.

HOOD vs. SCHW: Which Brokerage Stock is Better?

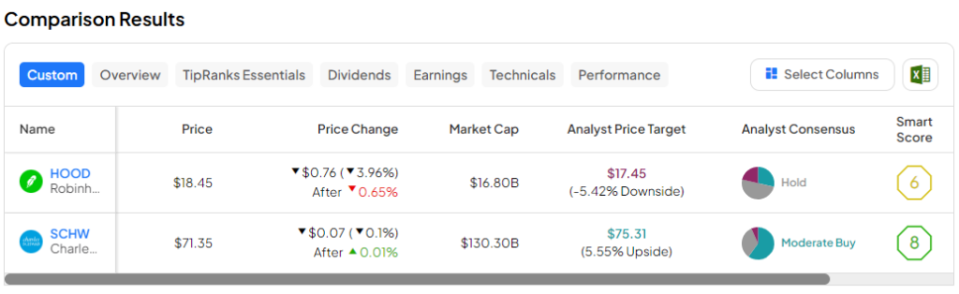

In this post, I use TipRanks' comparison tool to compare Robinhood Markets(NASDAQ resonance code: HOOD)) and Charles Schwab(New York Stock Exchange: SCHW)The two brokerage stocks are evaluated to see which is better or worse. A closer look reveals that Robinhood has a "bearish" rating, while Schwab has a "neutral" rating.

Robinhood Markets operates a proprietary financial services platform that supports stock trading, including fractional shares and cryptocurrencies. The platform also provides other financial services such as dividend reinvestment and initial public offerings.

Meanwhile, Charles Schwab is a savings and loan holding company that provides wealth management, securities brokerage, banking, asset management, trusteeship and financial advisory services.

Shares of Robinhood Markets have surged 51% year-to-date and 97% over the last year, while shares of Charles Schwab have risen just 4% year-to-date and 48% over the last year.

Since HOOD stock has risen much faster than SCHW stock, it is not surprising that there is a huge gap between the two valuations. Although Robinhood management said in its fourth-quarter report that it expects 2024 to be the first year of annual profitability, the company is currently not profitable.

Therefore, we will compare the price-to-sales (P/S) ratios of the two companies to gauge the valuation of the two companies and their industry valuations. We will also examine Schwab's price-to-earnings (P/E) ratio. In comparison, the Diversified Financials industry has a P/E of 17.1x compared to its three-year average of 30.8x, and a P/S of 3.8 compared to its three-year average of 2.7x.

Robinhood Markets (NASDAQ: HOOD)

Robinhood Markets trades at a P/E of 8.7x, a huge premium to its peers and Schwab. With the stock weekly near overbought territory, heavy insider selling, and a large sell-off by a high-profile bull, bearishness seems appropriate at this point.

First, while Robinhood shares have risen 1,06% in the past year, most of that increase has come since early February, when the stock soared from around $11 to nearly $20 per share in about two months. This rocket ship initially pushed the stock into overbought territory. However, as the stock price has fallen over the past few days, Robinhood's Relative Strength Index has slightly reversed and is now slightly above 70 (>70 is the threshold for overbought territory).

The recent drop has drawn attention to some signs of profit-taking in Robinhood stock. Cathie Wood, a longtime cryptocurrency bull, has recently begun to sell off a significant amount of Robinhood stock through her firm, ARK Invest. On March 25, the firm sold 1.6 million shares from three funds, according to a trade notification.

Of these, 1.25 million shares were from the ARK Innovation ETF.(NYSEARCA:ARKK)The latest sell-off is the largest since the company began increasing its stake in Robinhood last year.) This latest sell-off is the biggest since the company began increasing its stake in Robinhood last year, and the timing of it could mean some profit-taking, as it comes after the stock nearly doubled in price in just two months.

Insiders have also been selling Robinhood shares, and the increasing number of automatic sell trades over the past two months also suggests that they may be taking profits. However, given its high valuation and the sharp rise in price in such a short period of time, the stock would have to fall significantly from its previous levels before I would consider a more constructive view.

Moreover, Robinhood's direct exposure to cryptocurrencies could become an issue if or when the cryptocurrency market becomes volatile again. A key question is whether Robinhood will be able to continue on its path to profitability if the cryptocurrency trading market bottoms out.

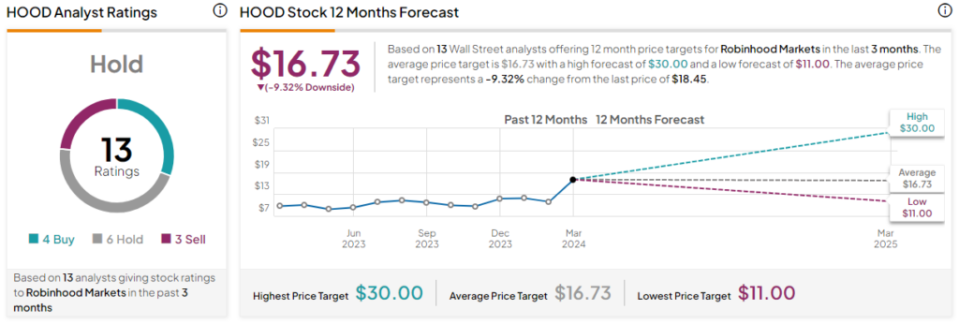

What is the target price for HOOD stock?

Robinhood Markets has given the stock a consensus rating of 4 Buy, 6 Hold and 3 Sell over the last three months.Robinhood Markets has an average target price of $16.73, implying a downside of 9.3%.

Charles Schwab (NYSE:SCHW)

Charles Schwab trades at a price-to-earnings (P/E) ratio of ~27.5x and a price-to-savings (P/S) ratio of ~7x, which is at a substantial premium to current valuations in the peer group, but slightly below the peer group's three-year average P/E ratio. Charles Schwab is not as overbought as Robinhood, but it's teetering on the edge of overbought, and it's starting to reverse. However, I'd like to see the stock drop a bit more before taking a constructive view on the company's stock. Therefore, a neutral view seems appropriate.

Currently, Schwab's daily and weekly RSIs are around 65, and earlier this week the daily RSI was over 70. Earlier this week, the RSI on the daily chart went above 70, a change that suggests the correction I've been waiting for may have just begun.

Although Schwab insiders have also been selling shares recently, Schwab's share price has risen much faster than Robinhood's. In fact, as Schwab's share price has risen from around $68 to $72, there has been a marked shift from automatic buy trades a month ago to mostly automatic sell trades less than a month ago. In fact, as Schwab's share price has risen from roughly $68 to $72, there has been a noticeable shift from automated buy trades a month ago to mostly automated sell trades less than a month ago.

However, in the last two weeks, insiders have made several informational buying trades as they fully exercised their options to validate the stock. This suggests that insiders like where the company is right now, which is a bullish sign for Charles Schwab in the long run. In fact, the company recently set a goal of 5% to 6% sequential revenue growth in the first quarter, which is a great sign.

In addition, Charles Schwab's long-term yield of 72% over the past 5 years and 213% over the past 10 years is further evidence that the stock is a great buy-and-hold candidate. However, as we have just seen the beginning of what we expect to be a positive correction in the stock after reaching overbought territory, I would probably wait to see if Schwab's stock falls to a more attractive price.

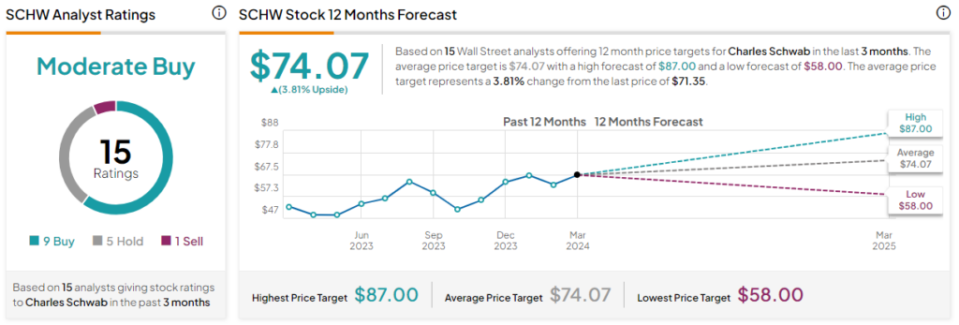

What is the target price for SCHW stock?

Over the past three months, Charles Schwab has received 9 "Buy", 5 "Hold" and 1 "Sell" consensus ratings. charles schwab stock has an The average price target for Charles Schwab stock is $74.07, implying an upside of 3.8%.

Conclusion: Bearish on HOOD, Neutral on SCHW

With Robinhood and Charles Schwab's share prices starting to fall out of overbought territory after significant profit taking, it looks like the correction that is usually expected when a stock is overbought has begun. However, in terms of insider trading, long-term and short-term price action, and the potential for steady price gains, Schwab is the winner of the pair, while Robinhood is less volatile.

On the other hand, Robinhood could see some positive catalysts as it moves toward profitability in 2024. Regardless, the stock is essentially perfectly priced at current share price levels, so any temporary wobble on the path to achieving this year's promised earnings target could trigger a nasty sell-off.

In fact, Robinhood's direct exposure to cryptocurrency trading could become an issue if there is another major cryptocurrency sell-off. So it's good news for Schwab's shareholders that the company doesn't allow cryptocurrency trading.

Disclosure of information