.

XLE ETF: Energy Stocks Are Booming Again

Don't look now, the energy sector is heating up again with the Energy Select Sector SPDR Fund.(NYSEARCA:XLE)) has quietly risen 16% so far this year, breaking a new 52-week high.

I am bullish on XLE based on the momentum of the energy sector, its portfolio of highly rated energy stocks, and the relatively cheap valuation of these holdings (even given the strong performance in 2024.) I am also bullish on XLE because of its cost-effective expense ratio and 3% dividend yield.

A Favorable Layout for Energy Prices?

Currently, crude oil prices have crept up 18.6% so far this year, boosting energy stocks that extract, refine and sell the commodity. Many analysts believe there could be more room for oil prices to rise. Russia is cutting production, which will reduce supply.

Meanwhile, Goldman Sachs(NYSE:GS)Analysts at the U.S. Department of Energy (DOE) expect commodities, including oil, to see strong gains during 2024 based on lower interest rates, a resurgent manufacturing sector, and continued geopolitical risk.

Goldman Sachs analysts 竝 not alone, Goldman Sachs former commodities research instruciton, now working for the Carlyle Group Jeff Currie (Jeff Currie) also believes that this is a favorable layout for oil prices. Currie believes that if the Fed cuts interest rates in the next few months, oil prices could be "well above" the normal level of 70-90 U.S. dollars per barrel.

In addition to the Fed's machinations, Currie pointed to other factors such as China's beginning to ramp up manufacturing and Europe's efforts to rebuild its energy reserves as further catalysts, telling Bloomberg Telegraph, "I'd like to be long oil and other commodity composites in this environment," and "there's there's a lot of upside."

XLE's strategy

XLE invests in an index that, according to the Fund, is "designed to be a good representation" of the S&P 500 Index(SPX)) in the "energy sector. "XLE's goal is to allow investors to "accurately invest in companies in the oil, gas and consumable fuels, energy equipment and services industries."

Investors can use XLE to "take more targeted strategies or tactical positions than traditional style investing."

Launched in 1998, it is currently the largest and most popular energy-themed ETF in the market, with US$39.3 billion in managed assets, and is the next largest competitor to the Vanguard Energy ETF.(NYSEARCA:VDE)The latter is nearly four times the size of the previous year's Goup Assets, which amounted to US$8.7 billion.

Top holdings that are highly regarded

XLE holds only 24 stocks. Its top ten holdings account for 76.2% of the Portfolio, of which resonamobil(NYSE:XOM)(and Snowdragon)(NYSE:CVX)It's not a very diversified ETF, though as a bet on U.S. energy stocks, it gets the job done and is a good representation of the sector.

Below are the top 10 holdings of XLE as viewed using the TipRanks holdings tool.

In addition, while XLE's holdings are not highly diversified, some of them have very high Smart Scores.

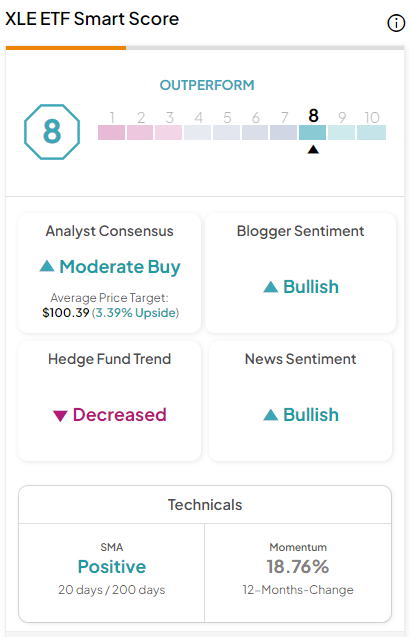

Smart Score is TipRanks proprietary quantitative stock rating system. It rates stocks on a scale of 1 to 10 based on eight key market factors, where a score of 8 or higher is considered an "Outperform" rating.

Six of XLE's top 10 holdings have "Outperform Big Pan" equivalent smart scores of 8 or higher. Chevron tops the list with a "perfect 10" rating, while Eversheds Mobil, Phillips66(NYSE:PSX), Marathon Oil (NYSE.MPC) and Williams Companies(NYSE:WMB) have all achieved an impressive smart score of 9 out of 10.

XLE itself has an Outperform Daban ETF Smart Score of 8 out of 10.

While these holdings score highly on the Intelligent Scoring System and are well-positioned for 2024, they remain undervalued in most cases. In fact, as of April 2, the fund's average price-to-earnings (P/E) ratio was just 13.6x, a significant discount to the S&P 500, which is currently trading at an average P/E of 23.6x.

XLE's top holding, ExxonMobil, is trading at a consensus 2024 earnings estimate of just 13 times, while the second largest holding, Chevron, is trading at a consensus 2024 earnings estimate of just 12.5 times.

While energy stocks have performed well so far this year, they remain attractively valued and there is little indication that they have been tapped out from a valuation perspective.

XLE Dividends are attractive and reliable

Energy stocks have long been known for their durable and above-average dividends, so it's no surprise that XLE pays a dividend. The ETF's current yield is 3%, which has been higher in the past but has fallen as ETF prices have risen, which most holders will be happy with. Moreover, while 3%'s yield may not be impressive, it's still more than twice the yield of the S&P 500. XLE has also been a very consistent performer, having paid a dividend for 24 consecutive years.

What is the utilization rate of XLE?

XLE's fee rate of just 0.09% is super cheap. 0.09% means that if an investor puts $10,000 into XLE, they will only have to pay $9 in fees over the course of a year.

Assuming that XLE maintains the same fee rate as before, and returns 5% per year, this investor would only pay $115 over a 10 year period, making XLE a very cost effective ETF.

Do analysts think XLE is a stock to buy?

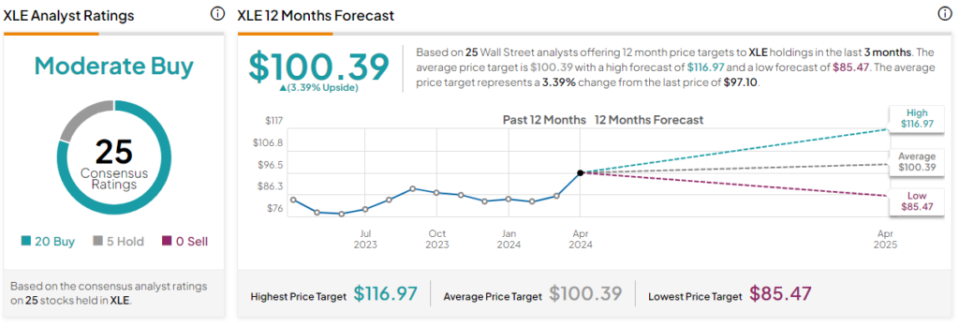

On Wall Street, XLE has received a consensus rating of "Moderate Buy" based on 20 Buy, 5 Hold, and 0 Sell ratings given over the last three months.The average price target for XLE stock is $101.57, implying an upside potential of 6.2%.

Investor Activation

XLE got off to a great start in 2024, and there's a lot to be bullish about going forward. I'm bullish on this popular energy ETF because of the potentially favorable environment for oil prices, XLE's cluster of highly rated energy stocks with strong smart ratings, the relatively cheap valuation of these holdings, and the attractive dividend yield of XLE 3%. XLE's favorable expense ratio also makes it a great way to invest in the sector.

Disclosure of information