.

Wells Fargo Thinks It's "Time to Buy" These Two Stocks

With a full quarter of 2024 behind us, it is clear that we are in the midst of another bull market, similar to last year's. The market bottomed in October 2023 and the S&P 500 has rallied 24.51 TP3T since then. The market bottomed out in October 2023, and since then the S&P 500 has risen 24.5% and the NASDAQ Resonance Index has bounced back 29%, and year-to-date the two indices are up 9% and 10%, respectively.

Moreover, while last year's rally relied heavily on a narrow base of mega-cap tech companies, this year's rally is built on a broader base, providing investors with a wider range of investment options. Professional stock analysts have also noticed this, and are not shy about labeling the second half of this year a "buy."

With that in mind, we've dug up details on two stocks that analysts at financial giant Wells Fargo are bullish on. They recently upgraded their ratings on these two companies - in other words, "it's time to buy". Looking at the TipRanks database, we can see that these stocks already have a "buy" rating, with double-digit upside, and Wells Fargo's view is that these stocks could rise as much as about 60%. The details are as follows

GoodRx Holdings(GDRX)

GoodRx, the first company on Wells Fargo's list, combines pharmacy services with online technology and the growing telemedicine industry to create a package deal designed to simplify prescription drug delivery. The company's headquarters is located in Santa Monica, California, and has been in business since 2011, operating on the basis of a key insight into the healthcare consumer: better informed consumers make better consumer decisions, which leads to better healthcare outcomes.

With this in mind, GoodRx now provides users with the information they need, including pricing transparency and affordable solutions, and is based on the convenience of remote medical consultations. As a result, GoodRx is a patient-driven online pharmacy that promotes greater medication adherence and faster treatment options, resulting in better outcomes for patients.

GoodRx's main service is to provide prescription drugs at discounted prices. Patients can consult with曏 doctors and pharmacists, use e-coupons, and choose generic equivalents. The system is optimized to ensure that each patient receives the correct prescription and can easily dispense the correct medication according to the correct instructions. This service is available directly through the company's website, where users can also find informative articles from medical experts to add to the prescription service.

By the numbers, GoodRx has built a huge business. The company offers more than 200 billion pricing points per day, and it is estimated that 80% of its transactions are round-trippers-an indication of how satisfied its customers are with the company. In total, GoodRx estimates that it has saved its customers about $60 billion over the years.

Turning to industry merit, we found that GoodRx realized $196.6 million in operating income in 4Q23, which was slightly higher than expectations by $0.73 million and up nearly 7% year-over-year.Earnings per share ($0.06) came in 1 cent below expectations.

In assessing the company's outlook, Wells Fargo analyst Stan Berenshteyn believes GoodRx is well positioned to outperform. An analysis of the strategic pivots over the past two years suggests that there may be growth headwinds, but revenue visibility (and downside risk) appears to have improved materially," he wrote. We believe that this will enable GoodRx to achieve merit growth in 2024 and meet consensus expectations in 2025. We expect this dynamic to help GDRX close the valuation gap with its peers, which in turn will allow the stock to realize meaningful excess returns over the next 12 months.

As a result, the analyst recently upgraded GDRX from Equal Weight (Neutral) to Hold (Buy), and his $10 price target (up from $7.5) suggests a one-year upside of 49%. (To view Berenshteyn's track record, click here).

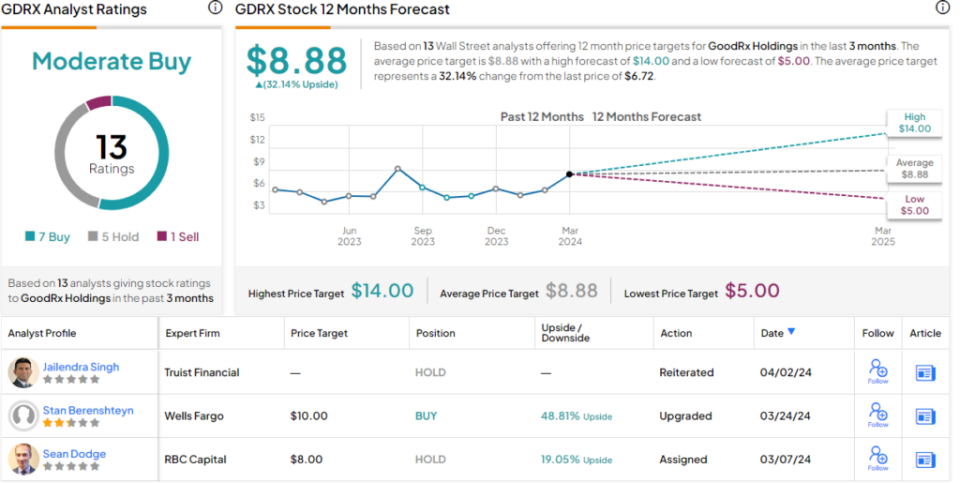

The stock recently had 13 analyst reviews, of which 7 were "Buy", 5 were "Hold" and 1 was "Sell", with a consensus rating of "Moderate The stock has a consensus rating of "Buy". The stock is currently trading at $6.72 with an average price target of $8.88, suggesting upside potential for 32% over the next year. (Read.GoodRx's Stock Forecast).

NeuroPace(NPCE)

Next is NeuroPace, another California company in the therapeutic field, which specializes in the treatment of epilepsy. The company has developed the RNS system, a therapeutic device that detects and prevents seizures without the need for medication. This is an important advance, as some types of epilepsy are known to be drug-resistant.

NeuroPace's system works directly on the brain to monitor and record EEG activity for neurostimulation during seizures. Because the device also records EEG data, patients and physicians can fine-tune the stimulation to better monitor the rate and frequency of seizure activity. Patients using the device have reported a significant reduction in seizure activity, with 1 in 5 patients reported as "seizure free" at their last screening.

Since the second half of 2022, the company's revenues have been on an almost continuous upward trend. In the last quarter of the year, 4Q23, revenues reached $18.0 million, up 41% from $12.8 million in 4Q22. Earnings per share were 23 cents lower than expected, 8 cents better than expected. For the full year of 2024, the company expects revenues in the range of $73.0 million to $77.0 million, compared to $65.4 million in 2023. For the full year 2024, the company expects revenue of $73 million to $77 million, compared to $65.4 million in 2023.

However, Wells Fargo's Vik Chopra believes the company may be playing it safe." Chopra said, "Our analysis suggests that there may be room for upward mobility in the 2024 and beyond numbers as NPCE expands access to RNS outside of Tier 4 CECs." We don't think that Koon has taken into account the meaningful growth from project CARE in the 2024 guidance, so we see potential for upward adjustments ...... We like the NPCE's expansion into CEC settings and don't think that the opportunity for project CARE has been priced in.

As a sign of his confidence, Chopra has rated the company a HOLD (BUY - upgraded last month), with a target price of $20, implying a 62% upside in one year (for more information on Chopra's track record, please click here). (To see Chopra's track record, click here).

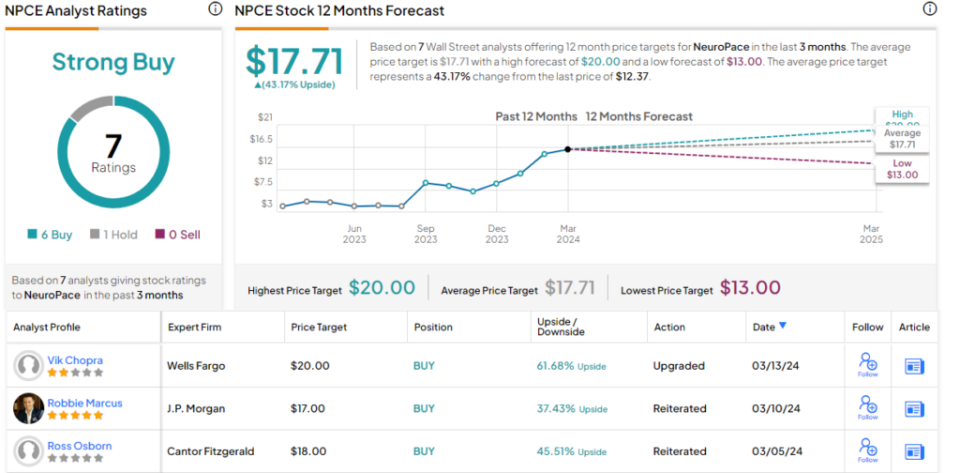

The market generally views this as a stock worth buying; the "Strong Buy" consensus rating is based on seven recent reviews, six of which are "Buy" and one of which is a "Hold." The average price target for the company's stock is $17.71, suggesting a 43% increase in the stock's price within one year from the current $12.37. (Check out theNeuroPace's Stock Forecast).

To find stocks with attractive valuations, visit TipRanks' Best Stocks to Buy, a tool that carries all of TipRanks' stock quotes.

Disclaimer: This article represents the views of the contributing analysts. The contents are for informational purposes only. It is important to conduct your own analysis before making any investment.