.

4 Reasons to Buy Meta Platforms Stock Like There's No Tomorrow

Before you buy a stock, it's a smart idea to list the top reasons for buying it. First, it allows you to go back over your notes and learn from your decisions - whether they were right or wrong. Second, it helps organize your thoughts and gives you things to look for in your quarterly reports. While the reasons for buying or holding a stock may change over time, it's always wise to keep this list up to date.

For me.Meta Platforms (NASDAQ resonance stock code: META)Right now it looks like a great stock to buy. Here's my list of four reasons you should buy Meta stock like there's no tomorrow.

1. Strong Core Business

There's no doubt that Meta Platforms' core business of social media platforms is very stable, and Meta has a firm grip on this area through its Facebook, Instagram, WhatsApp, Threads and Messenger platforms.

While your presence on these sites may vary, the number of daily household actives - people who use at least one of Meta's products every day - reached a record high of 3.19 billion in the fourth quarter. Nearly half of the world's estimated 8 billion people are Meta platform users. That's an amazing statistic.

Meta's products are so broad that it's hard to imagine the company struggling. Its wide diversity and large audience means that if Meta were to fail, it would affect the entire world. As a result, I'm confident in Meta's long-term growth, as the chances of a downturn are relatively low.

2. The Meta Platform Reinvents the Growth Enhancement Model

In addition to Meta's growing number of users, it's also seeing decent growth in sales and profits. The ad market was soft for a while in late 2022 and early 2023, but has since rebounded. It's important to understand this because the majority of Meta's revenue comes from the ads you see on its various platforms.

In the fourth quarter, Meta's advertising revenues increased to $38.7 billion, up 24% year-over-year. this was not just in one region, but strong revenue growth was seen everywhere.

|

District |

Fourth quarter revenue |

Year-on-year revenue growth |

|---|---|---|

|

United States and Canada |

17.78 billion dollars |

19% |

|

Europe |

US$9.16 billion |

33% |

|

Asia Pacific |

US$7.32 billion |

23% |

|

Rest of the World |

US$4.45 billion |

32% |

Data source: Meta Platforms: Meta Platforms. table written by author, YOY = year-on-year.

In the prior year, Meta's earnings were not optimistic due to lower advertising sales, which also weighed on revenues. As a result of strong advertising sales, increased revenues and stabilized expenses, Meta Platforms achieved its best operating margin since 2021.

Meta is succeeding as a business, with Wall Street analysts projecting growth of 17% by 2024, which is a good sign that its growth should continue.

3. Meta's share price is not overpriced.

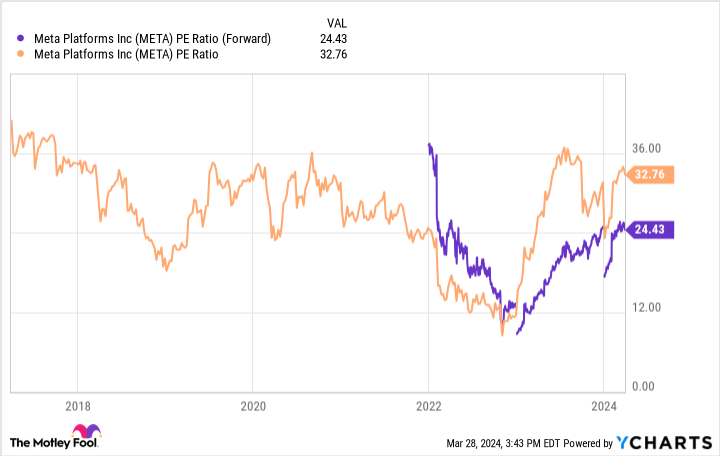

Some stocks are overvalued in the market today, but not Meta. At 24 times forward earnings, it's not cheap, but it's not expensive either.

Aside from the trough in 2022, when Meta's profits plummeted due to its relentless investment in the Reality Labs division amidst a downturn in the ad market, Meta's trailing P/E has remained in the mid-20s.

This means that if Meta meets the earnings estimates set by Wall Street within a year, then its stock will be undervalued based on historical data. That's a good position to be in, and another reason why I want to buy this stock.

4. Artificial Intelligence for Development

The last thing to discuss is the Meta Platform's Reality Room division. This department is responsible for realizing its metaverse, virtual reality, and augmented reality aspirations. While some of the uses of these technologies are a bit gimmicky, when combined with powerful generative AI, they can become must-haves.

For example, Meta has been developing Ego AI, which is essentially an artificial intelligence for how to accomplish tasks like tennis, cooking or painting. This technology will interact with augmented reality glasses and change the way we learn new tasks. While this product may be years or decades away, it will undoubtedly be a hit when it comes out.

Since Meta stock is essentially valued solely on its advertising business, any new AI technology Meta develops will be the icing on the cake. All of these reasons combine to convince me that Meta Platforms is a great buy now.

Should you invest $1,000 in Meta Platforms now?

Before buying shares of Meta Platforms, consider the following:

Motley Fool Stock AdvisorThe analyst team has just selected what they believe is the current trend of-est (superlative suffix)Worth investing in10Meta Platforms is not one of the 10 stocks listed on ....... The 10 stocks selected are expected to generate strong returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View these 10 stocks

*Stock Advisor's Report for the Period Ending April 1, 2024

Randi Zuckerberg, former Facebook Market Development Mass Director and Spokeswoman, and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's Board of Directors. Keithen Drury works at Meta Platforms. Keithen Drury serves on the board of directors of Meta Platforms, and The Motley Fool owns shares of Meta Platforms and recommends Meta Platforms with his wife, who has a disclosure policy.

4 Reasons to Buy Meta Platforms Stock Like There's No Tomorrow was originally published by The Motley Fool.