.

1 Growth stock worth buying now down to 65% only

It is said that necessity is the mother of invention. This is not always the case - but it is a valid point of view. TakeToast (NYSE: TOST)Pre-authorization, for example. Studio doesn't absolutely need its software to manage complex business. But the tools it provides can certainly help them - and many restaurants recognize that. As a result, Toast's revenue is expected to continue its growth momentum this year, reaching 25%.

So, if the company's software is so good, why is the stock down 65% from its 2021 peak for reasons veteran investors know. In fact, it's the same reason why many sophisticated investors are looking at this weakness as a buying opportunity - Toast is facing temporary headwinds.

Toast, up close and personal.

Managing a pre-primary school can be a real headache because there are so many moving parts. The kitchen, the staff, the supplies, the food (and by the way, the shelf life), the processing of payments, the inspections, the payroll, the advertising, and so on. It's just too much.

Toast makes it easier to stay on top of all the details. Although Toast is often categorized as a point-of-sale solution, it's much more than that. It helps preceptors take food orders, process payments, schedule and pay employees, cultivate customer lists, improve kitchen efficiency, and even process online orders-all on one integrated platform. More than 100,000 studios are currently using Toast's complete system.

But the question remains: why did the stock fall so much?

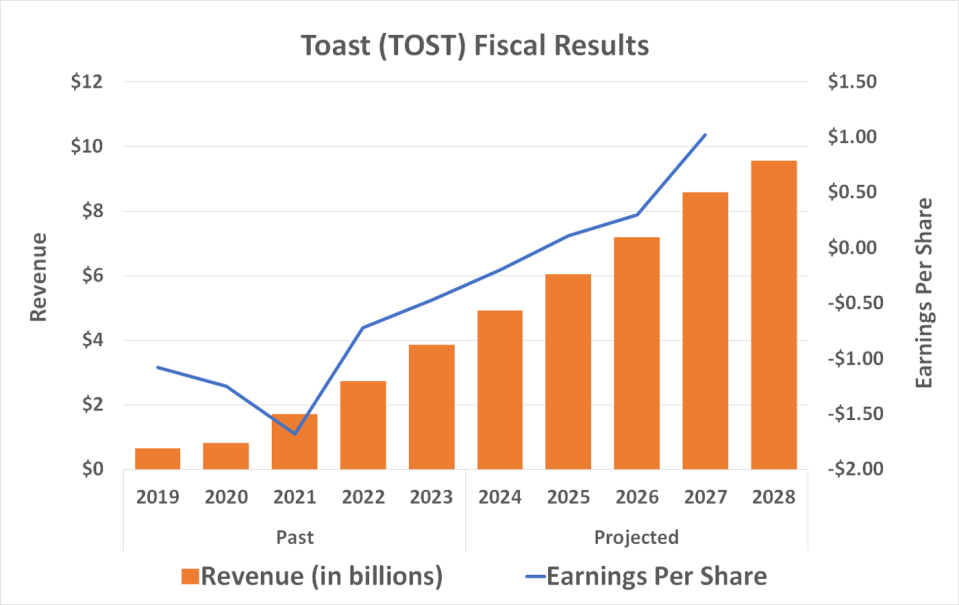

Toast was founded in 2011. But as you can imagine, the COVID-19 pandemic made it famous. Consumers suddenly started ordering online, looking for contactless ways to pick up and pay for their meals, and the studios were forced to cater to the overwhelming demand. The end result? Its sales soared from $823 million in 2020 to $1.7 billion in 2021. Since then, its sales have doubled again.

Like many other companies, Toast took advantage of the unique circumstances of a pandemic to raise capital for its September 2021 IPO. Shortly thereafter, the newly issued stock experienced several bullish erosions. However, as 2021 rolled into 2022, the health crisis was winding down. People started to pull out again and lost interest.

They have especially lost interest in expensive stocks like Toast stock. In retrospect, its sharp correction is not surprising. However, sellers have arguably exceeded their targets.

Reasons to be bullish on Toast stock

Toast's stock price is still expensive, and the company is still unprofitable, which makes a meaningful valuation of its stock even more difficult. The company is also still unprofitable, which makes it even more difficult to meaningfully value its stock. However, as long as you can make quantitative and qualitative judgments about Toast, there are reasons to be strongly bullish on it.

Chief among the bullish reasons is that revenue growth - past and projected - is driving the company to profitability. While Toast will likely remain in the red this year, analysts expect it to post earnings of $0.11 per share next year. At that point, the party really begins.

In addition, Toast has a competitive advantage in the large and ever-changing restaurant industry. Other companies also offer cloud computing software for the restaurant industry.PayPal(math.) andBlock Resonance) are some of the more familiar companies that provide products for the曏 catering industry.

However, neither of these industry giants started their platforms as a service for restaurateurs. Toast did. It's conceivably the only management tool a restaurant will ever need to use, as its integrated platform handles everything from customer payments, to inventory management, to payroll, to ordering. Restaurant owners can attest to the fact that anything that makes their jobs easier and faster is worth the money these days.

There are many opportunities for even greater growth. While Toast already has 106,000 customers, that's only a fraction of the approximately 700,000 restaurants in the United States. And that's just in the U.S. Toast is not limited by borders.

Of course, not all of these studios and locations are Toast customers. After all, restaurants likeMcDonald'sSuch large chains are more likely to customize their own point-of-sale solutions rather than buy off-the-shelf products. On the other hand, the National Restaurant Association reports that seven out of every 10 restaurants in the United States are single-store operations.

These restaurant owners can't afford to develop their own software. They are looking for a turnkey solution like Toast. Research firm Spherical Insights believes that with such a platform, and with affordable carries, the global restaurant POS market will grow at an average annual rate of nearly 10% by 2032. This outlook coincides with a similar forecast by Global Market Insights.

Toast is well positioned to capture a greater share of this growth.

look at sth. in perspective

This is a compelling prospect; Toast is launching the right product in the right place at the right time. And, while its share price is down 65% from its post-IPO high in 2021, it has actually seen no (net) decline since early 2022. This is a subtle hint that potential buyers may be waiting for the stock to begin a sustained bull run before making a move.

But you probably know how it works - once any rally starts, investors on the sidelines are already at a disadvantage. The best time to take action is before most other investors start to think about it. Just don't overdo it. While this stock has above-average return potential, it also has above-average risk and volatility. Position yourself accordingly.

Should you invest $1,000 in Toast now?

Before buying Toast stock, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10One stock, ......Toast, was not included. The 10 stocks that made the list will generate huge returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 1, 2024

James Brumley does not own any of the stocks mentioned above.The Motley Fool owns �Block�, �PayPal�, and �Toast�.The Motley Fool recommends the following options:� PayPal March 2024 $67.50 Call Option Short.The Motley Fool has a disclosure policy.

1 Growth Stocks Only Down 65% Now Worth Buying was originally published by The Motley Fool.