.

Kawa Group stock is up 60% this year, is it still a hot buy?

Kawa Group (C) ava Group (math.) genusNew York Stock ExchangeStock Code(CAVA)is the top restaurant stock to own this year, having risen an impressive 60% so far. Investors have been bullish on the Mediterranean fast-casual brand and its ability to cater to a broad and diverse customer base, which could make the chain even more resilient in a challenging economic environment.

But while the company has posted some strong industry results in recent quarters, is it too hot to buy this stock now, or could Kava's stock price soar even higher?

Strong industry performance by 2023

In February, Kawa announced its fourth quarter and year-end results. For the quarter ended December 31, 2023, the company reported total gross revenues of $177.2 million, a year-over-year increase of 36%.

Not only has the company opened more locations, but its existing locations have been doing very well. Studio Pre-price Comparable Sales (comps) grew by more than 11% in the fourth quarter. This is a good sign that demand remains strong and growing.

For the full year, Kava's comparable sales growth was even higher, slightly below 18%. impressive industry merit helped the company attract many growth investors. For the year, the company opened 72 new studios, and in 2024, it expects to open 48 to 52 new locations.

However, despite the recent performance of Koon, there are some red flags that may make investors think twice.

Is Kava's share price too expensive?

Kawa has been doing well, but the company also expects a slowdown. The company is in the process of opening more stores, but expects sales growth this year to be between 3% and 5%. That's a sharp slowdown from last year's year-over-year growth of 18%.

Opening more locations may be a great way to create growth, but with that comes more Koon and expenses, which doesn't necessarily lead to a stronger bottom line. And its bottom line isn't very strong in the first place.

In 2023, Cava's total gross revenues will be $728.7 million with a net profit of only $13.3 million and a profit margin of only 1.8%. Based on analysts' estimates of future profits, Cava's forward earnings multiple is 313.

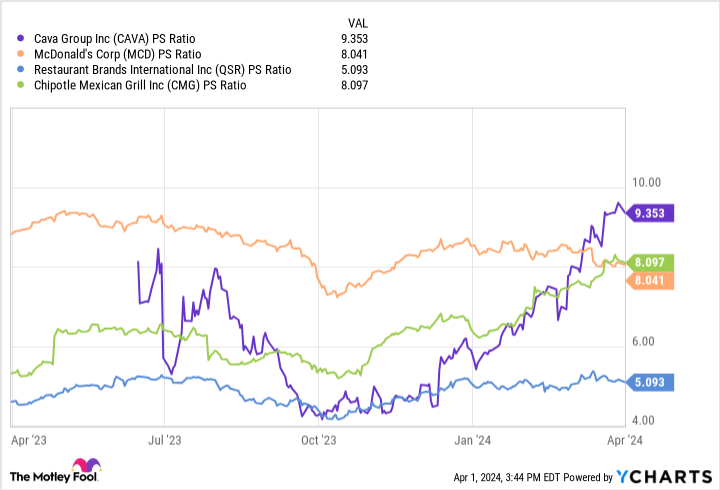

This is a very high valuation for any growth stock. Even on a revenue multiple basis, it's expensive compared to a few other restaurant stocks, which also happen to have higher margins than Cava.

Wall Street also believes that Kawa's stock price has peaked, with analysts agreeing on a target price of $56.50 per share, which means that Kawa's stock price could fall by at least 17% from where it is now.

The premium at which Kawa shares are trading is certainly large, and the question facing investors is whether it is worth it.

Should you invest in Kava stock?

Kawa did well last year, but the projected modest sales growth this year deters me from buying the stock now. Its growth story seems to rely too much on new store openings. While that's a good way to achieve growth, investors should focus on organic growth, which is slowing down.

Kawa's earnings and revenue premiums are so high, but not high enough to warrant a valuation of nearly $8 billion. Unless the company can show investors that it can deliver strong profits and does not rely on new store openings for high growth, I would avoid this stock for now.

Should you invest $1,000 in the Bubba Kawa Group now?

Before buying shares of Kawa Group, consider the following:

Motley Fool Stock AdvisorThe analyst team has just named what they believe to be the best value for investors.10Only the stock ...... Kawa Group was not included. The 10 stocks that made the list are poised to generate huge returns over the next few years.

Stock AdvisorIt provides investors with an easy-to-understand blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. Since 2002, StockAdvisorThe service has more than doubled the return on the S&P 500 Index.

View 10 stocks only

*Stock Advisory Rates as of April 4, 2024

David Jagielski does not own any of the stocks mentioned above.The Motley Fool recommends Chipotle Mexican Grill.The Motley Fool recommends Cava Group and Restaurant Brands International.The Motley Fool has a disclosure policy. The Motley Fool has a disclosure policy.

Kawa Group Stock Is Up 60% This Year; Is It Still a Hot Buy? This post was originally published by The Motley Fool.