.

Should you sell this stock when monitoring is blocked?

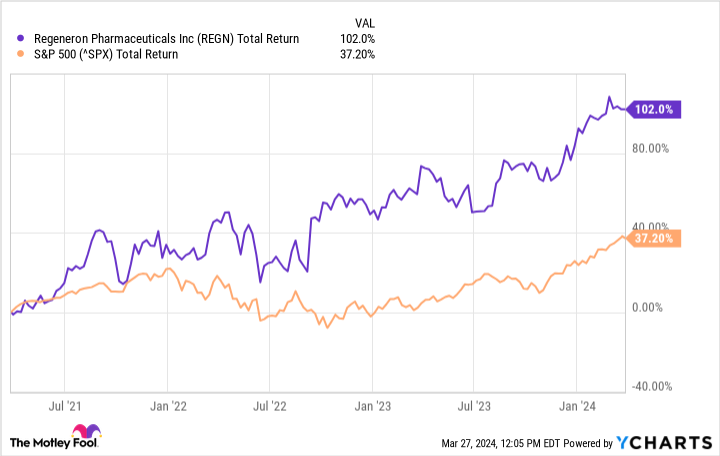

Biotech GiantsRecycled Meta Drugsfirms(Regeneron) Pharmaceuticals ) (NASDAQ: REGN)Performance has been strong over the past three years. The company has achieved strong clinical progress, a major regulatory approval, and generally strong financial performance, with the exception of the coronavirus antibiotic, whose sales are declining.

However, every company, even the best ones, has its share of headwinds, and Regeneron is no exception. The drugmaker recently received a denial letter from the U.S. regulatory agency regarding an application it filed for one of its drug candidates, Gunn. Let's look at what this means for the company and its shareholders.

Regeneron's Tumor Program Delayed

Regeneron wants to be a leader in the development of anti-cancer drugs. Oncology is one of the largest areas of the biotechnology industry, and despite intense competition, there is a pressing need for newer and better treatments. Last year, Regeneron submitted an application to the U.S. Food and Drug Administration (FDA) for odronextamab, a potential drug for lymphoma.

The application is based on the results of a Phase 2 study in which odronextamab achieved a complete response rate of 73% and an objective response rate (the proportion of patients with at least a partial response to the treatment) of 80%. Drugmakers typically seek regulatory approval after a Phase 3 study. But Regeneron's decision to seek accelerated approval means that if odronextamab is approved, the company will have to conduct a Phase 3 confirmatory trial.

The FDA decided to deny the application on the grounds that Regeneron's odronextamab confirmed that there were problems with enrollment in the trial. The FDA did not indicate that there were any safety or efficacy problems with the drug. Even so, Regeneron's shares fell on the news. But long-term investors shouldn't care. Here's why.

fig. vicissitudes of life

If odronextamab was expected to be a significant growth driver for Regeneron, then the FDA's denial could have changed the company's basic argument. But that's not the case. While estimates vary, revenue forecasts for odronextamab are not impressive. Some expect sales of the drug to reach $468 million by 2029. That's not bad, but it's not great - not for a company as small as Regeneron. odronextamab could still reach such a peak, just a little later. Since there are no questions about the drug's safety or efficacy, there's still a good chance the FDA will approve it.

Meanwhile, Regeneron is awaiting approval of another investigational anti-cancer drug, linvoseltamab, a potential treatment for multiple myeloma. The U.S. Food and Drug Administration should decide whether to approve or reject Regeneron's application by the end of August. As a result, the company's hopes in oncology are not entirely dependent on odronextamab.

Perhaps most importantly, Regeneron's most important growth drivers - ophthalmic drug Eylea and eczema treatment drug Dupixent - should continue to deliver solid top-line growth. Last year, the company's revenues grew 8% year-over-year to $13.12 billion. Excluding coronaviral carriers, revenues grew by 121 TP3T. Dupixent is Regeneron's biggest growth driver. The company is currently looking to expand the scope of its labeling for the treatment of chronic obstructive pulmonary disease (COPD), which could be launched in late June.

Combined with the much smaller negative impact of lower COVID-19 sales, this should work wonders for Regeneron's sales growth this year. With several other exciting drug candidates in the pipeline, Regeneron is looking to enter the hot, fast-growing weight-loss space.

The company's approach is different from that of most other drugmakers, with Regeneron emphasizing that patients who take drugs such as Wegovy experience a significant loss of muscle mass. The company is seeking to develop medications that can be used in conjunction with GLP-1 drugs such as Wegovy to help patients keep their muscle mass (for the most part) intact. Granted, Regeneron has a long way to go in this area. But the point is, given its strong product portfolio and deep product line, the company's latest regulatory setback won't be a deal breaker - far from it. Investors can still safely add this stock to their portfolio.

Should you invest $1,000 in Regeneron Pharmaceuticals right now?

Before buying shares of Regeneron Pharmaceuticals, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Only ...... and Regeneron Pharmaceuticals were not included. The 10 stocks that made the list could generate huge returns in the years to come.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 4, 2024

Prosper Junior Bakiny does not hold any of the above shares.The Motley Fool does not hold any of the above shares.The Motley Fool has a disclosure policy.

Should You Sell This Stock as Supervision Is Blocked? This post was originally published by The Motley Fool.