. As TipRanks reporter Kailas Salunkhe noted late last year, Toyota's share price has been rising due to strong global production growth. Of particular note are Toyota's gasoline-electric hybrids. Nearly one-third of all car sales this fiscal year came from hybrids.

Earlier this year.The Wall Street Journal.In the U.S., the mid-range category is reportedly skyrocketing at dealerships, generating huge profits. Koon has even predicted a record net profit of $30.3 billion for the fiscal year ending March as sales of hybrids continue to climb in all major markets.

This boom is in stark contrast to the electric vehicle industry, where in December, Bloomberg reported that electric vehicle inventories in the domestic market were at an all-time high. In addition, car sales have generally slowed as U.S. consumers have been hit by prices. However, Toyota only operates under a different model, making Toyota stock attractive.

Even better, the market may continue to look favorably on Toyota. According to government statistics, about 63% of homes have garages or carports. Logic dictates that a further 37% of homes do not have such facilities, meaning that public charging facilities must be used. However, this could cause serious inconvenience if the popularity of electric vehicles accelerates.

An arguably superior solution is to have an internal combustion powered vehicle with a very high fuel efficiency. This is where Toyota's hybrids come in.

Compelling valuation of TM stock

Currently, Toyota Motor Corp. shares are trading at a price-to-earnings ratio of 10.7x. This compares favorably to the average P/E ratio of 18.9 for automakers.

Happily, however, Toyota's stock price may be lower than it looks on paper. In terms of sales of hybrids, Toyota is one of the few automakers doing well in these challenging times. Moreover, hybrids may not be short-lived. Instead, it may be the standard for mobility until electric vehicles truly become convenient for everyone.

Do analysts think Toyota stock is worth buying?

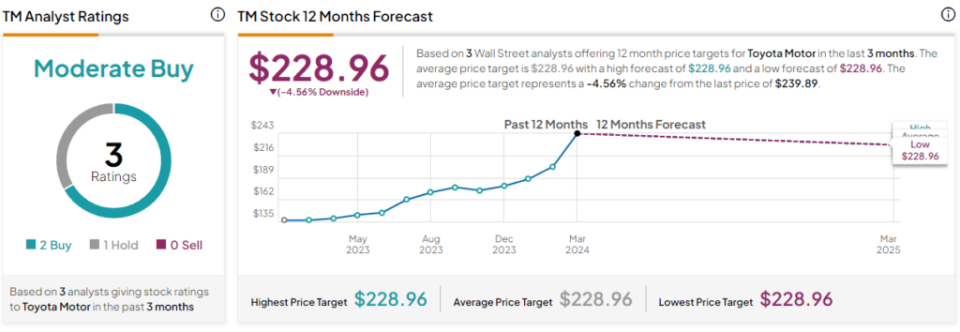

On Wall Street, Toyota stock has a consensus rating of "Moderate Buy" (Moderate Buy) with two "Buy" (Buys), one "Hold " (Hold) and one "Sell" (Sell). Toyota has an average target share price of $228.96, implying a downside risk of 4.6%.

Revealed: TM stock is the hidden gem of the automotive industry

While Toyota has been slow to adopt electrification technology, that slowness seems to be working in the company's favor. Toyota's main competitors have scaled back their electric vehicle ambitions as the industry faces tough demand challenges. What's more, sales of hybrids have remained high, making Toyota's stock a "hidden gem" in the auto industry.

Disclosure of information