.

Realty Income is the king of the $13.9 trillion market opportunity. Is it time to buy this stock?

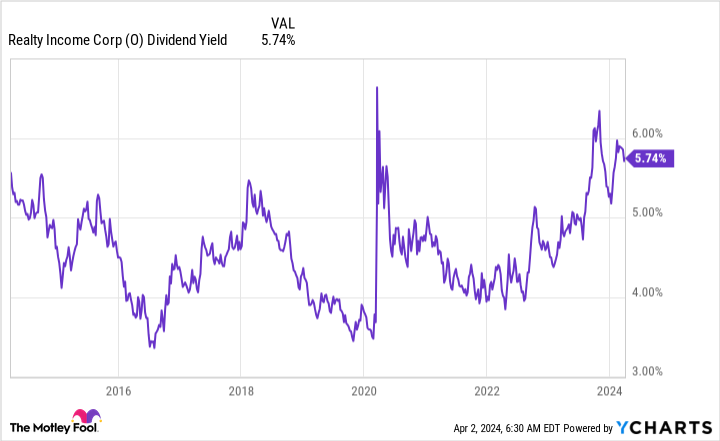

It's been a tough time for real estate, but now it could mean opportunity. Consider one of the giants of the industry:Realty Income (NYSE: O)The company's dividend yield is close to a 10-year high. Its dividend yield of around 5.7% is near a 10-year high, suggesting that this industry-leading real estate investment trust (REIT) is selling like hotcakes.

That's good news for investors, because Koon estimates that there's still a huge growth opportunity ahead. Here's what that opportunity looks like, and why the outlook for Realty Income remains bright despite being the 800-pound gorilla of the net lease REIT industry.

How big is Real Estate Income, Inc.

For the naysayers, Realty Income will not be a fast-growing REIT. In fact, the company has not been a fast-growth REIT for a long time, with management focusing on a conservative approach that favors stability over growth. It's worth noting that the company has trademarked the nickname "Monthly Dividend Company". This not only illustrates the frequency of the company's dividends, but also highlights the importance of dividends. Aggressive growth is not the goal here.

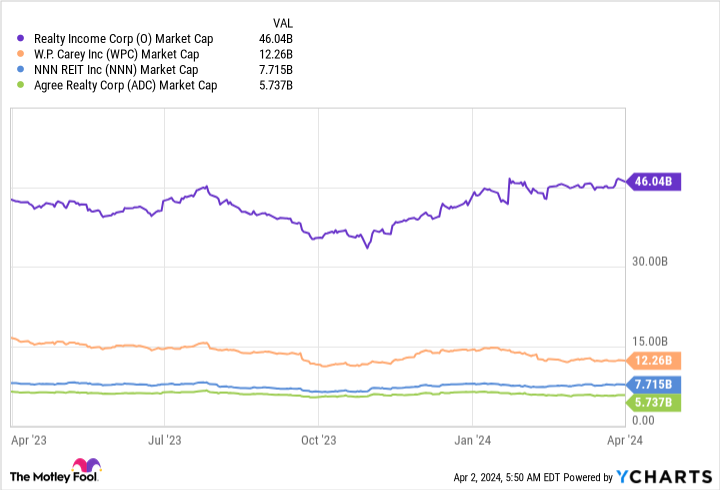

That said, with a market capitalization of about $46 billion, Realty Income has struggled to grow as fast as its smaller peers. To illustrate, Realty Income's second-biggest competitor in the net leasing space, $12 billion market capitalizationW.P. Carey (New York Stock Exchange: WPC)The Company's business model is less than one-third of the Company's. The net lease requires the tenant to pay the majority of the operating expenses of the property. Net leases require tenants to pay the majority of the property's operating expenses. In short, Realty Income needs to work harder to succeed than its smaller peers.

However, conservative dividend investors looking for a high yield from a reliable industry leader will like the products of Realty Income, Inc. It's worth noting that the REIT's assets and liabilities are rated investment grade, and the dividend has increased annually for 29 consecutive years. Yes, the average rate of dividend growth over this nearly three-decade period has only been about 4.31 TP3T. But that's more than enough to keep up with the historical rate of inflation growth, which means that the purchasing power of Realty Income dividends has increased over time.

What are the future opportunities?

These figures tell the story of what has happened, not what will happen in the future. The risk is that Realty Income has become so large that there are not enough new properties to buy. Koon is confident that there is enough room to continue to expand the portfolio in the future.

First of all, Realty Income's model is strong enough to be a name in the industry, such as its recent acquisition of Spirit Realty and its acquisition of VEREIT just a few years ago. For example, it recently acquired Spirit Realty, and just a few years ago it acquired VEREIT. You can't predict when Realty Income will acquire a competitor, but it offers a non-organic growth path that can't be ignored.

The majority of our peers operate in the single-tenant retail sector in the United States. Net leasing in this segment is approximately $1.5 trillion. Despite this, the REIT has identified consumer-focused spa properties as a separate group, which represents approximately a $1.1 trillion opportunity. Most retail-focused net lease REITs are likely to invest in both areas, making their opportunity set approximately $2.6 trillion.

What is interesting about Realty Income, however, is that its business extends beyond the retail sector to include a number of other niche markets. It sees a $2 trillion opportunity in the industrial sector in the future. This has long been part of the REIT business, but it is always looking for new niches to add to its long-term growth opportunities.

For example, it sees existing data centers as a new addition to the portfolio that will bring $500 billion in business opportunities. This includes both existing data centers ($100 billion opportunity) and new data centers ($400 billion opportunity). Gaming is also a relatively new part of the portfolio, adding another $300 billion to the U.S. opportunity set. The total amount of addressable market opportunity in the U.S. is approximately $5.4 trillion. For a company with a market capitalization of $46 billion, there is a lot of room for growth in the US.

However, Realty Income is not just focused on the US market, it is also investing in Europe. Net leasing is not as prevalent in Europe, so there are greater opportunities for growth. The UK alone has a $2.6 trillion market. The rest of Europe has a market of $5.9 trillion and the total opportunity in Europe is about $8.5 trillion. Only one major U.S. counterpart, W.P. Carey, operates in Europe.

Taking the US and Europe together, the total market opportunity is US$13.9 trillion. For a company with a market capitalization of $46 billion, this seems like plenty of room to find more properties to add to its portfolio.

Slow and steady, but far from exhausted.

One of the major accusations against Realty Income is that the company's size is a limiting factor in its growth. This is true, because in order to develop a larger REIT, more properties need to be acquired. But that doesn't mean that Realty Income can't grow. It just means that growth may be slow and steady - which is exactly the way management likes to run things. If you're a conservative income investor, Realty Income's 5.7% dividend yield is historically attractive and worth a look today.

Should you invest $1,000 in Realty Income now?

Before buying Realty Income stock, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Only ...... and Realty Income were not included. The 10 stocks that made the list could generate huge returns in the coming years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 1, 2024

Reuben Gregg Brewer has a position in Realty Income.The Motley Fool holds a recommendation for Realty Income.The Motley Fool recommends W. P. Carey.The Motley Fool has a disclosure policy.

Realty Income is the king of the $13.9 trillion market opportunity. Is it time to buy this stock?