.

In a few years, you'll regret buying a high-growth stock.

Many investors find it difficult to buy a stock after it has moved significantly higher.INVISTA (NASDAQ: NVDA)This is certainly the case. Since the beginning of 2023, its stock price has risen a staggering 515%.

This is due to the explosive growth of its data center business with the advent and development of artificial intelligence (AI). Generative AI applications continue to roll out, and Nvidia is a leading provider of the high-performance computing power platforms they require.

INVISTA's Sales Explode

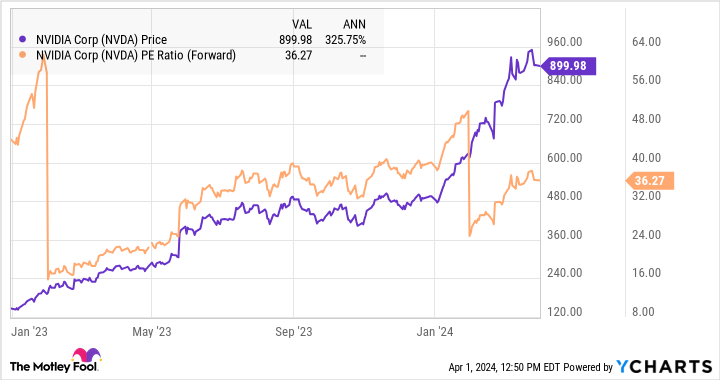

Nvidia's stock price is moving up at a breakneck pace as revenue from its data center division is growing at a rapid pace. In the fourth quarter of Nvidia's fiscal year 2024, which ended Jan. 28, the data center division generated $18.4 billion in revenue. That compares with $15 billion in revenue for the full year of fiscal 2023. It's no surprise, then, that the company's stock price has skyrocketed as well.

The sharp rise in the stock price has some investors wondering if they've missed the boat and if it's too late to buy Nvidia stock. But those sales have also translated into profits. Earnings per share (EPS) after dilution in the most recent quarter soared 7,65% year-over-year, and there's reason to believe there's more to come.

Beyond "Magnificent Seven"

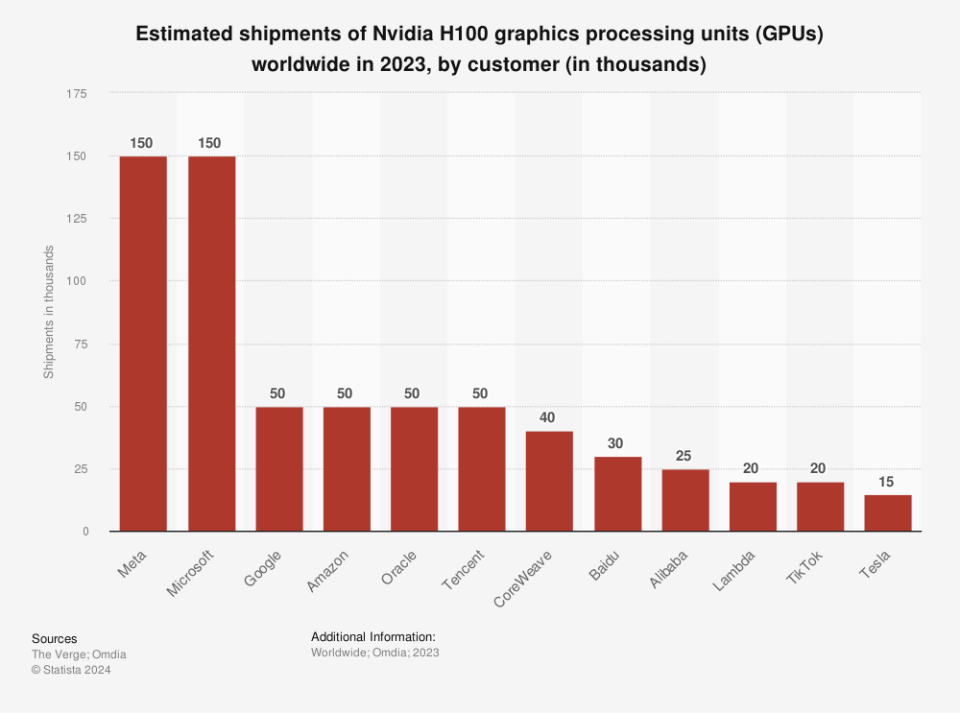

Nvidia's chips are in high demand across many industries and regions, so the company has to prioritize certain customers. The best-funded high-growth tech stocks - known as part of the "Big Seven" - have been at the forefront. The chart below shows the tech companies that spent the most on Nvidia's H100 graphics processing unit (GPU) last year.

But the uses of AI are growing, and the technology is still in its early days. At Nvidia's GTC (GPU Technology Conference) last month, executive director Jensen Huang said the first achievement was to "bridge the technology gap" and make the technology available to the general public. The next achievement is likely to be expanding the supply to more buyers for more industry uses.

Next Generation Artificial Intelligence Technology

At the same conference, Nvidia unveiled its latest AI technology. Its new Blackwell AI platform is expected to be used by automakers, advanced data centers and cloud infrastructures, and other generative AI supercomputing needs. As a result, buyers of Nvidia stock now will see more sales to a growing number of customers.

As for missing out on the stock's big rally, just look at how its valuation has changed as sales have exploded and profits have grown. Even though the stock has soared above 500%, its forward price-to-earnings (P/E) ratio has fallen.

As Nvidia's financial performance continues to surprise investors, the downward trend in its stock valuation is bound to continue. It is a leader in the fast-growth space. Clearly, the demand is there.

In this case, investors should not think that they have missed out on gains. Nvidia's stock may not return 500% in the next 18 months, but in a few years' time it may still be an important holding in any investment portfolio.

Should you invest $1,000 in Nvidia now?

Before buying Nvidia stock, consider the following:

Motley Fool Stock AdvisorA team of analysts have just selected what they believe to be the most popular analysts in the world at the moment.-est (superlative suffix)Worth investing in10Nvidia is not one of the 10 stocks listed on ....... The 10 stocks that made the list could generate huge returns in the coming years.

Consider that on April 15, 2005NvidiaOn the list at ...... If you invest $1,000 at the time of our referralYou will have 545,088dollar! * *The

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Stock Advisor The service has contributed to the S&P 500 Index's return since 2002.translate twiceMuch*.

View 10 Gift Certificates

*Stock Advisory Rates as of April 4, 2024

John Mackey, former Chief Executive Officer of Whole Foods Market, an Amazon subsidiary, is a member of the Board of Directors of The Motley Fool. Randi Zuckerberg, former Director of Mass Development and Spokeswoman for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool Board of Directors, and Suzanne Frey, an Alphabet executive, is a member of The Motley Fool Board of Directors. (Alphabet executive Suzanne Frey is a board member of The Motley Fool. Howard Smith has holdings in Alphabet, Amazon, Microsoft, Nvidia, and Tesla. The Motley Fool owns or recommends shares of Alphabet, Amazon, Baidu, Meta Platforms, Microsoft, Nvidia, Oracle, Tencent, and Tesla. The Motley Fool recommends Alibaba Group, and recommends the following options: Microsoft January 2026 $395 Call Option Long and Microsoft January 2026 $405 Call Option Short. The Motley Fool has a disclosure policy.

In a Few Years, You'll Regret Buying This High Growth Stock was originally published by The Motley Fool.